- Surmount Markets

- Posts

- Why Big Tech Is Going Nuclear (Literally) — And What It Means for You

Why Big Tech Is Going Nuclear (Literally) — And What It Means for You

Meta, Microsoft & Amazon are betting on nuclear to power AI. Here's what it means for your portfolio — and how to play it smart.

News you’re not getting—until now.

Join 4M+ professionals who start their day with Morning Brew—the free newsletter that makes business news quick, clear, and actually enjoyable.

Each morning, it breaks down the biggest stories in business, tech, and finance with a touch of wit to keep things smart and interesting.

THIS WEEK’S BREAKDOWN

Why Big Tech Just Went Full Nuclear (And You Should Care)

If the AI boom is the gold rush, energy is the shovel. And right now, nuclear is the pickaxe Big Tech is swinging like Thor on a caffeine binge.

Meta just signed a 20-year deal with Constellation Energy (CEG) to fuel its ever-hungry AI data centers. This isn’t just some fluffy green PR move — it's a billion-dollar chess play to lock in reliable, carbon-free power.

Let’s break down what’s going on, why the biggest companies on Earth are suddenly obsessed with nuclear, and what this means for you as an investor.

The AI Boom Needs More Than Just Chips

Everyone’s talking about NVIDIA and semiconductors. But what’s being overlooked is the massive power suck behind AI infrastructure. These models are energy gluttons. Meta alone is projected to spend $72 billion this year expanding its data centers.

Problem? The grid can't handle it. Enter: nuclear energy.

Unlike wind and solar, nuclear gives you consistent, round-the-clock power — no sunshine or wind required. That’s why Meta tapped Constellation to expand its Clinton nuclear facility in Illinois, adding 30 megawatts of clean energy.

For investors, this means nuclear isn’t just “back” — it’s becoming essential infrastructure for the AI arms race.

How Clean Energy Is Powering the Digital Future

As demand for AI skyrockets, companies like Meta and Microsoft are turning to clean, reliable power sources to support their growing data infrastructure. That’s why nuclear energy — and clean energy more broadly — is becoming a strategic priority, not just an environmental one.

Surmount’s Envirotech / Cleantech Strategy is designed to provide diversified exposure to companies leading the clean technology revolution. From renewable energy and energy storage to sustainable infrastructure and electric vehicles, this strategy focuses on businesses at the forefront of environmental transformation.

These are the types of companies that are playing a critical role in helping industries scale responsibly — and they’re becoming increasingly relevant as tech giants compete for energy security and carbon-neutral growth.

This strategy aims to provide long-term capital appreciation by investing in a diversified group of companies driving the clean energy transition.

CEG’s Silent Climb

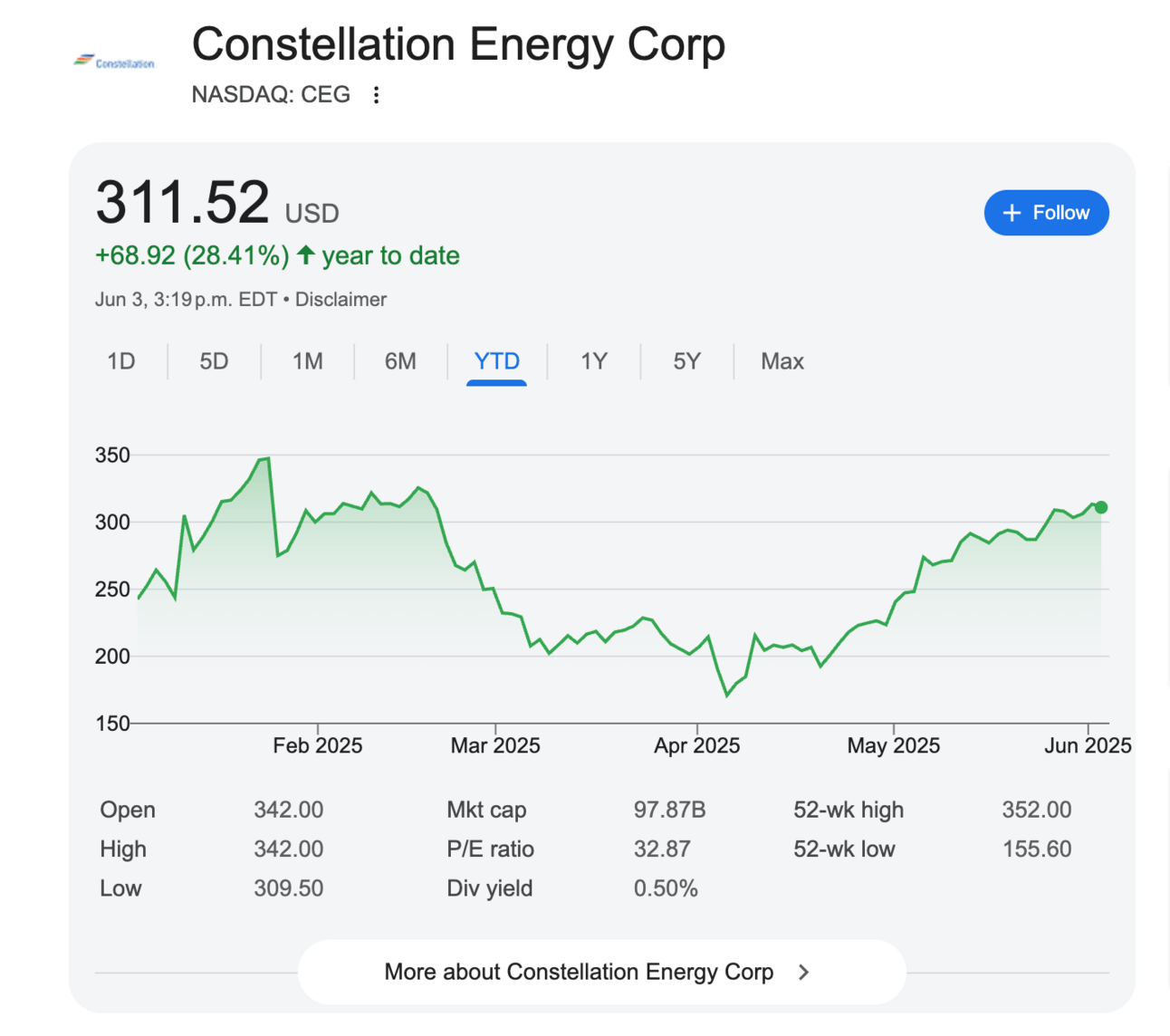

Constellation Energy (CEG) stock popped 7% after the Meta deal — and is up 27% this month. Not bad for a utility stock, right?

Even before this, Constellation had momentum. Microsoft inked a deal last year to reopen Three Mile Island, and Amazon shelled out $650M for a nuclear-powered data center. It’s a growing trend: nuclear = strategic moat.

What’s happening here isn’t just news — it’s a re-rating of nuclear assets. CEG isn’t being valued like a boring old power company anymore. It’s becoming an AI infrastructure play.

Why This Actually Makes Sense for Big Tech

Data centers are now viewed like oil rigs in the digital age — whoever controls the energy source controls the game.

But there’s more:

Carbon Goals: Microsoft, Meta, Amazon — they’ve all pledged net-zero targets. Nuclear lets them grow AI without killing their ESG scorecards.

Energy Security: They don’t want to compete with cities for power. Long-term nuclear contracts give them control.

PR Leverage: Clean, stable, job-creating nuclear is an easy win politically.

Bottom line: If you’re scaling AI and need power, nuclear is the most logical move — especially in the U.S.

What This Means for You

If you’re only betting on chipmakers and AI software, you’re missing a chunk of the stack. Think upstream — who’s powering the infrastructure?

Here’s how to start thinking smarter:

Look at CEG not as a utility, but as an AI infrastructure enabler. That reframe alone changes the valuation narrative.

Pay attention to long-term power deals (20+ years) — they offer predictability, cash flow, and insulation from short-term noise.

Don't forget about ETFs like URNM (nuclear) or PICK (infrastructure/materials) if you want diversified exposure without picking winners.

Most importantly: understand that as AI expands, power is the new constraint — and that means energy plays are the real unsung heroes.

The Smartest Way to Ride the Trend (Without Guessing)

At Surmount, we believe in investing with strategy, not speculation.

Instead of YOLO-ing into individual stocks every time a headline drops, Surmount lets you automate your investing with tested, data-driven strategies that adapt to macro trends like this one.

Whether it's nuclear, AI, or the next energy play, our portfolios are built to act when the edge is real — and sit out when it’s not.

👉 Want your portfolio to think as smart as you do?