- Surmount Markets

- Posts

- What Trump’s “Big, Beautiful Bill” Means for Investors in 2025

What Trump’s “Big, Beautiful Bill” Means for Investors in 2025

Trump's new economic legislation aims to reshape taxes, Medicaid, and energy policy. Here’s how investors can think strategically about the risks and opportunities.

Final Chance to Own a Piece of Virtuix

Virtuix is redefining the future of immersive entertainment — and time is running out to join in. Its flagship “Omni” treadmill lets users physically walk and run in 360 degrees through virtual worlds, with real-world applications across gaming, fitness, and military training.

✅ $18M+ in product sales

✅ 400K+ registered players

✅ 4X revenue growth in the last fiscal year

✅ Backed by $40M+ from top investors, including Shark Tank’s Kevin O’Leary

With over $2.7M raised in this round, investor demand is accelerating — but the raise closes June 20.

This is your final chance to back one of the most exciting players in the VR space.

This Reg CF offering is made available through StartEngine Primary, LLC. This investment is speculative, illiquid, and involves a high degree of risk, including the possible loss of your entire investment.

THIS WEEK’S BREAKDOWN

How Trump’s “Big, Beautiful Bill” Could Reshape Investing in 2025

There’s nothing subtle about it. President Trump’s “big, beautiful bill” is exactly what it sounds like: bold, sweeping, and full of noise. Whether you lean red, blue, or just financially green, it’s the kind of legislation that forces investors to pay attention. But beyond the headlines and political theater, there are real implications for your wallet and portfolio.

Here’s what you need to know, and how to think strategically as this bill moves toward becoming law.

Tax Changes That Actually Matter for You

Forget the soundbites. The tax changes buried in the Senate version of this bill could actually change how you manage your income and investments.

What’s staying the same:

The 2017 Trump tax cuts? Locked in. No more expiration dates to guess around.

Standard deduction? Boosted and permanent.

Personal exemptions? Gone and staying gone.

New deductions worth noting:

Tips: Deductible up to $25,000 through 2028.

Overtime pay: Deduct up to $12,500 (or $25,000 if you file jointly).

Auto loan interest: Up to $10,000 deductible through 2028.

If you’re in the gig economy or a service-based job where tips and overtime are a big part of your income, this bill could put real money back in your pocket. It won’t make you rich overnight, but in an era of high inflation and tight cash flow, even these targeted deductions can be meaningful.

These deductions increase disposable income for millions. That means more spending, more investing, and if you’re watching sectors like consumer discretionary or fintech… more movement.

What This Means for Tech Investors: Don't Just Look at AI

Trump’s “big, beautiful bill” has a lot to say about energy, healthcare, and taxes — but it’s what it doesn’t mention directly that should get investors thinking.

While the spotlight’s on AI as the supposed engine of 3–5% GDP growth, the real foundational tech shift might be happening in quantum computing.

Here’s the deal: the bill is implicitly bullish on U.S. innovation. It locks in corporate tax deductions for R&D, capital investments, and tech infrastructure — all areas where quantum companies are starting to quietly scale. As firms like IBM, Rigetti, and IonQ build real-world applications in logistics, cybersecurity, and pharma, the tax landscape could give them even more room to run.

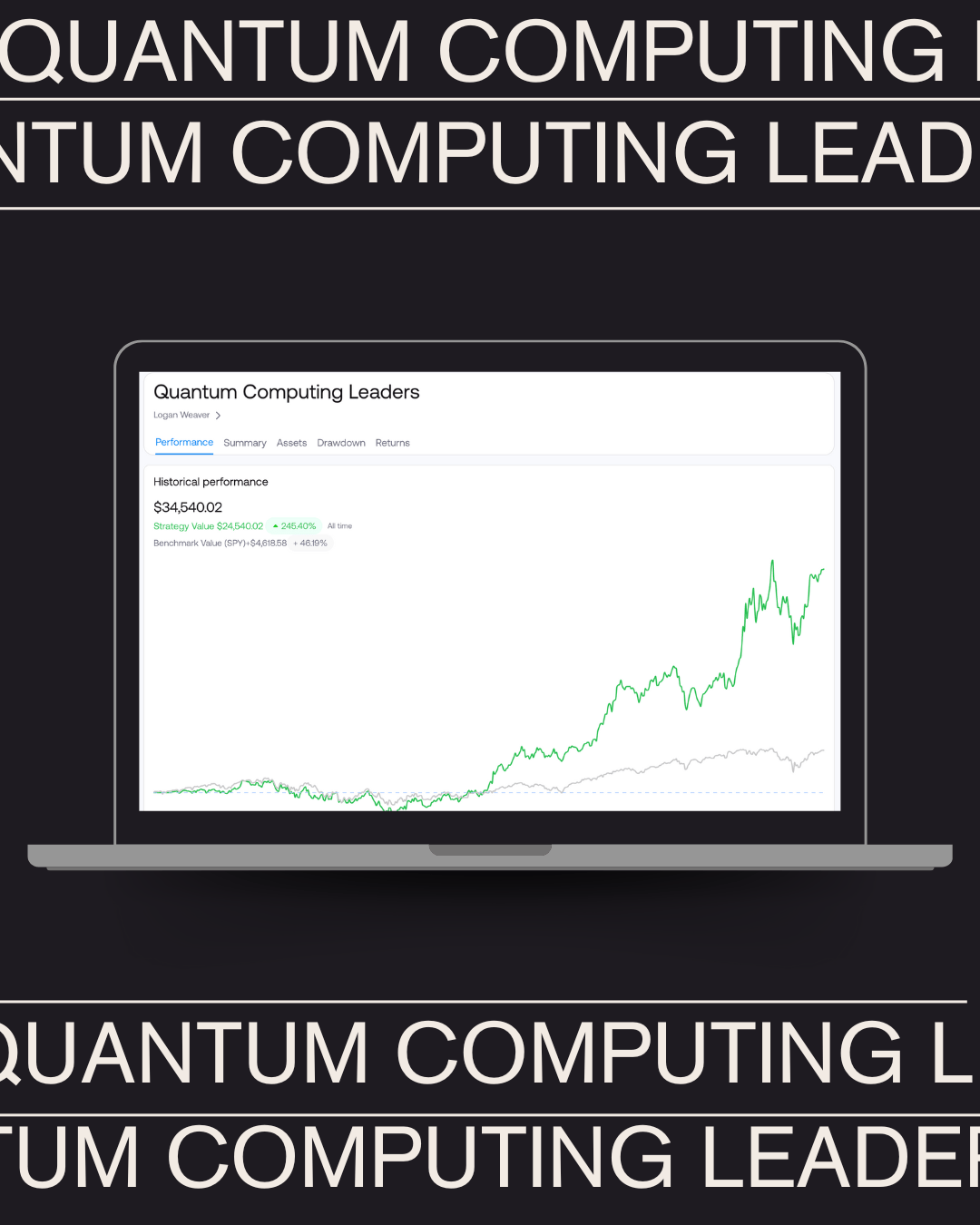

If you’re someone already thinking beyond the hype cycle — beyond just buying another AI ETF — it might be time to look deeper. Our Quantum Computing Leaders strategy is built for exactly this kind of forward-looking exposure. It invests in the companies laying the groundwork for what comes after AI: the hardware and algorithms that will one day make machine learning look like dial-up.

It’s early. But early is where the real edge lives.

The Energy Sector Shake-Up

One of the quiet but powerful levers in this bill is how it phases out clean energy tax credits.

Under the 2022 Inflation Reduction Act, green energy projects had generous timelines. Trump’s bill slams on the brakes. Projects must begin construction this year to get full credits. Begin in 2026? You’ll only get 60%. Wait until 2028? You’re out of luck.

This dramatically alters the runway for companies in solar, wind, EVs, and related infrastructure. If you’re holding clean energy ETFs or stocks like Enphase, First Solar, or even Tesla, it’s worth reevaluating timelines. On the flip side, oil and gas could see longer momentum as federal policy shifts back toward traditional energy.

Also interesting: Nuclear, hydro, and geothermal get carve-outs—hinting where the long-term bipartisan compromise may land.

Medicaid Cuts and the Healthcare Fallout

The Senate version slashes state Medicaid payments and imposes stricter work requirements, particularly for adults with kids over 14. It also caps provider taxes and eliminates some existing state payments to hospitals.

Rural hospitals? Bracing for impact.

Watch healthcare REITs and hospital operators—especially those with heavy rural exposure. This could reduce revenues and strain profitability in the short to medium term. Think names like Community Health Systems ($CYH) or Universal Health Services ($UHS).

The SALT Cap Stays (For Now)

Blue states, especially high-income regions like NYC, LA, and SF, are not thrilled. The $10,000 cap on state and local tax deductions is back in full effect, permanently, unless House Republicans can negotiate it back up to $40,000.

High-income earners in high-tax states lose a deduction edge. This may drive continued migration trends to low-tax states like Texas, Florida, and Tennessee—which could boost real estate demand and local economies in those areas. It also reinforces a long-term trend for investors to consider tax-efficient relocation as part of their financial strategy.

Ballooning Debt & AI-Fueled Optimism

The bill adds $5 trillion to the debt ceiling. Trump’s team is betting that AI-driven productivity will offset that over time.

Treasury Secretary Scott Bessent is openly banking on 3%–5% annual GDP growth, fueled by AI adoption in sectors like manufacturing, logistics, and services.

That’s…ambitious.

There’s a clear narrative being pushed: "AI = economic boom." Whether that comes true or not, the market often prices in narrative as much as numbers. AI infrastructure, chipmakers (think $NVDA, $AMD), and even AI SaaS platforms may benefit as public and private investment flood in.

Strategic Takeaways for Investors

This bill is a lot. It touches nearly every major sector; energy, healthcare, fintech, tech, and beyond. But here’s how you can stay smart about it:

Reassess Sector Exposure: Energy is rotating back to fossil fuels, healthcare may see margin compression, and AI is being set up as a national growth pillar.

Keep an Eye on Disposable Income Plays: With tips and overtime tax deductions, services and discretionary sectors could see an uptick.

Don’t Ignore Geopolitical Risk: Trade tensions and new tariffs could re-ignite volatility in international stocks and tech-heavy multinationals.

Cash Flow Planning Matters More: The mix of tax cuts and spending means more debt, more inflation pressure. Make sure your investments reflect a realistic view of rates and inflation into 2026.

Whether you love or loathe Trump, this bill is going to ripple through the markets. And as an investor, your job isn’t to pick sides. It’s to understand the terrain and position yourself accordingly.

2025 is shaping up to be one of the most dynamic investing environments in years. Stay nimble. Stay strategic.