- Surmount Markets

- Posts

- Trump’s $70B AI Play: What It Means for the Markets & Your Portfolio

Trump’s $70B AI Play: What It Means for the Markets & Your Portfolio

From AI data centers to a possible power crunch—here’s what investors really need to know (and how to play it smart).

Finally, a powerful CRM—made simple.

Attio is the AI-native CRM built to scale your company from seed stage to category leader. Powerful, flexible, and intuitive to use, Attio is the CRM for the next-generation of teams.

Sync your email and calendar, and Attio instantly builds your CRM—enriching every company, contact, and interaction with actionable insights in seconds.

With Attio, AI isn’t just a feature—it’s the foundation.

Instantly find and route leads with research agents

Get real-time AI insights during customer conversations

Build AI automations for your most complex workflows

Join fast growing teams like Flatfile, Replicate, Modal, and more.

AI is Getting a $70B Jolt, Here’s Why That Matters for You

Imagine this: $70 billion in new AI and energy infrastructure flooding into the U.S. economy, and that’s just the beginning.

This week, Trump announced the mother of all tech-investment packages in Pennsylvania: a mix of AI acceleration, power grid revamps, and big-name players (BlackRock, Palantir, Anthropic, Blackstone—you know, just your usual Tuesday). The vibe? America’s going all-in on AI dominance.

This is a serious signal. For investors like us, it’s time to look deeper: What does this mean for tech, energy, and your portfolio over the next 12-24 months?

Let’s break it down.

1. “Big Tech” Isn’t Just About Apps Anymore

The future is in the wires, and the watts.

We’re entering the age of infra-tech. Think AI models that don’t just need GPUs, but entire cities-worth of power and real estate.

Blackstone’s $25B play into data centers and power generation isn't just another headline—it’s a clear bet that AI infrastructure is the next gold rush. Data centers are expected to eat up 8.6% of U.S. electricity by 2035 (up from 3.5% today), and we’re already watching utilities scramble to keep up.

Start looking at second-order plays: data center REITs, utilities with high-capacity grid exposure, and companies tied to chipmaking or cooling solutions (think: $NVDA, $AMD, $PLTR, $EQIX, $CARR).

2. The Power Problem Is Real (and Investable)

The government’s solution? Bring coal back online, tap nuclear, and accelerate gas plant approvals. Love it or hate it, this means old energy is quietly staging a comeback—but this time, to power the new tech economy.

And it’s not just about fossil fuels: grid modernization, battery storage, and nuclear startups are heating up, fast.

Don’t sleep on mid-cap energy plays. While oil majors like $XOM and $CVX were present at the summit, the real upside might lie in companies focusing on modular nuclear reactors or grid optimization software.

3. AI Is National Security Now

China’s DeepSeek model sent a wake-up call through D.C. earlier this year, proving that low-cost AI at scale is real—and threatening America’s dominance. Trump’s response? Massive deregulation, private-public partnerships, and tech-first policy.

This means fewer red-tape slowdowns and faster time-to-market for AI innovations, which will benefit private firms, especially those in early growth stages.

Growth-stage AI firms might see tailwinds from looser regulations. Keep your eyes on emerging AI infrastructure and software companies—not just the household names.

Want to Invest in the Infrastructure Behind the Infrastructure?

While the market obsesses over Nvidia headlines and billion-dollar AI chips, the real innovation is happening at the atomic level—literally. Nanotech is powering the AI and energy revolution behind the scenes: in chips, batteries, grid hardware, and medical breakthroughs that’ll define the next decade.

That’s why we built the Nanotechnology Innovators Strategy—a curated portfolio of companies pioneering nanoscale tech across sectors like semiconductors, clean energy, and biotech.

This isn’t your average sector ETF. It’s a hyper-focused, AI-powered strategy that identifies less obvious plays in nanoelectronics, nanosensors, nanomedicine, and more—all built to evolve with the frontier of innovation.

As Trump’s $70B push into AI and energy infrastructure unfolds, the demand for high-performance materials and cutting-edge chips will explode. Nanotech isn’t just a tailwind—it’s the foundation. And this strategy puts you at the core of that momentum.

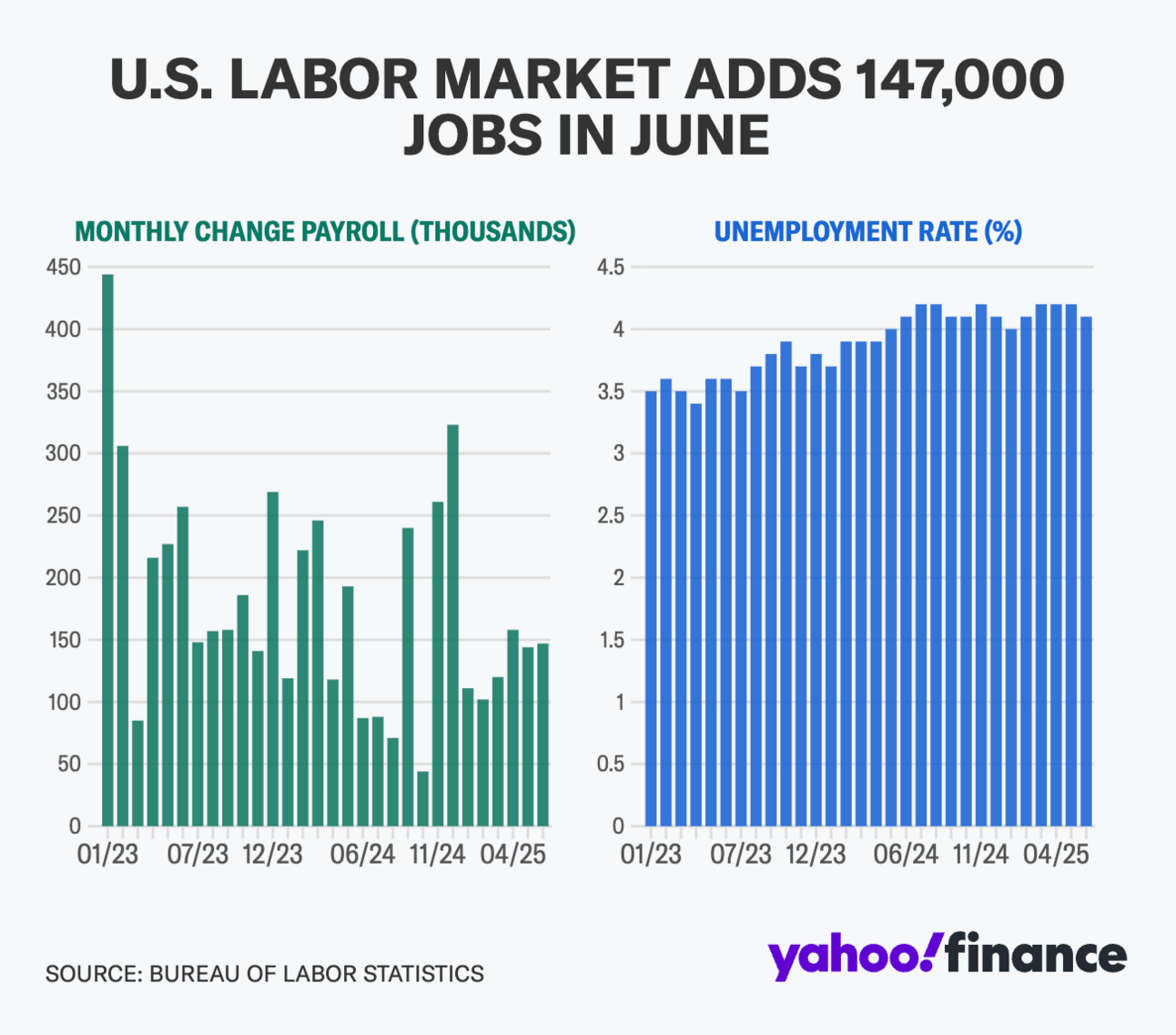

4. Jobs, Jobs, Jobs… and Real Economic Movement

Unlike many top-down announcements, this initiative has teeth. Groundbreaking projects will actually start soon, especially in swing states like Pennsylvania. That means we could see faster-than-usual timelines for execution.

More jobs = more spending = more local economic momentum = possible boosts in regional banks, industrial suppliers, and commercial real estate.

Think regional: exposure to local economies near new data center hubs could create asymmetrical opportunities. Look into ETFs with geographic focus or mid-cap industrials with exposure to these builds.

5. The Market Rotation Is Happening in Real Time

Most investors are still laser-focused on AI stocks, but this $70B announcement shifts attention to the support system around AI—power, land, chips, policy. That’s where alpha might live.

This is the kind of macro shift that creates “narrative arbitrage”—when everyone’s looking one way, the smart money is already building exposure elsewhere.

If you're automating your investing, make sure your strategies account for these broader sector rotations. If they’re still weighted heavily into mega-cap tech alone, you might miss the next leg of growth.

At Surmount, we build automated investing strategies that adapt to macro and sector-level trends—like the AI x energy boom playing out right now.

Instead of trying to time headlines or chase hype, Surmount lets you automate your brokerage account with strategies built by experienced quants, refined by real market data, and tested for durability. Whether you're bullish on AI infrastructure or energy plays, we’ve got smart, automated strategies to help you stay ahead, without needing to watch the markets 24/7.