- Surmount Markets

- Posts

- The Small Business Warning Signal: Markets Rally as Main Street Struggles

The Small Business Warning Signal: Markets Rally as Main Street Struggles

The Fed cut rates but signaled caution ahead. Bitcoin consolidates while gold soars. Here's what systematic investors need to know about December's diverging markets.

The market closed out this week with an uneasy smile. Stocks hovered near record highs, the Federal Reserve appears ready to cut rates again, and corporate earnings from tech giants continue to impress. But beneath the surface, something important is shifting—and it's happening on Main Street, not Wall Street.

On Wednesday morning, private payroll processor ADP dropped a bombshell: American businesses shed 32,000 jobs in November, the worst monthly decline since March 2023. But the headline number only tells half the story. Small firms with fewer than 50 employees cut 120,000 positions, while larger companies with 50+ workers actually added 90,000 jobs. It's a divergence that reveals a two-speed economy, and it's raising questions about whether the strength we see in major indices reflects the reality facing most American businesses.

The Future of Shopping? AI + Actual Humans.

AI has changed how consumers shop by speeding up research. But one thing hasn’t changed: shoppers still trust people more than AI.

Levanta’s new Affiliate 3.0 Consumer Report reveals a major shift in how shoppers blend AI tools with human influence. Consumers use AI to explore options, but when it comes time to buy, they still turn to creators, communities, and real experiences to validate their decisions.

The data shows:

Only 10% of shoppers buy through AI-recommended links

87% discover products through creators, blogs, or communities they trust

Human sources like reviews and creators rank higher in trust than AI recommendations

The most effective brands are combining AI discovery with authentic human influence to drive measurable conversions.

Affiliate marketing isn’t being replaced by AI, it’s being amplified by it.

The Fed's December Dilemma

With the Federal Reserve's final policy meeting of 2025 scheduled for December 9-10, Chair Jerome Powell faces one of his most challenging decisions yet. Markets are pricing in an 85-90% probability of another 25 basis point rate cut, which would bring the federal funds rate down to a range of 3.50-3.75%. That's more than a full percentage point below where rates stood in September.

But here's where it gets complicated. The Fed is operating partially blind. A government shutdown that lasted from October through mid-November delayed key economic data, including the official September jobs report and October inflation figures. The delayed September PCE—the Fed's preferred inflation gauge—won't be released until Friday, after policymakers have already begun their deliberations.

What the Fed is seeing:

Manufacturing contracted for the ninth consecutive month, with November's ISM at 48.2

Services sector holding steady with PMI at 52.6%

Holiday spending resilient: Cyber Monday sales up 4.5% year-over-year

Wage growth decelerating: 4.4% for job-stayers, down from 4.5% in October

The internal debate at the Fed has become unusually public. New York Fed President John Williams signaled that current policy remains "modestly restrictive" and that there's "room for further adjustment." Others worry that cutting rates while inflation sits stubbornly above the 2% target could reignite price pressures.

Main Street vs. Wall Street

The ADP report's stark divergence between small and large employers deserves closer attention. Small businesses, which employ roughly 46% of American workers, are canaries in the coal mine. They lack the pricing power, cash reserves, and operational flexibility of their larger competitors.

ADP Chief Economist Nela Richardson put it bluntly: "The labor market is not weak, but it is weakening—and the first to crack are small establishments. I see them as a canary in the coal mine."

What's squeezing small businesses:

Cumulative price increases since 2021 remain elevated

Tariff uncertainty creating planning challenges

Consumer caution rising as pandemic savings deplete

Interest rates expensive relative to 2008-2021 levels

Large corporations, meanwhile, are navigating these challenges more successfully. Companies in the S&P 500 have maintained healthy profit margins, benefiting from operational scale, global diversification, and technological advantages. But this widening gap raises questions about sustainability—if Main Street continues to struggle while Wall Street thrives, the economic expansion becomes increasingly fragile.

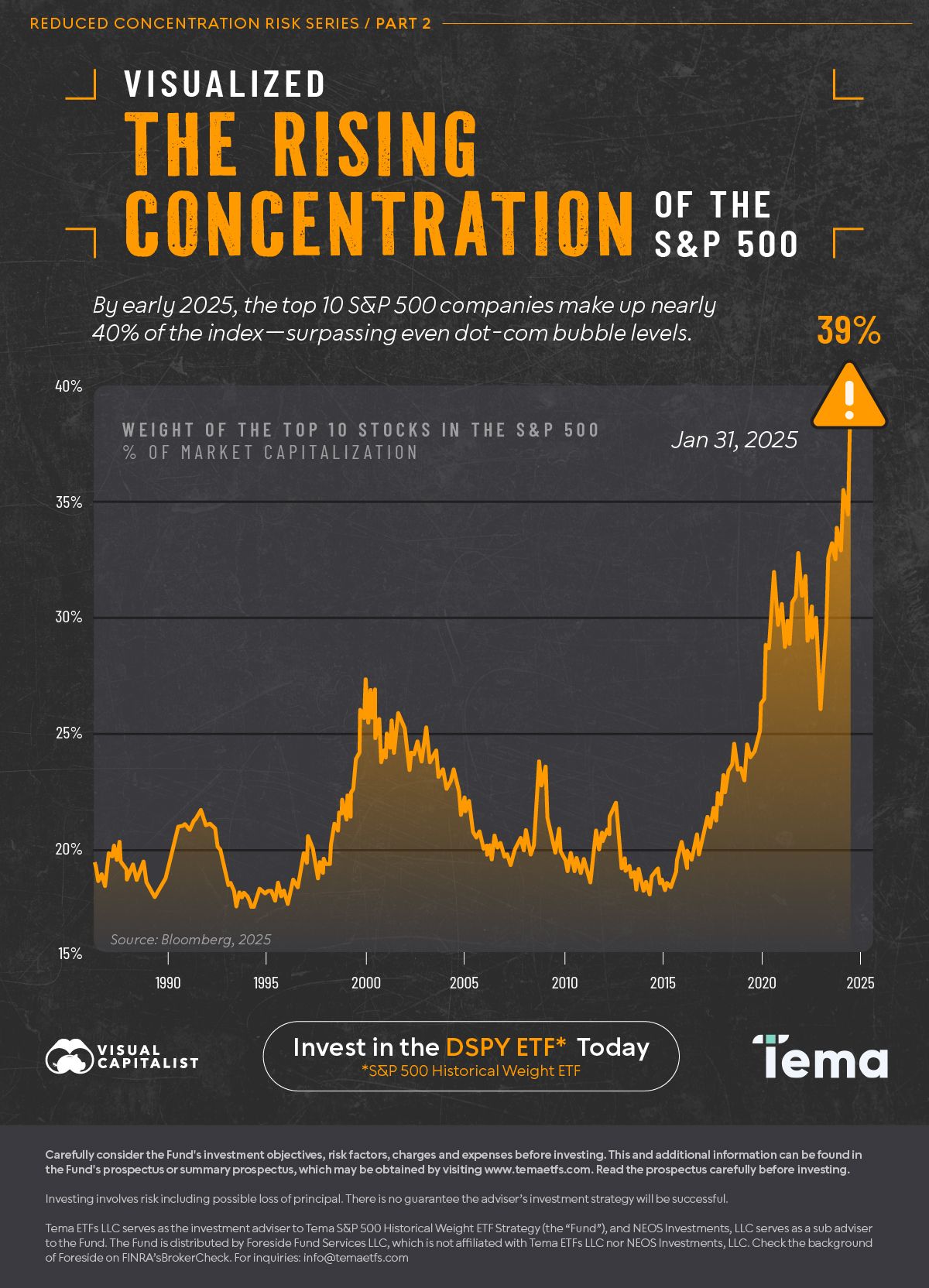

The Concentration Conundrum

Another warning signal flashing in markets is extreme concentration. The top 10 stocks now account for 39% of the S&P 500's total weight—the second-highest level on record. Throughout 2024, only 19% of stocks in the index actually outperformed the S&P 500 itself.

This concentration creates both opportunity and risk:

The bull case:

These companies have fortress balance sheets

Dominant market positions with real moats

Exposure to transformative AI technologies

Legitimate competitive advantages driving outperformance

The bear case:

History shows extreme concentration rarely persists

Small disappointments in a handful of stocks trigger outsized moves

Rotation away from leaders can be uncomfortable

Valuation stretched relative to historical norms

Interestingly, Wednesday's market action hinted at potential rotation. After the weak ADP report reinforced rate cut expectations, cyclical sectors and small-cap stocks rallied more aggressively than mega-cap tech. The Russell 2000 index of small-cap stocks jumped nearly 2%. It was a reminder that not every rally needs to be led by the same seven stocks.

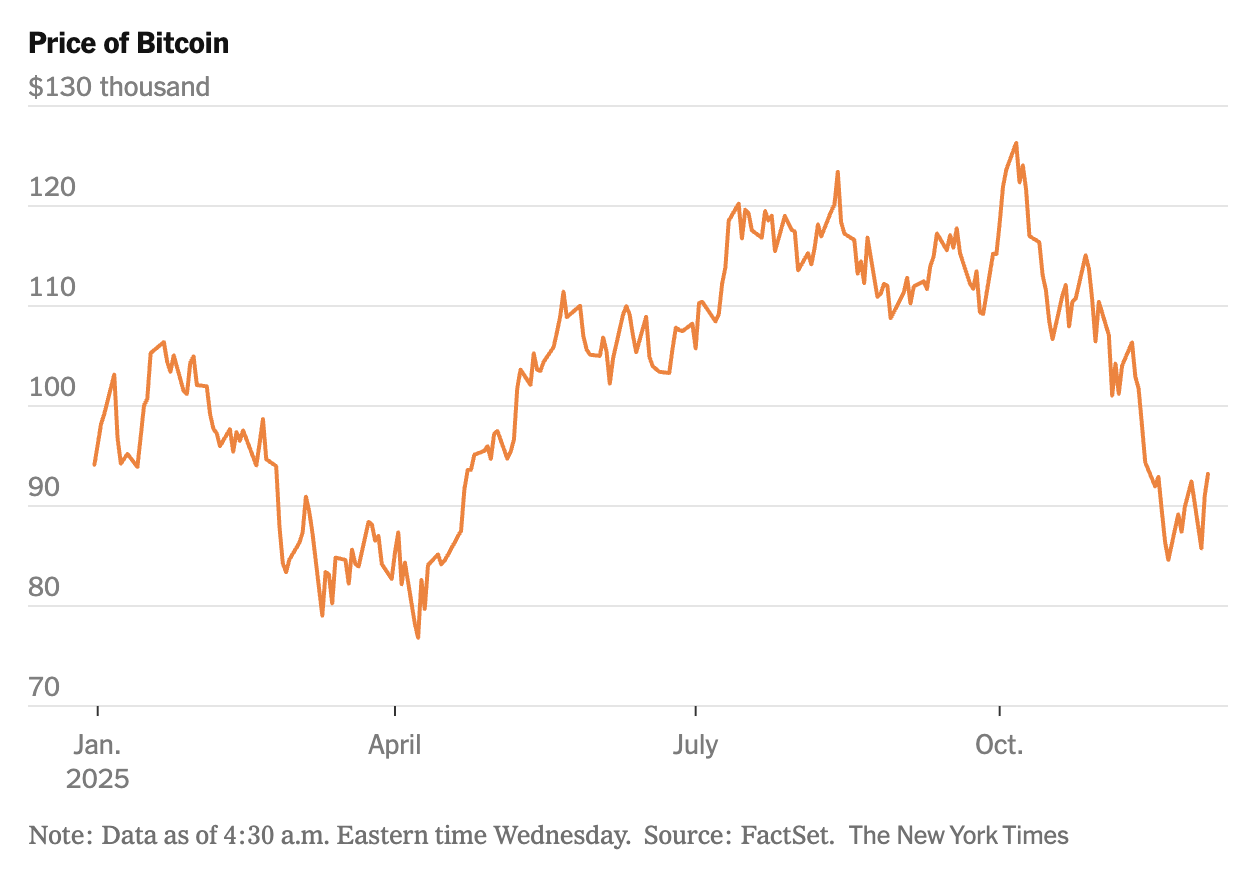

Crypto's Reality Check

While equities danced near all-time highs, cryptocurrency markets experienced a brutal reality check. Bitcoin plunged below $86,000 this week, down nearly 30% from its October peak. The decline represents Bitcoin's worst monthly performance since the 2022 crypto crash, with November seeing more than $3 billion in net outflows from U.S. spot Bitcoin ETFs.

Key crypto headwinds:

Profit-taking after strong earlier gains

Cooling retail and institutional appetite

Nearly $1 billion in leveraged positions liquidated on Monday alone

Regulatory uncertainty persisting

The crypto correction serves as a reminder that even in a generally strong market environment, pockets of excess can unwind quickly. When macro conditions tighten and risk appetite fades, speculative assets typically feel the pain first.

AlphaFactory Protective

Given current market dynamics—elevated valuations, narrowing leadership, and Fed policy uncertainty—systematic volatility management becomes increasingly valuable.

The AlphaFactory Protective strategy addresses this by dynamically adjusting exposure based on SPY realized volatility. The approach maintains a fixed basket of 10 large-cap stocks (currently concentrated in NVIDIA and Apple at 50% each), selected using combined momentum and value signals from PE and PEG ratios.

The protective mechanism:

Low volatility: Full stock allocation based on momentum/value scores

Rising volatility: Systematic shift toward GLD (Gold ETF)

High volatility: Maximum defensive posture with substantial gold weighting

Since inception, the strategy has delivered a 36.64% annual return with a Calmar ratio of 2.00, demonstrating effective risk-adjusted performance. The 1.54% standard deviation reflects disciplined volatility control.

Key considerations: Current tech concentration means heavy exposure to mega-caps. Volatility signals can whipsaw in choppy markets. Protection costs upside during sustained low-volatility rallies.

For investors seeking equity participation with automatic downside guardrails—particularly as labor market data deteriorates and the Fed meeting approaches—rules-based volatility adaptation offers a rational alternative to emotional market timing.

Looking Ahead

Next week brings the Fed's decision, which will be parsed for both the rate move itself and the updated dot plot projections for 2026. Chair Powell's press conference will be scrutinized for clues about how policymakers are weighing labor market weakness against inflation concerns.

Key data releases to watch:

Friday, Dec 5: Delayed September PCE inflation data

Monday, Dec 8: Fed communications blackout begins

Tuesday-Wednesday, Dec 9-10: FOMC meeting and rate decision

Wednesday, Dec 10: Powell press conference (2:00 PM ET)

Three key takeaways:

Labor market bifurcation is accelerating – Small businesses are cutting aggressively while large firms continue hiring

Concentration risk demands attention – The top 10 stocks driving 39% of S&P 500 weight creates fragility

Fed facing impossible trade-offs – Weak labor data argues for cuts; persistent inflation argues for patience

Markets don't move in straight lines, even when they're near all-time highs. The small business warning signal is worth heeding, not as a reason to abandon risk assets, but as a reminder that resilience and adaptability matter as much as conviction. In times of uncertainty, systematic approaches that respond to changing conditions—rather than trying to predict them—offer a rational path forward.

The information contained in this newsletter is for informational purposes only and should not be construed as investment advice. All investments carry risk, including the potential loss of principal. Past performance does not guarantee future results. Before making any investment decisions, consult with a qualified financial advisor to ensure any strategy aligns with your individual financial situation, goals, and risk tolerance

.