- Surmount Markets

- Posts

- The Great Reversal: When Good News Became Bad News

The Great Reversal: When Good News Became Bad News

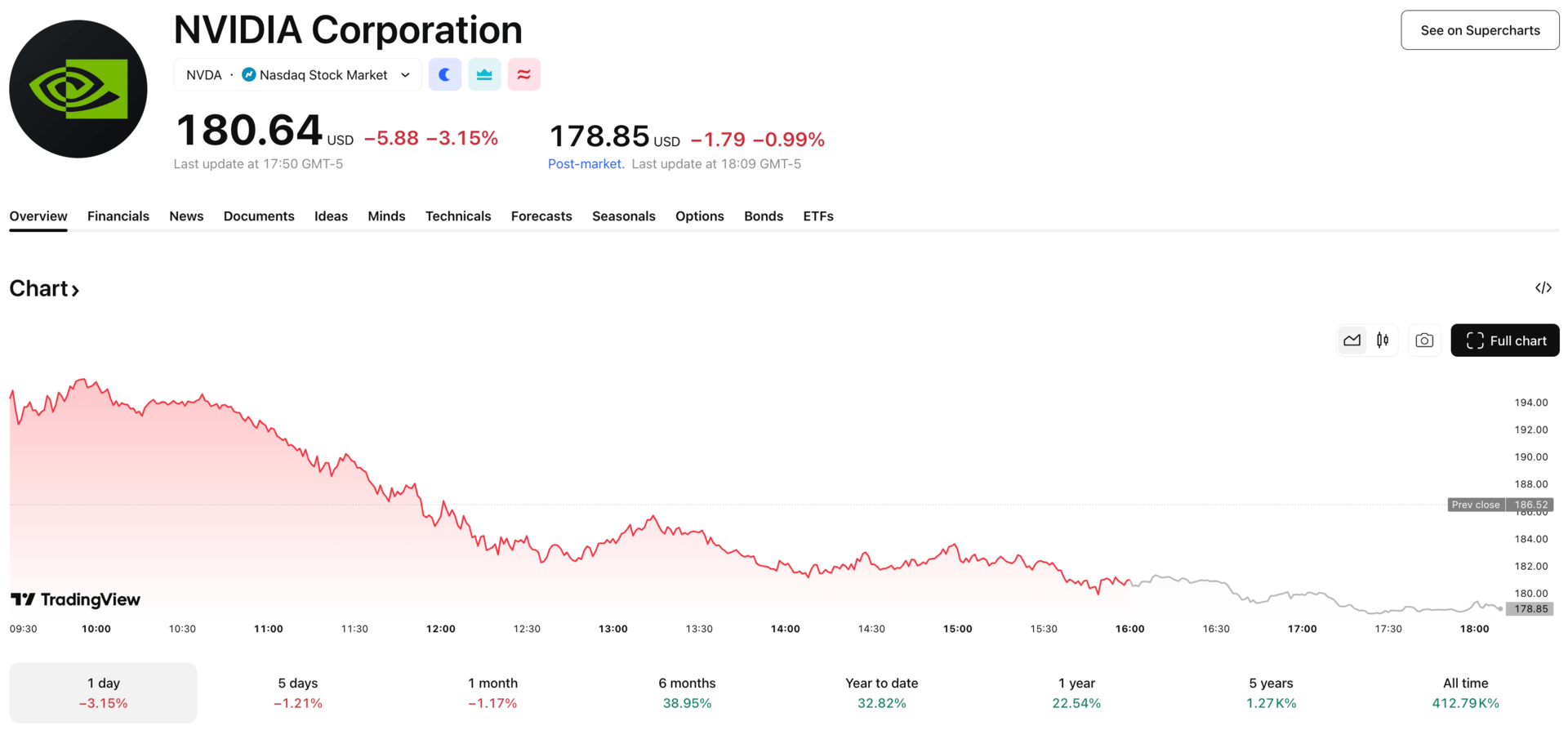

Nvidia crushed earnings, the Fed divided on cuts, and markets sold off anyway. Inside this week's stunning disconnect between fundamentals and price action.

Markets Encounter a Reality Check

The financial markets delivered a masterclass in complexity this week, one that left even seasoned investors scratching their heads. In a script that would have seemed absurd just months ago, Nvidia reported blockbuster earnings that exceeded every estimate—and promptly saw its stock crater 3% the following day. Bitcoin, the bellwether of risk appetite, plunged below $90,000 for the first time in seven months, erasing every gain it had accumulated in 2025. And the Federal Reserve, once marching confidently toward lower rates, now finds itself deeply divided about whether to cut again in December.

Welcome to late 2025, where good news has become strangely irrelevant and investors are wrestling with a fundamental question: Are we witnessing a healthy correction or the early tremors of something more serious?

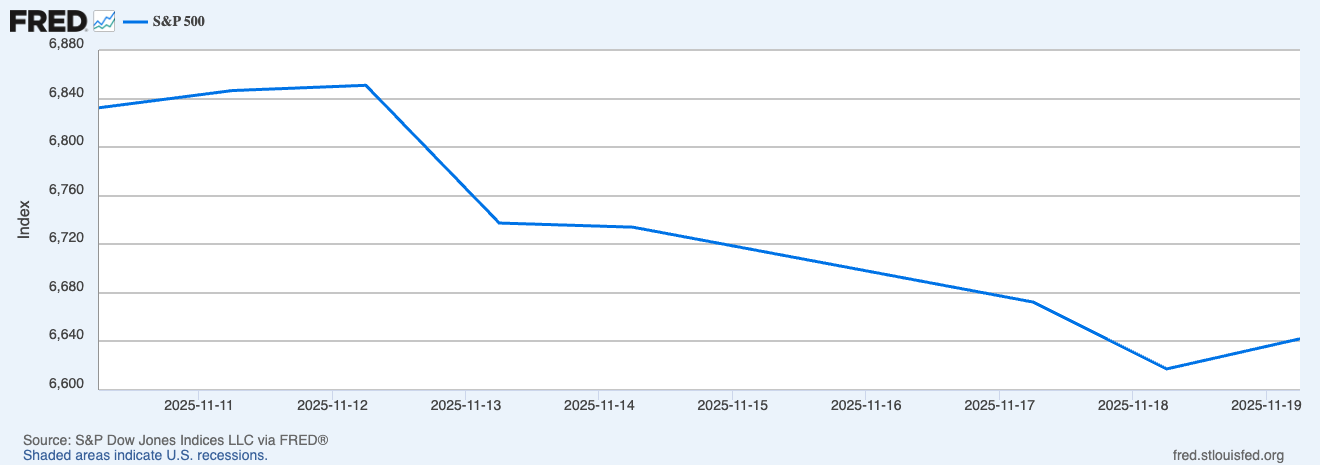

The S&P 500 logged its longest losing streak since August—four consecutive down days—before staging a brief Wednesday recovery that proved fleeting. By Thursday's close, the index had surrendered another 1.56% after an intraday rally of nearly 2% evaporated in spectacular fashion. The Nasdaq fared even worse, dropping 2.16% despite opening the session up more than 2.6%. The Dow swung wildly, falling 1,115 points on an intraday basis from session high to low—the kind of volatility typically reserved for crisis moments.

The Fed's December Dilemma: A House Divided

The probability of a Federal Reserve rate cut in December now stands at just 22%, down from a likelihood of 97% as of mid-October, marking one of the sharpest reversals in market expectations in recent memory. This dramatic shift followed the release of Fed minutes from October's meeting, which painted a picture of a central bank wrestling with conflicting signals and diverging views among its members.

The minutes revealed key divisions:

Only "several participants assessed that a further lowering of the target range for the federal funds rate could well be appropriate in December"

In Fed-speak, "many" outranks "several"—a clear tilt toward holding rates steady at the current 3.75%-4.00% range

Chair Jerome Powell reinforced this uncertainty during his post-meeting press conference, stating bluntly that a December cut is "not a foregone conclusion". He acknowledged "strongly differing views" among committee members about the appropriate path forward, with some advocating for a pause and others pushing to continue easing.

The Fed's dual mandate—controlling inflation while supporting employment—has become a high-wire act:

September's payroll gains showed that employers hired 119,000 people—more than double what most economists had forecast, suggesting the labor market remains resilient

Inflation has edged up, climbing at an annual rate of 3% in September, stubbornly above the Fed's 2% target and driven partly by tariff-related price pressures

Adding another layer of complexity: the recent government shutdown delayed critical economic data, leaving policymakers to navigate in what Powell colorfully described as "driving in the fog." The October jobs report was canceled entirely, and the November report—originally scheduled for early December—has been pushed to December 16, well after the Fed's December 9-10 meeting.

For investors accustomed to a dovish Fed backstopping markets, this newfound uncertainty represents a meaningful shift in the backdrop. The era of reflexive rate cuts may be giving way to something more measured—and more unsettling.

Bitcoin's Brutal Reckoning

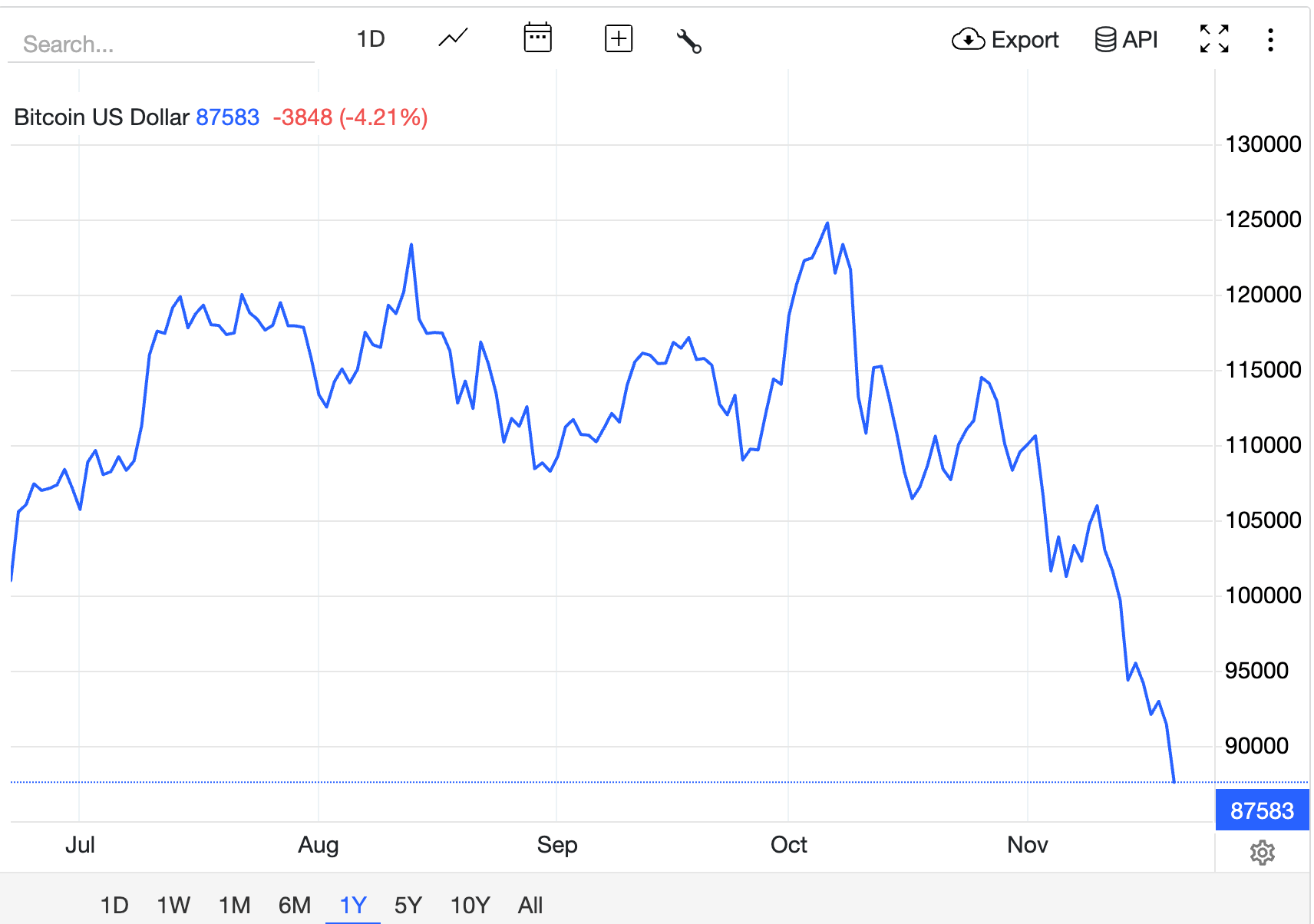

While equity investors grappled with Fed uncertainty, cryptocurrency holders faced their own reckoning. Bitcoin dropped below $90,000, deepening a month-long slide that has erased the cryptocurrency's gains for 2025 and rocked sentiment across the digital-asset world. At its nadir this week, Bitcoin touched $88,500—its lowest level since April—representing a stunning 26% decline from its October peak above $126,000.

This latest slump dragged the total crypto market cap from roughly $4.3 trillion down to about $3.2 trillion, with around $1.2 trillion wiped out from digital assets over the past six weeks. The violence of the move caught many by surprise, particularly given the presence of a crypto-friendly administration in Washington and the successful launch of multiple Bitcoin ETFs earlier in the year.

The proximate cause? A toxic combination of factors:

AI bubble fears

Rising interest rate expectations

A broader risk-off rotation that punished speculative assets

"Bitcoin has now turned negative for 2025...fears of an AI bubble and concerns about the market's heavy dependence on a handful of tech giants have caused investors to dial back their exposure to speculative assets such as Bitcoin", explained market analysts tracking the selloff.

The correlation between Bitcoin and AI-linked equities—once a source of mutual strength—has become a liability. When Nvidia's stock reversed course Thursday despite stellar earnings, Bitcoin fell in sympathy, underscoring how intertwined these once-distinct asset classes have become. Both attract the same momentum-chasing capital, and when that capital gets spooked, the exit door gets crowded quickly.

Institutional defenders of Bitcoin, including billionaire Michael Saylor, have attempted to reframe the decline as a healthy purge. "Volatility is a gift to the faithful. It scares away the tourist, it scares away the lazy, it scares away the people that are already conventionally rich", Saylor argued. But for investors who bought near the October highs, that's cold comfort.

The Nvidia Paradox: Winning But Losing

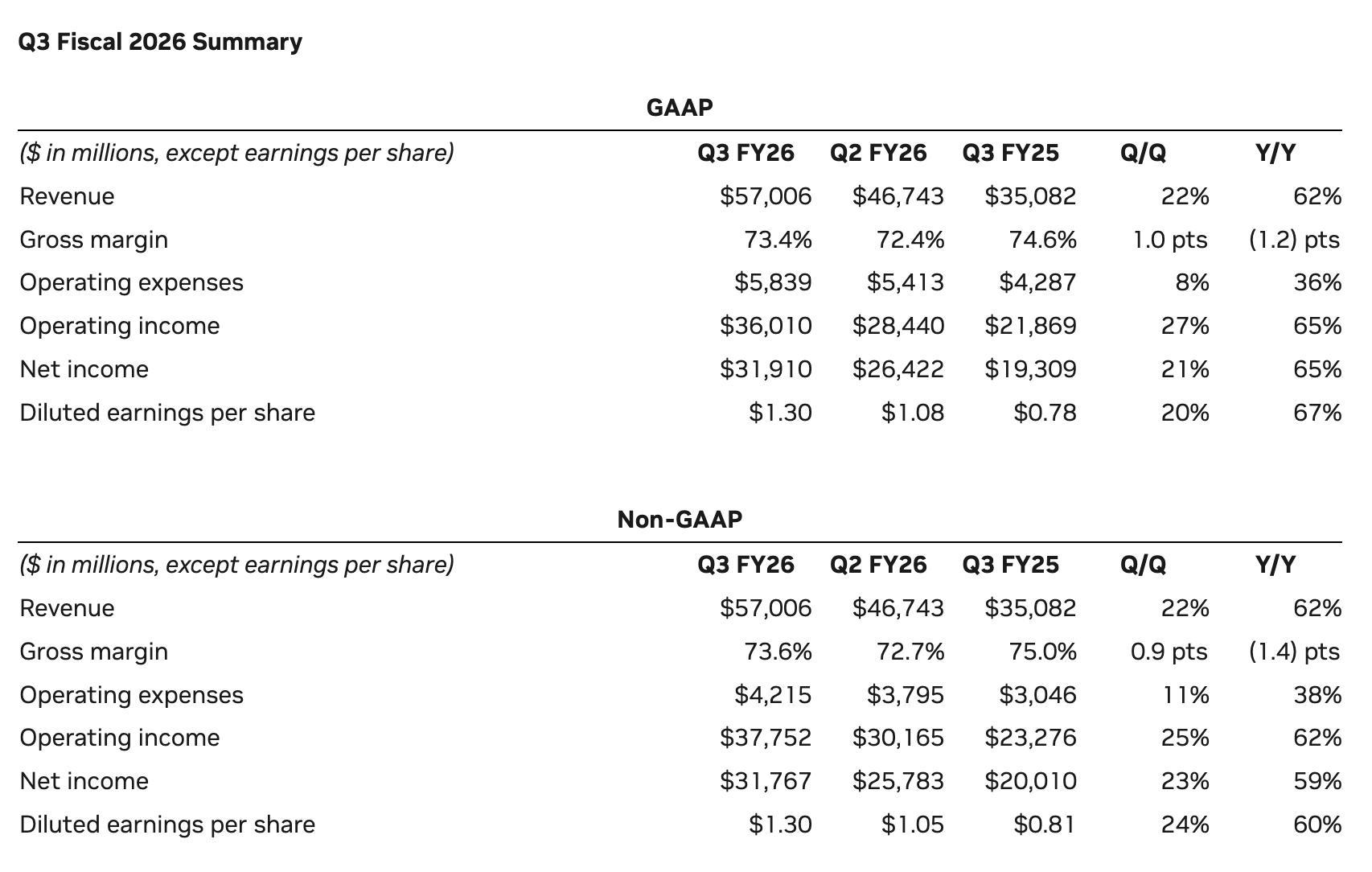

Wednesday evening delivered what should have been an unambiguous positive for markets. Nvidia reported record revenue of $57.0 billion, up 22% from the previous quarter and up 62% from a year ago, with earnings per share of $1.30 beating the $1.26 consensus estimate. CEO Jensen Huang proclaimed that "Blackwell sales are off the charts, and cloud GPUs are sold out", while guidance for the fourth quarter came in at $65 billion—well above the $62 billion Wall Street had penciled in.

By any traditional measure, this was a blowout quarter:

Data center revenue hit a record $51.2 billion

Margins held firm at 73.6%

Demand for the company's cutting-edge Blackwell chips appeared insatiable

Initial market reaction seemed appropriate: Nvidia shares gained as much as 5% in after-hours trading, and tech futures surged.

Then came Thursday. Nvidia's reversal dragged the broader market down. Shares had gained as much as 5% after the chipmaker released better-than-expected quarterly results and an upbeat fourth-quarter sales forecast. However, the stock ultimately closed down 3%, despite Huang's reassurances about robust demand. The Nasdaq, which had opened up 2.6%, finished down 2.16%. The S&P 500 surrendered a 1.9% opening gain to close down 1.56%.

What happened? The simplest explanation is that valuation concerns finally overwhelmed fundamentals. At 52 times trailing earnings before the report, Nvidia's stock had already priced in perfection—and perhaps more. When the company delivered merely excellent (rather than miraculous) results, profit-taking ensued. But the severity of the reversal hints at something deeper: a growing nervousness that the AI infrastructure buildout, while real, has gotten ahead of itself.

This wasn't an isolated event. Other AI beneficiaries like Palantir, AMD, and Taiwan Semiconductor also gave back gains, suggesting investors are increasingly questioning how much more upside remains in a trade that has already delivered spectacular returns. The fact that Nvidia can report record revenue and earnings growth of 60%+ and still see its stock decline speaks volumes about the psychological fragility of this market.

Oil's Oversupply Problem and the Safe-Haven Shuffle

Away from the drama of tech and crypto, commodity markets told their own story this week. Crude oil prices are under considerable pressure, with Brent crude hovering around $63.52-$64.03 per barrel and West Texas Intermediate around $59.60-$60.10 per barrel, representing a notable decline from prices observed earlier in the year.

The culprit is straightforward: too much supply chasing too little demand. The International Energy Agency forecasts a significant global oil supply surplus extending into 2026, with the IEA anticipating a surplus of 2.3 million barrels per day in 2025, rising to 4.0 mb/d in 2026. Record U.S. shale production, combined with robust output from Brazil, Canada, and Guyana, has flooded the market just as Chinese demand—once a reliable growth engine—has plateaued.

Key factors driving oil lower:

Record U.S. shale production

Robust output from Brazil, Canada, and Guyana

Stagnant Chinese demand

OPEC+ struggling to manage supply discipline

The Energy Information Administration expects this glut to persist, projecting Brent will average just $55 per barrel in 2026. For energy producers and exporters, this represents a significant headwind. For consumers and oil-importing nations, it's welcome relief that should help ease inflationary pressures—assuming it lasts.

Meanwhile, gold has mounted a stunning rally to the opposite extreme. Gold has surged to record highs (over $4,000/ounce, with an October peak of $4,381.58), propelled by geopolitical tensions, economic uncertainty, persistent inflation concerns, and strong central bank demand. The precious metal is behaving exactly as a safe haven should, rising as investors seek refuge from volatility in equities and crypto.

The divergence between oil and gold—one drowning in oversupply, the other soaring on safety bids—captures the strange duality of this moment: deflationary pressures in some corners, inflationary anxieties in others, all wrapped in pervasive uncertainty about what comes next.

Strategy in Focus: Recession Resistant

Given the week's volatility and mounting uncertainty around Fed policy, it's worth considering strategies designed to weather turbulence. Our Recession Resistant strategy offers a disciplined approach to defensive positioning, focusing on companies that have historically demonstrated resilience during economic downturns.

The strategy invests in essential goods and services providers:

Consumer staples companies

Healthcare providers

Utility companies

Essential retail operations

These sectors tend to exhibit lower sensitivity to economic cycles, providing a degree of stability when growth stocks are under pressure.

The current environment presents an interesting setup for defensive positioning. While we're not necessarily on the brink of recession, we are clearly in a period where growth expectations are being recalibrated and valuation multiples are compressing. Consumer discretionary stocks have lagged this week and month, with the S&P 500 sector slipping more than 2% week to date, making it the worst performing of the 11 sectors. This rotation out of discretionary spending and into essentials is exactly the kind of shift that defensive strategies are designed to capture.

How the strategy works:

Rebalances periodically to maintain diversification across defensive sectors

Reduces exposure to industries that may be more vulnerable during downturns

Focuses on companies with strong fundamentals and reliable cash flows

Provides stability rather than explosive returns

Of course, no strategy is without risk. If markets resume their upward trajectory and growth stocks reclaim leadership, defensive positioning will likely lag. But for investors concerned about the sustainability of recent valuations and the Fed's diminishing willingness to provide support, having exposure to recession-resistant names offers a sensible counterbalance to more aggressive holdings.

What Comes Next

Nvidia's spectacular reversal, Bitcoin's brutal decline, and the Fed's newfound hawkishness all point to a market in transition, one that's recalibrating expectations after an extended period of easy money and frothy valuations.

The path forward remains uncertain:

If the Fed does pause in December, it would mark a meaningful shift in the policy backdrop that has supported risk assets for much of 2025

If inflation remains sticky and employment stays resilient, the case for further cuts weakens considerably

If AI valuations continue to compress despite strong earnings, we may see broader pressure on the growth stocks that have led this market higher

Yet amid this uncertainty lies opportunity. Systematic, disciplined strategies—whether defensive positioning, momentum following, or value-oriented approaches—provide structure when emotions run high. They force us to look beyond the daily noise and focus on what actually works over time: diversification, risk management, and a clear-eyed assessment of both opportunity and danger.

Markets will continue to gyrate. The key is having a plan that can withstand the volatility—and the discipline to stick with it when everyone else is panicking. That's what separates successful long-term investors from those who get shaken out at precisely the wrong moment.

The information contained in this newsletter is for informational purposes only and should not be construed as investment advice. All investments carry risk, including the potential loss of principal. Past performance does not guarantee future results. Before making any investment decisions, consult with a qualified financial advisor to ensure any strategy aligns with your individual financial situation, goals, and risk tolerance

.