- Surmount Markets

- Posts

- Tech Rebounds, Fed Wobbles, Tariffs Bite—Markets Are Shifting Fast

Tech Rebounds, Fed Wobbles, Tariffs Bite—Markets Are Shifting Fast

AI-led rallies, Fed drama, and new global tariffs—all in one week. Here’s how to navigate it.

Big investors are buying this “unlisted” stock

When the founder who sold his last company to Zillow for $120M starts a new venture, people notice. That’s why the same VCs who backed Uber, Venmo, and eBay also invested in Pacaso.

Disrupting the real estate industry once again, Pacaso’s streamlined platform offers co-ownership of premier properties, revamping the $1.3T vacation home market.

And it works. By handing keys to 2,000+ happy homeowners, Pacaso has already made $110M+ in gross profits in their operating history.

Now, after 41% YoY gross profit growth last year alone, they recently reserved the Nasdaq ticker PCSO.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

⚡ Markets Surge as Fed Rate Cut Bets Rise

After months of mixed signals, July’s jobs report finally gave Wall Street something to cheer about: a clear sign of economic softening. Job creation slowed sharply and revisions to earlier months revealed an even weaker labor market than previously thought. That was all markets needed to start pricing in a near-certain Fed rate cut in September.

The result? The S&P 500 and Nasdaq both rallied more than 1%, led by tech and consumer discretionary stocks.

But behind the scenes, political risk is rising. The White House abruptly dismissed the head of the Bureau of Labor Statistics, and a Federal Reserve governor resigned, prompting fears that political interference could erode the Fed’s independence.

Investor takeaway:

Odds of a rate cut in September are now near 90%

Rate-sensitive sectors like tech are outperforming

Political noise could increase volatility as we head into the fall

🚀 AI and Tech Stocks Continue to Lead—But It's Getting Crowded

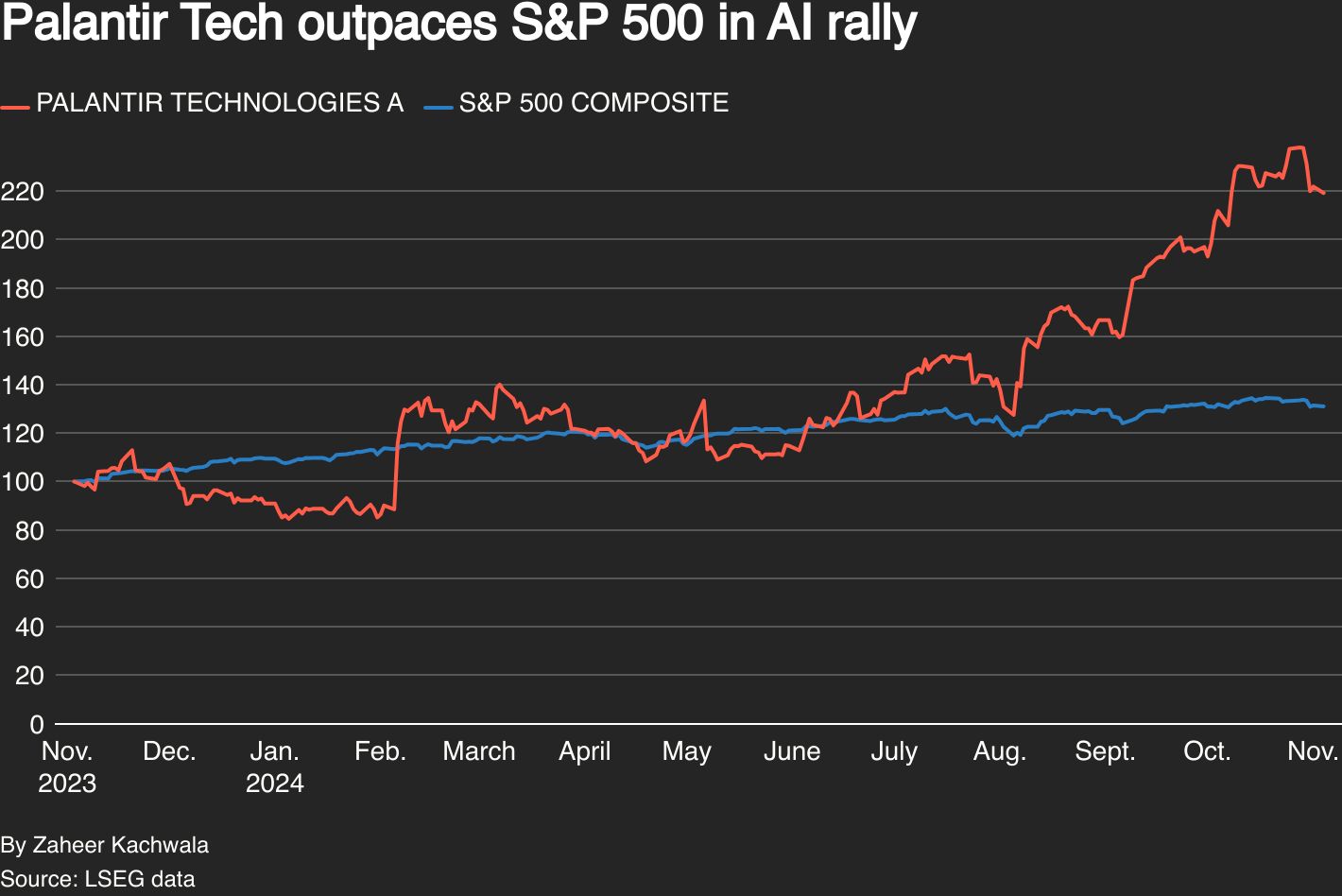

Palantir surged after beating earnings and lifting its full-year outlook, reaffirming investor excitement around AI. The stock is now up over 35% year-to-date. Meanwhile, the rest of the “Magnificent Seven”—Nvidia, Tesla, Microsoft, Apple, Amazon, Meta, and Alphabet—continue to account for a massive share of S&P 500 gains.

That’s both a strength and a risk. These tech titans have delivered, but their dominance means any stumble could drag the entire market down with them.

What to watch:

Palantir and Nvidia’s forward guidance

Whether earnings growth is still justifying premium valuations

Market concentration risks as passive flows chase the same few names

🌎 Tariffs Are Back—And Global Tensions Are Heating Up

This week, the U.S. dropped a new round of tariffs:

39% on Swiss luxury and industrial imports

Trade penalties on India over oil imports from Russia

A proposed 250% tariff on semiconductors and pharmaceuticals from select countries

These measures mark a return to aggressive protectionism. Canada and the EU have already hinted at retaliation, and markets are reacting.

What it means for investors:

Multinationals in pharma and chips could face margin pressure

Supply chain disruption risks are rising again

Emerging markets exposed to U.S. trade may see capital flight

This is not 2018’s trade war replay. It’s broader—and coming amid fragile economic conditions.

📉 Are Stocks Overdue for a Pullback?

Despite bullish headlines, technical signals are flashing yellow. The S&P 500 just formed a bearish engulfing pattern, and the Russell 2000 (small caps) is underperforming. Meanwhile, trading volume is dropping—a classic sign of buyer fatigue. So what does really entail?

Near-term momentum is stalling

Some traders are locking in profits

A healthy correction may be ahead

For long-term investors, this could be a chance to rebalance or buy the dip. Just don’t mistake short-term noise for trend reversals.

🧠 Strategy of the Week: Tesla Short and Long EMA

Tesla has been back in the headlines—this time for CEO Elon Musk’s $29B stock award approval and renewed earnings momentum. But TSLA remains volatile, reacting to news, sentiment, and market flows faster than most stocks.

This EMA-based strategy helps manage that volatility by using technical signals, not emotion:

The strategy is simple yet effective:

Buys TSLA when the 10-day EMA crosses above the 50-day EMA (bullish trend)

Sells TSLA when the 10-day falls below the 50-day (bearish trend)

With TSLA bouncing on macro news, this strategy lets you ride the wave without guessing tops or bottoms.

📅 Looking Ahead

Here’s what’s coming next week:

Earnings from AMD, Pfizer, and Disney

U.S. ISM Services Index and Consumer Credit data

More clarity on Fed commentary and tariff retaliation

As always, the best time to prepare was yesterday. The second-best time is today.

Disclaimer: The information presented is for educational purposes only and not an offer or solicitation for any specific investments. Investments involve risk and are not guaranteed. Consult with a financial adviser before making any investment decisions. Past performance does not guarantee future results.