- Surmount Markets

- Posts

- Volatility Isn’t the Enemy—It’s the Opportunity

Volatility Isn’t the Enemy—It’s the Opportunity

Markets are swinging. Most panic. The smart ones profit. Here’s how to master volatility with discipline—and a Tesla strategy that’s crushing it (+576%)

THIS WEEK’S FOCUS

Mastering Volatility Like a Pro 🌪️

Market volatility is often seen as a villain by many investors, but for those who understand how to manage it, volatility can actually present incredible opportunities. The key is having the right mindset and strategy to turn unpredictability into a tool for success. This week, we’re breaking down how to navigate volatility effectively—and position yourself for long-term gains, even when the market gets rocky.

INVESTMENT OPPORTUNITY

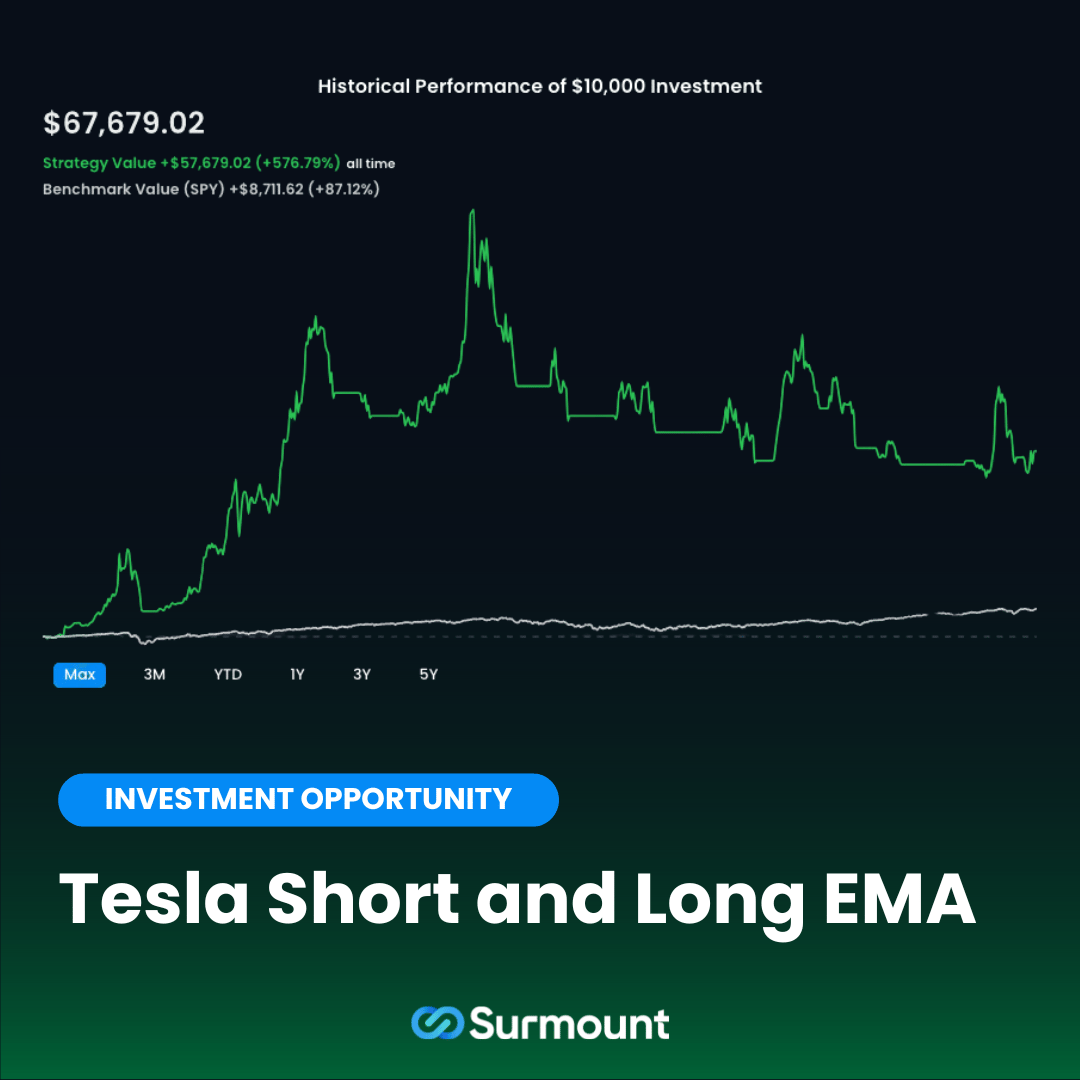

Tesla Long and Short EMA ⚡️

In times of market volatility, staying ahead requires more than just reacting to the daily fluctuations—it’s about leveraging strategies that capitalize on both rising and falling trends. Our Tesla Short & Long EMA Strategy does just that, offering a disciplined approach to navigating unpredictable market conditions with precision and confidence.

How the Strategy Works

This strategy combines short-term (10-day EMA) and long-term (50-day EMA) exponential moving averages to generate buy and sell signals based on Tesla's price movements. When the short-term EMA crosses above the long-term EMA, it signals a buying opportunity, reflecting bullish momentum. On the flip side, when the short-term EMA drops below the long-term EMA, it signals a time to sell, allowing the strategy to adapt seamlessly to changing market conditions.

Proven Performance in Volatile Markets

Market volatility often creates opportunity for those prepared to act swiftly. Here’s how the Tesla Short & Long EMA Strategy has performed:

Total Return: +576.79%

Annual Return: 47.17%, significantly outperforming the S&P 500’s historical benchmarks

Winning Trades: 360 out of 432 trades, resulting in an impressive 83% win rate

These results underscore the strategy’s ability to generate profits in both bullish and bearish environments, particularly in a stock like Tesla, which is known for its price fluctuations.

With this strategy, you’re equipped with a tool that handles the market’s unpredictability while still aiming for a solid return. Click here to check it out!

UNDERSTANDING VOLATILITY

What It Really Means for Investors 🔍

Market volatility is essentially the speed and scale of price fluctuations in the stock market. You’ve probably heard it described in terms of “up days” and “down days” or major swings in prices. While volatility can feel unsettling, it’s not necessarily a bad thing—it’s simply how markets react to new information, be it economic news, earnings reports, or geopolitical events.

Why you should care:

Volatility matters because it’s often during these periods that many investors make emotional decisions, buying high when optimism is rampant and selling low out of fear. Understanding volatility and preparing for it in advance can protect your portfolio from these common mistakes and even position you to take advantage of market fluctuations.

KNOW THE DIFFERENCE

Volatility vs. Risk 📉

It’s important to understand that volatility and risk are not the same.

Volatility refers to the short-term fluctuations in asset prices—essentially how quickly and by how much they change.

Risk is the possibility of a permanent loss of capital or a failure to meet your investment goals.

While volatility might cause short-term declines in your portfolio, it doesn’t necessarily mean you're at risk of losing money long term. Understanding this distinction can help you stay level-headed when markets swing. When viewed correctly, volatility is an opportunity, not a threat.

TIPS FROM THE PROS

3 Strategies to Master Volatility 🛠️

1. Stick to Your Long-Term Plan

One of the biggest mistakes investors make during volatile times is abandoning their long-term strategy. Emotional decisions driven by short-term price swings—whether fear of losses or greed from sudden gains—can lead to poor outcomes. Instead, ground yourself in your overall financial goals and avoid letting volatility tempt you to stray from your plan.

Revisit your goals, remind yourself of why you’re investing, and trust your long-term strategy. Volatility is temporary, but your goals should remain constant.

2. Dollar-Cost Averaging: A Proven Approach in Volatile Markets

Dollar-cost averaging (DCA) is one of the best strategies for navigating volatility. By investing a fixed amount on a regular basis, you buy more shares when prices are low and fewer shares when prices are high. Over time, this smooths out the price you pay for investments and reduces the risk of making poor timing decisions.

This steady, disciplined approach allows you to benefit from price dips while maintaining consistency in your investment plan—no matter how volatile the market gets.

3. Diversify to Manage Risk

Diversification is key to managing volatility. By spreading your investments across a variety of asset classes (stocks, bonds, real estate, and more), you reduce the impact of a downturn in any single asset or sector. When one area experiences volatility, another may remain stable, helping to protect your portfolio as a whole.

While diversification doesn’t eliminate all risk, it does help smooth returns and reduce the effects of volatility on your overall performance.

DON’T FEAR THE DIP

How to Spot Opportunities in Volatile Markets ✨

Here’s the good news: volatility often creates opportunities for young investors willing to look beyond the noise.

Price Drops as Opportunities:

When the market swings wildly, prices of high-quality stocks can drop below their true value. During these times, many investors panic-sell, but if you’ve done your research and are focused on long-term value, you can pick up stocks at a discount. History shows that disciplined investors who buy during market downturns often reap significant rewards as markets recover.

Pro Tip: Create a “watchlist” of companies or assets you believe in, and when volatility drives their prices down, consider adding to your positions. Just ensure these investments align with your overall strategy.

CASE STUDY

Navigating Volatility During the 2020 Market Crash 💉

When discussing market volatility, one of the best modern examples is the 2020 market crash triggered by the COVID-19 pandemic. In early March 2020, global markets took a nosedive, with the S&P 500 dropping more than 30% in a matter of weeks. This sudden and severe volatility caused widespread panic, leading many investors to sell off assets in fear of further declines.

However, those who maintained discipline and stayed invested—or even added to their positions—were rewarded handsomely as markets rebounded rapidly. Investors who stuck to strategies like dollar-cost averaging (DCA) continued to buy assets at lower prices, and by the end of the year, the S&P 500 had recovered all its losses and even hit new highs.

How Long-Term Investors Thrived

One standout example comes from those who followed Jack Bogle’s index fund philosophy. His concept of low-cost, passive investing through diversified index funds, such as the Vanguard 500 Index Fund, protected many investors from the worst of the volatility. Since index funds inherently spread risk across a wide array of assets, investors who held onto these funds throughout 2020 saw their portfolios bounce back quickly after the initial crash. This strategy allowed them to avoid the sharp losses individual stocks might have faced and participate in the broader market’s recovery.

Additionally, those who adopted low-volatility strategies, focusing on high-quality companies with stable earnings and strong fundamentals, fared much better. For instance, during the 2020 crash, companies in defensive sectors like consumer staples and healthcare saw less dramatic declines and recovered more steadily than higher-risk sectors

Key Takeaway:

This case illustrates the importance of remaining calm and sticking to a long-term investment strategy during periods of volatility. By leveraging strategies like dollar-cost averaging, diversification, and focusing on quality assets, investors can not only weather volatile times but also capitalize on opportunities to grow their portfolios when the market rebounds.

BUILDING MENTAL RESILIENCE

How to Stay Calm in Volatile Times ☁️

Volatility can take a mental toll, especially when you see your portfolio fluctuating wildly. But the key to mastering volatility is staying calm and avoiding emotional reactions.

1. Focus on the Fundamentals:

During market swings, it’s easy to get distracted by day-to-day news. Instead of reacting to the noise, focus on the fundamentals of the companies or assets you’re investing in. If the underlying business or asset remains strong, short-term price movements shouldn’t shake your confidence.

2. Limit Your News Intake:

Constantly watching market news or checking your portfolio can heighten anxiety. Set a limit on how often you check your investments and trust the strategy you’ve put in place.

3. Zoom Out and Think Long Term:

When in doubt, zoom out. Markets can look volatile in the short term, but when you take a long-term view, you’ll notice that most downturns are temporary blips on the path to growth. Keep your eyes on your future financial goals and remember that patience is often the greatest virtue in investing.

CLOSING THOUGHTS

Volatility Is Inevitable—Your Response Makes the Difference 🌊

Volatility is a natural part of investing, but how you handle it is what truly matters. By using strategies like Surmount’s Volatility-Adjusted approach, sticking to your plan, employing dollar-cost averaging, and diversifying your portfolio, you can turn market turbulence into an advantage.

Mastering volatility requires discipline, a long-term mindset, and the right tools to stay calm and collected while others panic. With the right strategies, you can navigate the ups and downs of the market—and emerge stronger for it.

Ready to take control of your investment psychology? Discover how Surmount’s automated strategies can help you remove emotion from your decision-making process and keep you on track to reach your financial goals.

Stay resilient. Stay Surmount ⛰️

Receive Honest News Today

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.