- Surmount Markets

- Posts

- Small Caps' Historic Run, Gold Hits $5,500, Corning's Surprise $6B AI Windfall

Small Caps' Historic Run, Gold Hits $5,500, Corning's Surprise $6B AI Windfall

The Russell 2000 just staged its longest winning streak since 1996, while a 175-year-old glassmaker is suddenly the hottest name in AI infrastructure.

The Great Rotation Is Here (Maybe)

For the first time since the dot-com era, small caps dominated large caps for 14 straight trading days—a streak not seen since May 1996. The Russell 2000 surged nearly 8% through January 22 while the S&P 500 managed just 2%, before the streak finally snapped on January 23. Meanwhile, gold blew past $5,500 as the dollar cratered to four-year lows, and a company best known for making iPhone glass just inked a $6 billion AI infrastructure deal that sent its stock up 16% in a single session.

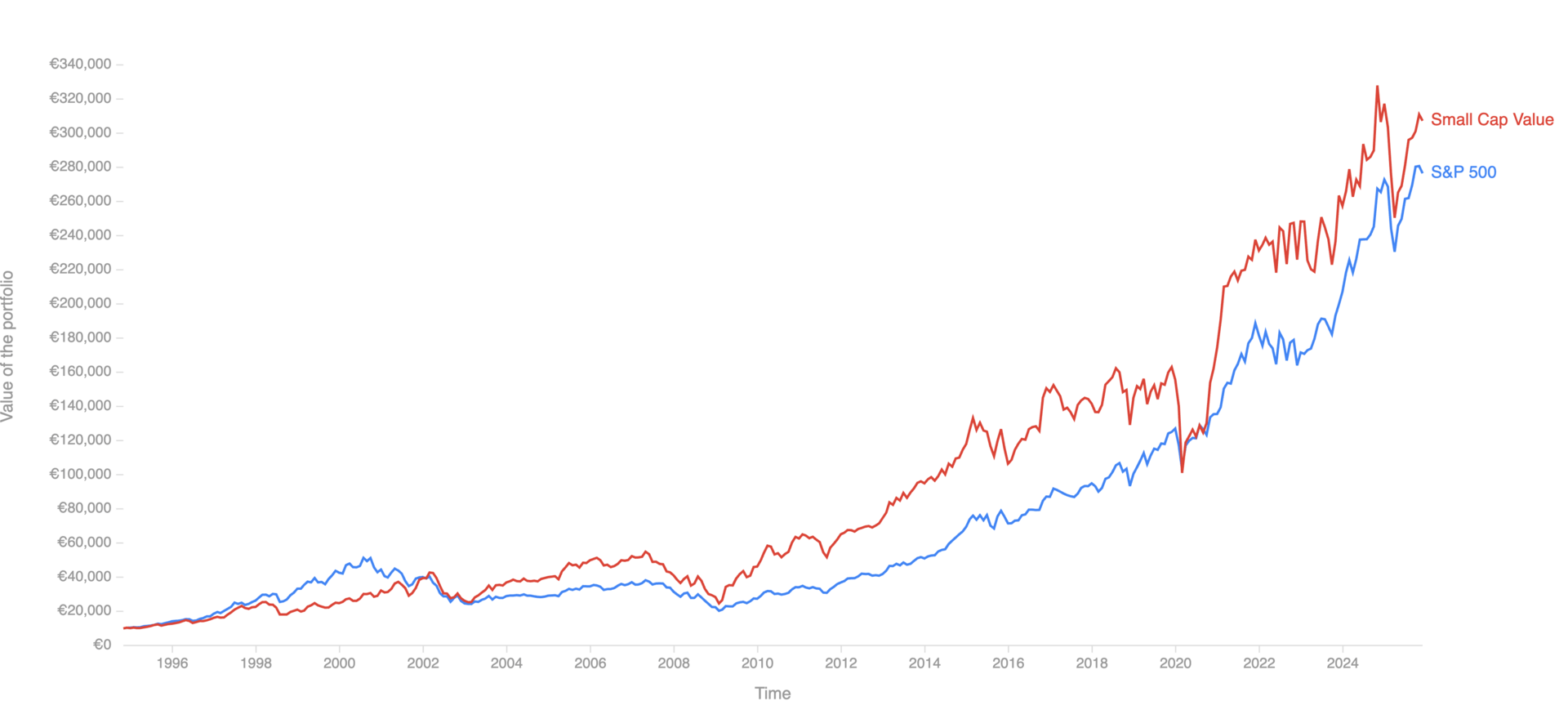

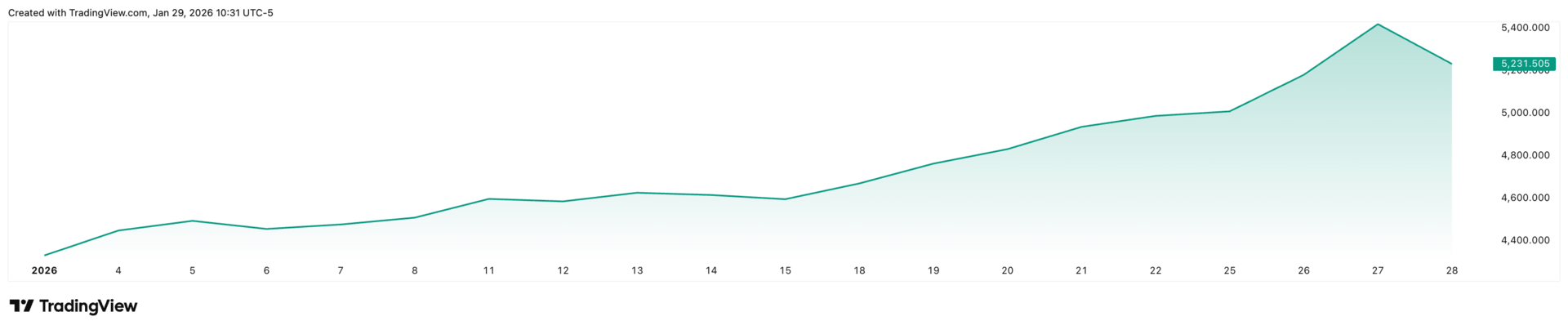

S&P 500 vs Small Cap Value

If 2025 was the year of Magnificent Seven dominance, 2026 is shaping up very differently.

When Is the Right Time to Retire?

Determining when to retire is one of life’s biggest decisions, and the right time depends on your personal vision for the future. Have you considered what your retirement will look like, how long your money needs to last and what your expenses will be? Answering these questions is the first step toward building a successful retirement plan.

Our guide, When to Retire: A Quick and Easy Planning Guide, walks you through these critical steps. Learn ways to define your goals and align your investment strategy to meet them. If you have $1,000,000 or more saved, download your free guide to start planning for the retirement you’ve worked for.

Small Caps Stage a Historic Comeback

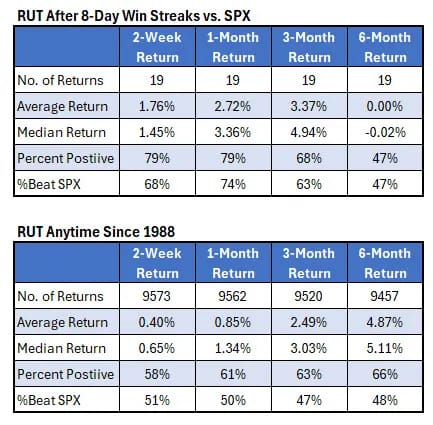

The Russell 2000 just delivered its longest streak of daily outperformance versus the S&P 500 in nearly three decades. From January 5-22, small caps beat large caps by an average of 45 basis points every single day, gaining 8.2% compared to the S&P's 1.9%.

This isn't just a technical bounce. Three structural shifts are driving capital into smaller companies:

Earnings handoff: Russell 2000 companies are forecast to grow earnings 60% in 2026 as previously unprofitable firms turn corners. Meanwhile, Magnificent Seven growth is decelerating from 36% in 2024 to 18% in 2026.

Lower borrowing costs: Fed rate cuts to 3.50-3.75% are a lifeline for small caps, 40% of which carry floating-rate debt.

Valuation gap: The Russell 2000 trades at 18.11x forward P/E versus the S&P's 22x—a discount that's attracting rotation from richly valued mega-caps.

The concentration risk that defined 2025 finally matters. When the top 10 S&P 500 stocks hit 40% of index weight (surpassing even the 1980 peak of 26%), investors started looking elsewhere. The last time we saw this kind of concentration before a rotation? February 2000.

Historical data suggests small-cap outperformance tends to continue in the short term following these streaks, though mean reversion is always a risk. The key watch: whether Russell 2000 companies can actually deliver on those 60% earnings growth estimates.

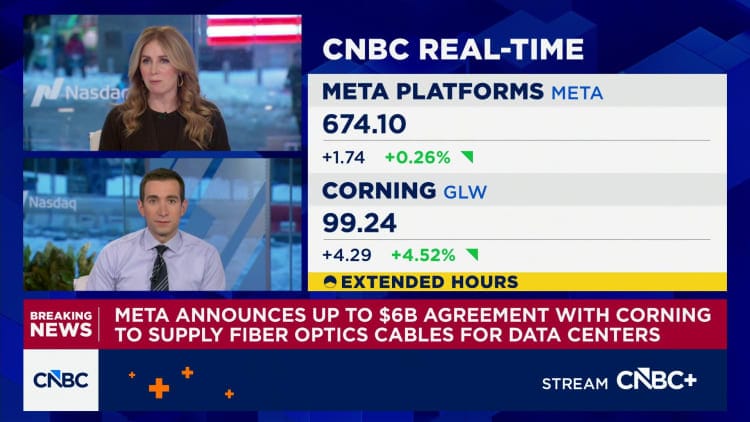

The AI Infrastructure Play You Probably Missed

While everyone was watching Nvidia, a 175-year-old glassmaker just became one of the most critical suppliers in the AI stack.

Meta announced it will pay Corning up to $6 billion through 2030 for fiber-optic cable to wire its expanding fleet of AI data centers. The stock surged 16% on the news, then added another 15% the following day after beating Q1 guidance on overwhelming fiber demand.

The bottleneck thesis: AI data centers require 8 million miles of optical fiber each—for a single facility like Meta's Louisiana "Hyperion" project. That's exponentially more than traditional cloud infrastructure. As Mike O'Day, Corning's fiber optics head, explained: "Moving photons is between five and 20 times lower power usage than moving electrons."

With power now the biggest constraint for hyperscalers, fiber becomes mission-critical. Yet fiber capacity wasn't on anyone's 2026 bingo card.

The picks-and-shovels boom is real:

Caterpillar reported higher profits as demand for power generation equipment surged amid data center buildouts

ASML posted record bookings of €13.2 billion (versus €6.85B expected) driven by chipmaker capacity expansions

IBM beat on 21% infrastructure revenue growth, with mainframe sales up 67% year-over-year

These aren't semiconductor companies—they're the infrastructure layer that makes AI possible. Corning CEO Wendell Weeks survived the dot-com fiber crash (stock lost 99% of value in 2000-2002) by continuing to develop fiber technology. Twenty-five years later, that patience is paying off as optical fiber demand hits record levels.

Risk check: The hyperscalers are projecting $470+ billion in 2026 capex, up from $350B in 2025. If even a fraction of those projects slip on permitting, power availability, or demand concerns, supply chains could face whiplash. But for now, every supplier is sold out through at least 2027.

Gold's $5,500 Wake-Up Call

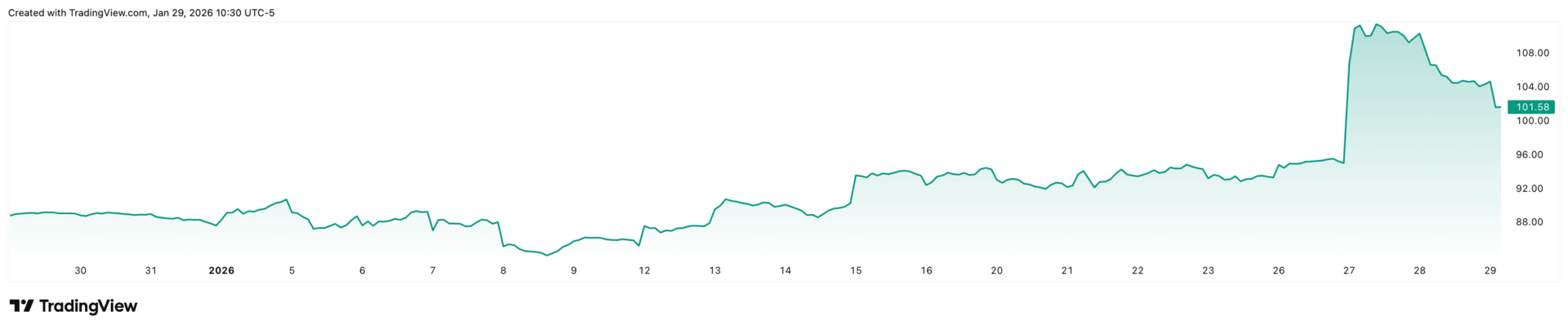

Gold extended its record-breaking rally above $5,500 on Thursday, hitting fresh highs amid dollar weakness and heightened uncertainty. The metal is now up 22% year-to-date—nearly matching the S&P 500's entire 2025 return in just one month.

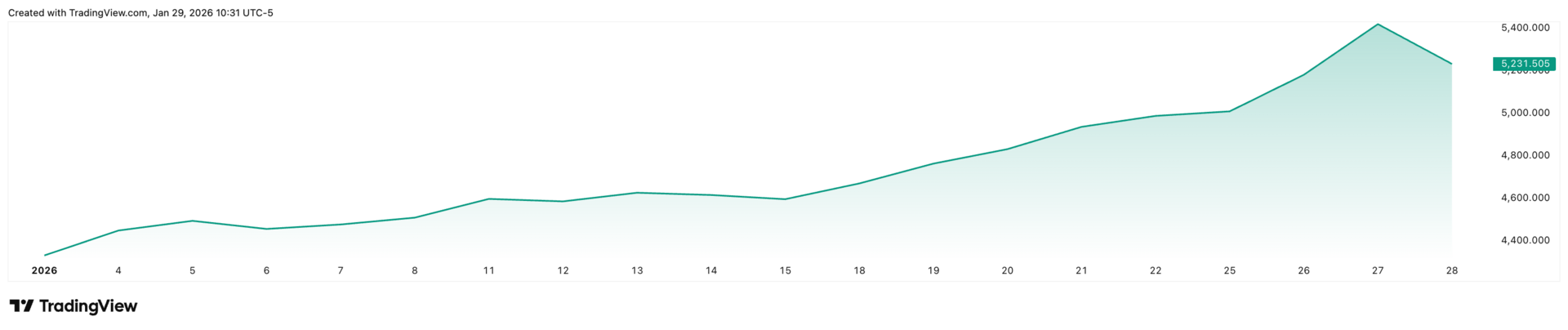

Gold Price (USD) YTD

Trump's dollar tolerance: When asked about the dollar's slide to four-year lows, President Trump said "I think it's great." That comment accelerated a selloff that has the DXY down over 2% this year. One euro now buys $1.20, and the British pound trades at $1.38—levels not seen since 2022.

U.S. Dollar Index (YTD)

What's driving gold:

Fiat skepticism: "Gold is the inverse of confidence," explained one IG analyst. "When belief in policy coherence weakens, gold ceases to behave like a hedge and instead acts as an alternative."

Fed independence concerns: Two Fed officials dissented at this week's meeting, favoring immediate cuts. Speculation about Trump potentially replacing Powell keeps uncertainty elevated.

Geopolitical premium: Trump warned Iran that U.S. forces stand ready to act "with speed and violence, if necessary," adding to Middle East supply concerns.

Wall Street is raising targets. Goldman Sachs lifted its year-end forecast to $5,400 from $4,900, while Deutsche Bank sees $6,000 as possible, citing central bank buying and private sector diversification.

This isn't fear of recession—it's doubt about fiat stewardship. Gold trading 30% above its 200-day moving average usually signals a correction, but the structural drivers (fiscal concerns, central bank buying, geopolitical risk) remain intact. For now, the "debasement trade" has momentum.

Strategy in Focus: Following the Best Analysts

With earnings season in full swing and analyst calls multiplying, Surmount's new Analyst Buys Strategy offers a systematic way to track Wall Street's most accurate voices.

Quiver Quantitative's proprietary scoring rates analysts based on historical price target accuracy. The strategy weights each analyst's most recent forecasts accordingly—giving more influence to those with proven track records and lower (or negative) weights to those with poor accuracy. It then selects the top 100 stocks by weighted forecast, narrows to the 10 largest by market cap to ensure liquidity, and rebalances monthly.

Q4 earnings are tracking 82.8% EPS beats and 68.8% revenue beats among the 64 S&P 500 companies that have reported. With growth remaining strong but dispersion widening, systematic approaches to analyst research become more valuable.

Past accuracy doesn't guarantee future performance, and the strategy concentrates in mega-caps to avoid illiquid names. But for investors looking to systematically harness expert opinion without chasing every headline, it's a rules-based filter worth watching.

Also launching: Tim Moore Tracker and Rob Bresnahan Tracker—strategies that mirror congressional stock portfolios, rebalancing when new trades or annual reports are disclosed. Because sometimes following the flow matters more than picking stocks.

What to Watch

Next week brings earnings from Alphabet and Amazon—two more hyperscalers whose capex guidance will shape the AI infrastructure narrative. Watch for commentary on power availability, data center timelines, and any hints of projects getting delayed.

The small-cap rally faces its first real test as Russell 2000 companies start reporting Q4 results. Can they deliver on that 60% earnings growth forecast, or was this just a momentum-driven squeeze?

And if gold holds above $5,000, watch for more institutions to announce gold allocations. When the "debasement trade" becomes consensus, corrections get sharper—but the structural bid remains.

The market's showing us that 2026 won't be a rerun of 2025. Small caps matter again, infrastructure bottlenecks are real, and the dollar's no longer untouchable. Adapt accordingly.

— Surmount Markets Team