- Surmount Markets

- Posts

- Markets Start 2026 on Solid Ground—But the Easy Money Era Is Over

Markets Start 2026 on Solid Ground—But the Easy Money Era Is Over

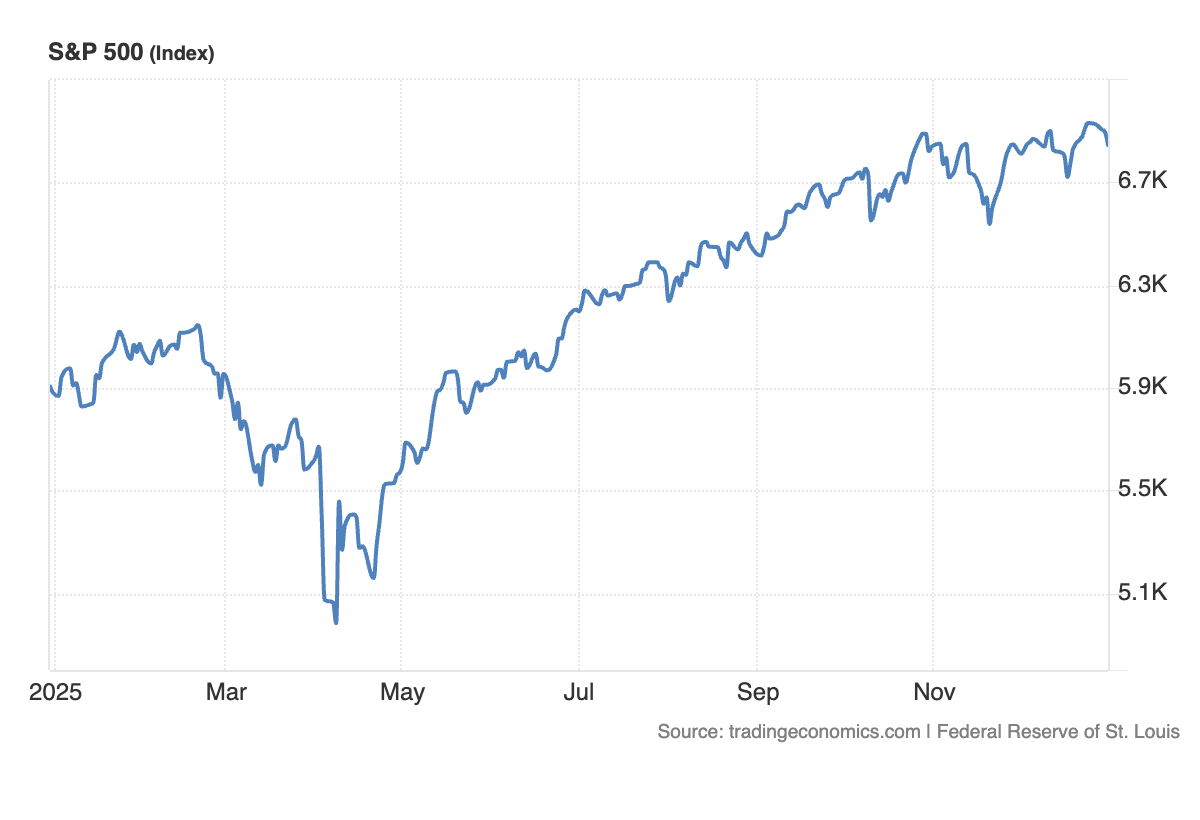

The S&P 500 gained 17% in 2025, marking three straight years of double-digit returns. As we enter 2026, the Fed is tapping the brakes, tariffs remain uncertain, and investors are watching whether the market can broaden beyond big tech.

Happy New Year! Wall Street closed the books on 2025 with a flourish—and opened 2026 the same way. The S&P 500 rose 0.7% on the first trading day of the new year, extending a remarkable three-year winning streak that saw the index gain 16.6% in 2025, following 23% gains in both 2024 and 2023. The Nasdaq, powered by artificial intelligence and mega-cap tech, surged 20% for the year, while even the more staid Dow managed a respectable 13% advance.

But beneath the champagne toasts and record closes lies a more complicated story. The Federal Reserve, which cut rates three times in the final months of 2025, is now signaling a pause. Chair Jerome Powell's December press conference carried an unmistakable message: the era of easy monetary support is winding down. With rates now sitting in what the Fed calls "neutral territory", the central bank is stepping back to assess whether the economy can stand on its own—and whether inflation, still running above the 2% target, will cooperate.

At the same time, trade policy remains a wildcard. President Trump's tariffs raised roughly $250 billion in 2025, and while some levies have been delayed or negotiated down, the average effective tariff rate stands at nearly 17%—the highest in decades. The Supreme Court is set to rule on the legality of some of these tariffs in 2026, adding another layer of uncertainty for businesses and investors alike.

So as we turn the calendar, the question isn't whether markets can continue to climb—it's whether they can do so without the twin tailwinds of dovish monetary policy and low trade friction that defined much of the past three years.

Federal Reserve: The Pause That Matters

December's quarter-point rate cut brought the federal funds rate to 3.5-3.75%, completing a trio of reductions that began in September. But this wasn't your typical dovish pivot. Powell's press conference was blunt: "We're well positioned to wait and see how the economy evolves." Translation: don't expect more cuts anytime soon.

The Fed's dynamics tell the story:

The updated "dot plot" projects just one additional cut in 2026, down sharply from earlier expectations

Market participants remain more optimistic, pricing in two or more reductions by year-end

The vote itself revealed deep divisions: 9-3 split with dissents from both sides—some wanted faster cuts, others no cut at all

Core inflation remains at 2.8%, well above the Fed's 2% target

Powell acknowledged the bind directly: "Risks to inflation are tilted to the upside and risks to employment to the downside. There is no risk-free path."

Adding to the intrigue is Powell's impending departure. With just three FOMC meetings left before his term ends, speculation has turned to President Trump's nominee—widely believed to be Kevin Hassett, who has publicly advocated for faster rate cuts. Whether the next Fed chair maintains Powell's cautious approach or shifts toward accommodation will be one of 2026's defining questions.

For now, the message is clear: investors should prepare for a Fed that's watching, not acting. And in an environment where monetary policy has been a reliable tailwind, that shift matters.

The Market Broadens, Finally

One of 2025's most encouraging developments was the broadening of market leadership beyond the so-called "Magnificent 7" technology stocks. While mega-cap names continued to dominate—Nvidia up 39%, Palantir up 136%, Alphabet up 65%—the year's late-stage rally was powered by financials, industrials, and cyclical sectors that had lagged for much of the AI boom.

The evidence of rotation is compelling:

Small-cap stocks hit new all-time highs in December, with the Russell 2000 reaching record levels

The S&P 500's December rally wasn't propelled by technology but rather by financials and industrials

Wall Street strategists are calling for S&P 500 targets between 7,500-8,000 for 2026, citing improved breadth

The CNBC Market Strategist Survey shows an average S&P 500 target of 7,629, implying 11.4% upside

This rotation suggests something important: investors are starting to believe the economic expansion can extend beyond the handful of companies driving AI infrastructure spending. As U.S. Bank's Tom Hainlin noted, "That just gives more confidence heading into 2026 that it's not just tech here and everybody behind them."

That said, valuations remain elevated. The S&P 500 trades at roughly 21x forward earnings, well above historical averages. Technology sector P/E ratios have reached levels last seen during the dot-com bubble. A "valuation hangover" is a real risk if corporate earnings fail to meet lofty expectations or if the Fed's pause extends longer than markets anticipate.

Still, the shift from a tech-only story to a broader market narrative is a positive sign. If 2026 can deliver on the promise of leadership rotation, it would mark a healthier foundation for sustained gains.

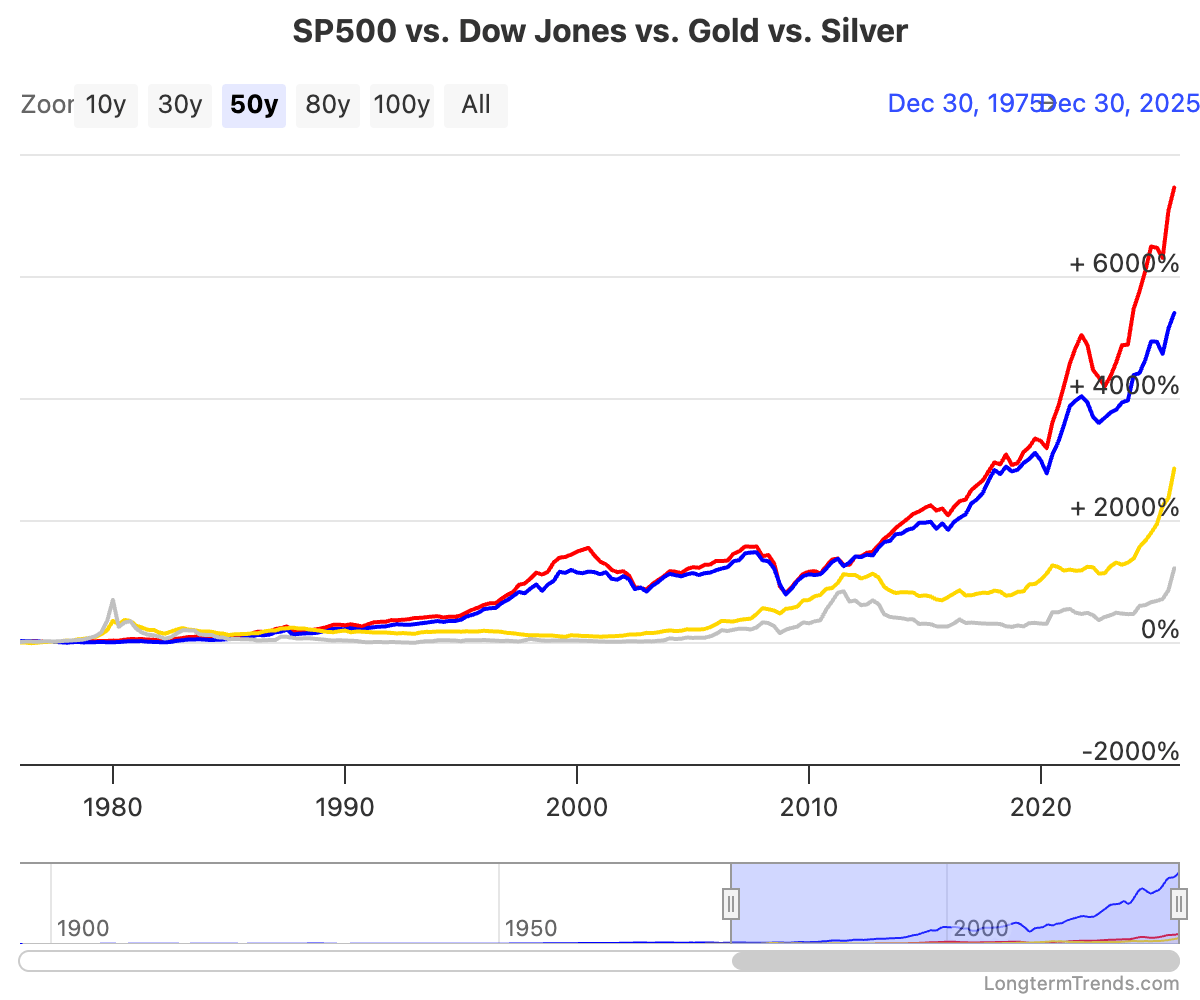

Gold Shines, Bitcoin Stumbles: A Tale of Two Safe Havens

Few assets had a better 2025 than gold. The yellow metal surged nearly 70%, reaching record highs above $4,500 per ounce and capping its strongest annual performance since 1979. The rally was driven by multiple factors:

Aggressive central bank buying from countries seeking to diversify away from the dollar

The Federal Reserve's rate-cutting cycle, which reduced the opportunity cost of holding non-yielding assets

Persistent geopolitical uncertainty from conflicts in Ukraine and the Middle East

A softer U.S. dollar throughout 2025 that provided a tailwind

Goldman Sachs projects gold could reach $4,900 by the end of 2026, citing structural support from continued diversification. Bank of America sees potential for $5,000, arguing that expanding U.S. fiscal deficits will provide persistent support.

Bitcoin, by contrast, finished the year with a whimper. After touching new highs above $120,000 in October, the cryptocurrency slid 30% to close the year below $90,000. The divergence between gold and Bitcoin—often touted as "digital gold"—has never been more pronounced. While gold responded to macro uncertainty and dovish monetary policy, Bitcoin appeared more sensitive to liquidity conditions and crypto-specific flows, shedding the safe-haven narrative that had driven earlier rallies.

Bloomberg analyst Mike McGlone warned that Bitcoin's ratio to gold could fall to 10x from its current 20x, suggesting further downside to around $50,000 if macro conditions deteriorate. For now, gold remains the preferred hedge against uncertainty—a role Bitcoin has struggled to reclaim.

Tariffs: The Uncertainty Tax

If there's one constant in Trump's second term, it's tariffs. By the end of 2025, the administration had imposed levies on roughly $2.3 trillion worth of imports, raising an estimated $250 billion in revenue. The average effective tariff rate hit 16.8% in November, the highest level since World War II.

Recent developments paint a mixed picture:

In late December, the White House delayed a scheduled increase on furniture, cabinets, and vanities by one year, citing ongoing trade negotiations

A deal with China extended tariff relief through November 2026, removing some of the most punitive levies

The Supreme Court heard arguments in November on whether the administration exceeded its authority under IEEPA

Framework agreements were reached with Vietnam (20%), Philippines (19%), Indonesia (19%), and South Korea (15%)

But uncertainty remains. If the Court rules against the administration in 2026, billions of dollars in tariffs could be invalidated—or reworked through different legal channels. For businesses, this creates a planning nightmare. Should they invest in reshoring capacity or wait to see if tariffs are rolled back?

The Tax Policy Center estimates that tariffs will impose an average burden of roughly $2,100 per U.S. household in 2026—a hidden tax that weighs on discretionary spending and corporate margins. The Tax Foundation projects an average tax increase of $1,400 per household, representing 0.47% of GDP and making these the largest tax hikes since 1993.

Trade policy will remain a key wildcard in 2026, particularly as President Trump prepares for a planned April state visit to Beijing.

Strategy in Focus: Deep Tech

In a year where AI continues to reshape the economic landscape and Powell himself noted productivity may be running at 2% thanks to technological innovation, Surmount's Deep Tech Innovators strategy offers a compelling way to capture this secular growth trend.

This strategy focuses on companies at the forefront of transformative technology—artificial intelligence, machine learning, cybersecurity, cloud computing, and advanced semiconductors. These aren't speculative moonshots; they're established companies with real revenue streams and proven business models that are redefining how industries operate. The portfolio spans 30 carefully selected firms across hardware, software, IT services, and semiconductor sectors.

Why this makes sense now:

JPMorgan highlights that hyperscale data center operators—Amazon, Google, Microsoft, Meta—are expected to maintain elevated capital expenditure levels, with cumulative spending potentially reaching several hundred billion dollars by 2026

This investment cycle supports key constituents like Nvidia, AMD, and Broadcom, which remain core holdings in the Deep Tech universe

The Fed's acknowledgment that AI is driving productivity gains suggests this isn't a bubble—it's a fundamental shift in economic capacity

Even as the market broadens, technology remains the sector with the strongest earnings growth trajectory heading into 2026

The strategy operates systematically, rebalancing every 30 days based on each company's financial strength, competitive positioning, and growth potential. It's not about chasing the hottest AI stock of the month—it's about maintaining disciplined exposure to the companies building the infrastructure of the digital economy.

What differentiates this approach is diversification within the theme. Rather than betting on a single AI narrative, the strategy spreads exposure across the entire deep tech ecosystem: the chips that power AI, the cloud platforms that host it, the cybersecurity systems that protect it, and the software companies that monetize it. This balanced approach captures the upside of technological transformation while mitigating single-stock risk.

In an environment where the Fed is pausing but productivity gains continue, deep tech companies offer something rare: the ability to grow earnings even without accommodative monetary policy. That's the kind of fundamental strength that matters in 2026.

Closing Thoughts

As we step into 2026, markets are in a curious position. Three years of double-digit gains have pushed valuations to elevated levels, yet corporate earnings remain robust and economic growth continues at a moderate pace. The Federal Reserve has moved to the sidelines, content to let the economy prove it can stand on its own. Trade policy remains a wildcard, with tariffs, legal challenges, and geopolitical negotiations all in play.

What's clear is that 2026 will require more vigilance than 2025. The tailwinds that powered the market higher—dovish monetary policy, AI euphoria, and a resilient consumer—are still present, but they're no longer strengthening. Investors will need to be more selective, more patient, and more aware of risk.

That's where systematic, disciplined investing matters most. In an environment where uncertainty is the only certainty, having a rules-based approach that adapts to changing conditions is invaluable. Whether the market broadens, contracts, or simply grinds sideways, the investors who succeed in 2026 will be those who respect risk, stay diversified, and resist the temptation to chase momentum without conviction.

Here's to a prosperous 2026. The market may be more complex than last year, but for thoughtful investors with a long-term perspective, complexity creates opportunity. Stay systematic, stay disciplined, and most importantly—stay invested. Happy New Year!

— Surmount Markets Team