- Surmount Markets

- Posts

- Markets near record highs — but beneath the surface, turbulence is building

Markets near record highs — but beneath the surface, turbulence is building

Earnings beat, banks stumble, trade tensions simmer, and the Fed prepares its next move. Here's what you need to know this week.

This week, the S&P 500 flirted with all-time highs while the market digested a cocktail of strong earnings, credit jitters, and geopolitical drama. It's the kind of week that reminds us why investing is equal parts art and endurance.

Orbit builds and sends a weekly newsletter for you, so your audience hears from you on time, every time. Turn last week's leads into this week's demos with consistent, value-packed emails that keep you top of mind.

Onboarding is quick: we learn your voice, goals, and audience, then tailor topics and calls to action to your pipeline. You get content that fits your brand and nudges prospects toward purchase without adding work to your day.

Clients like Jesse Clemmens call Orbit an amazing partner with top-notch newsletters that strengthen audience connections. Nathan Fales reports the consistent flow of content has been a game changer, driving higher engagement and sales, all backed by smooth, quick onboarding.

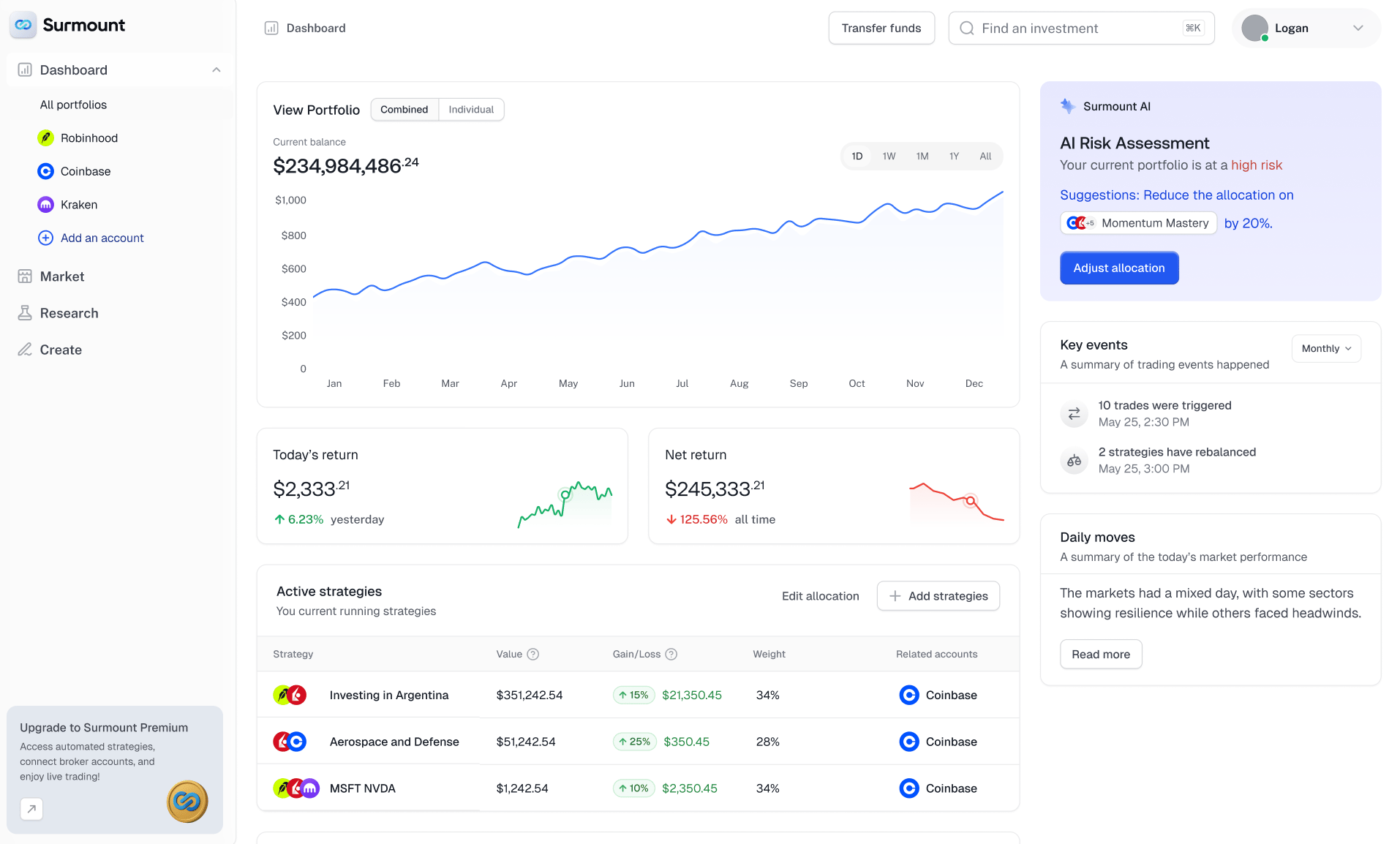

Quick Update from the Surmount Team:

We just launched a complete UI/UX redesign on Surmount, and we'd love for you to check it out! We've reimagined the platform to make systematic investing even more intuitive and powerful.

Take it for a spin and let us know what you think — your feedback shapes where we go next. Join our beta community Slack channel to share thoughts, ask questions, or just connect with other systematic investors.

Now, let's dive into what moved markets this week.

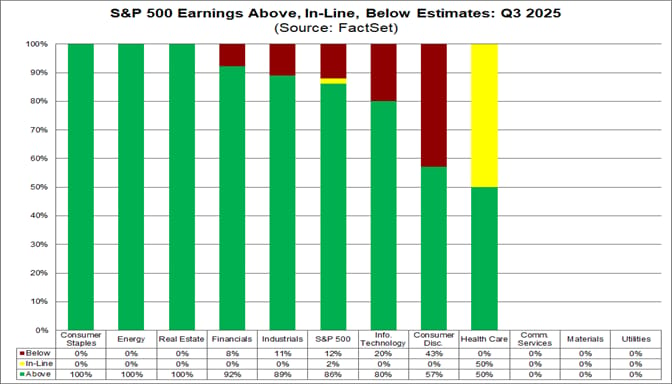

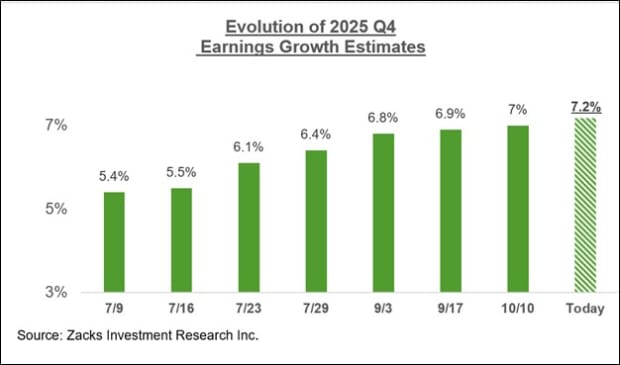

Earnings season delivers — mostly

Q3 earnings came in surprisingly strong:

The S&P 500 is tracking toward 8% year-over-year earnings growth, marking the ninth consecutive quarter of expansion

Analysts raised their estimates during the quarter rather than lowering them — a rare occurrence that signals genuine confidence

86% of companies beat earnings expectations, above the 5-year average of 78%

Tech continues to dominate. Companies like Meta, Microsoft, and Alphabet are posting substantial growth driven by robust digital advertising and surging demand for AI-related cloud services. The AI spending boom isn't slowing down — if anything, it's accelerating.

Outside of tech, the news was mixed. GM crushed expectations and raised guidance. 3M and Coca-Cola beat estimates handily. But beneath the headlines, there's a growing concern about margin pressure and what companies are saying about Q4.

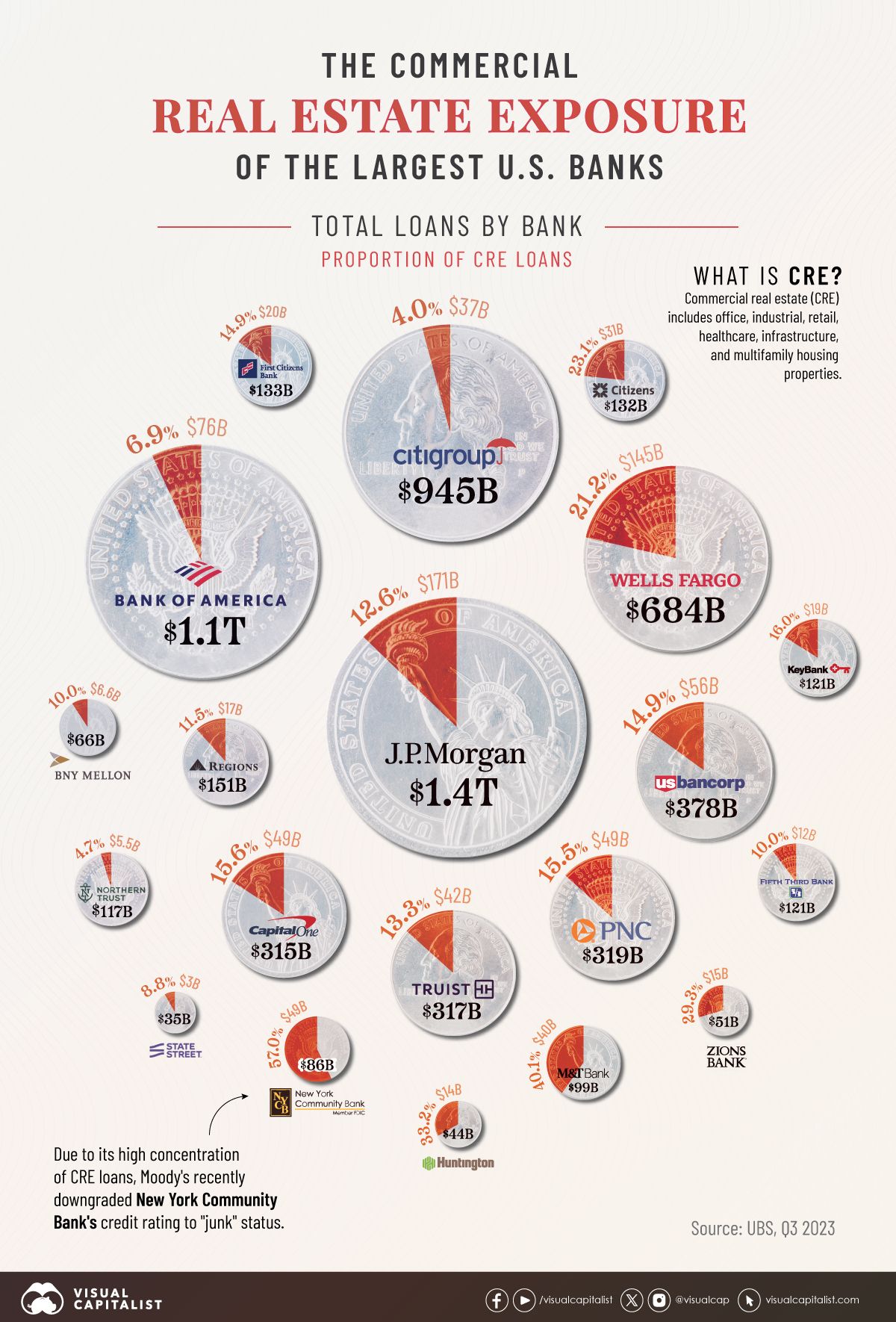

Credit concerns rattle regional banks

Here's where things got uncomfortable:

On October 16, Zions Bancorporation announced a $50 million charge-off related to loans involving apparent fraud, projecting a $60 million provision for credit losses

Western Alliance disclosed similar troubles with a fraud lawsuit against a borrower

The real issue: regional banks hold roughly 44% of their loan portfolios in commercial real estate, compared to just 13% for larger institutions

Over $1 trillion in CRE loans mature by year-end, with office loan delinquency rates near 10.4%

Source: Visual Capitalist

The SPDR S&P Regional Banking ETF dropped 4.6% as investors worried about what else might be lurking in loan books. JPMorgan CEO Jamie Dimon summed it up: "When you see one cockroach, there are probably more."

Larger banks seem better insulated thanks to diversified portfolios, but this is a reminder that credit quality matters — especially when rates have been elevated for this long.

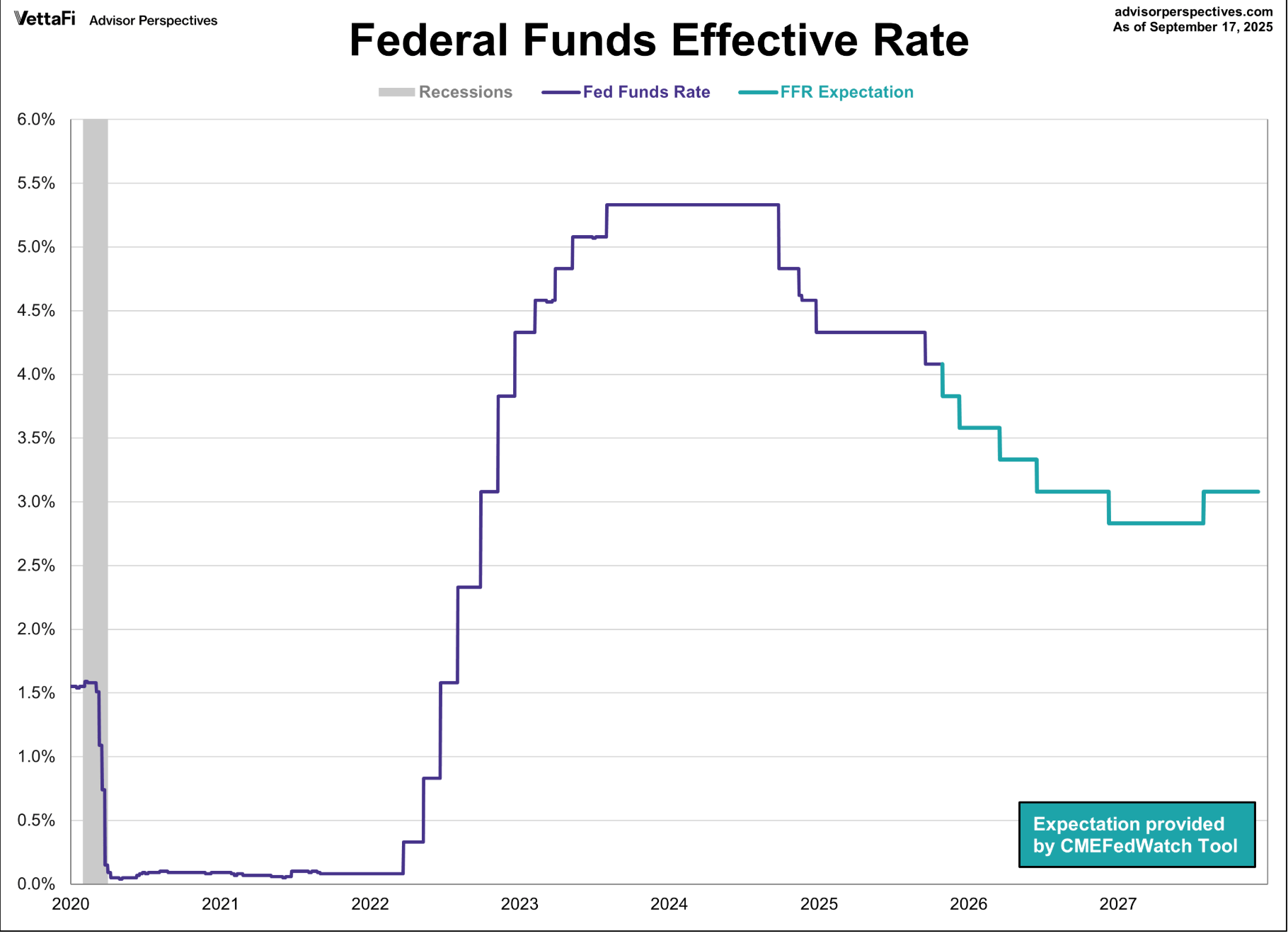

The Fed's balancing act

In September, the Fed cut rates by a quarter point to 4.00%-4.25% in an 11-1 decision

Markets are pricing in another 25 basis point cut at the October 29 meeting with near certainty

Fed Chair Powell emphasized that a sharp slowdown in hiring poses a growing risk to the economy

The government shutdown has complicated their job — critical labor market data has been delayed, leaving the Fed flying somewhat blind

Minutes from the September meeting revealed division among policymakers, with most agreeing further cuts are likely but some still concerned about inflation. Tariffs remain a wildcard that could keep inflation stickier than expected.

US-China trade tensions heat up again

Just when it looked like trade talks might be progressing, tensions escalated:

China expanded export controls on rare earth materials used in everything from smartphones to fighter jets

Trump threatened an additional 100% tariff on Chinese products and listed rare earths, fentanyl, soybeans, and Taiwan as top priorities

A potential Trump-Xi meeting later this month remains on the table, with both sides holding what China described as "candid, in-depth and constructive" talks

Trump vowed to reach a "fantastic deal," though he also hedged that maybe the meeting won't happen. Classic negotiating theater.

For investors, this matters because supply chains, semiconductor availability, and tariff impacts can swing profit margins dramatically.

Government shutdown drags on

The federal shutdown that began October 1 has now stretched into its fourth week

750,000 workers are furloughed daily, blocking the release of key economic data

The delayed September jobs report and CPI data have left investors and policymakers working with incomplete information

Historically, shutdowns have been brief and markets shrug them off. But the longer this drags, the more it weighs on consumer confidence and GDP.

Strategy in Focus: AlphaFactory Protective

Given everything happening this week, one strategy stands out as particularly well-suited for the current environment: AlphaFactory Protective.

We're near all-time highs with strong earnings, but just beneath the surface there are real pressure points — credit issues at regional banks, trade tensions with China, and a government shutdown creating data blind spots.

This is exactly when AlphaFactory Protective shines. It focuses on high-conviction positions in top NASDAQ and NYSE stocks, but adapts based on market volatility:

Low volatility? Fully allocated to quality stocks — capturing upside from strong earnings

Moderate volatility? Adds gold (GLD) as a hedge without abandoning equities

High volatility? Shifts defensively to protect capital

The strategy combines momentum and value signals, gravitating toward companies with strong fundamentals. But when credit concerns pop up or geopolitical tensions flare, the volatility mechanism kicks in automatically.

Think of it as having a co-pilot watching the turbulence gauge while you focus on the destination. You stay invested in quality, but with built-in protection when things get choppy.

Closing thoughts

Markets are at an interesting inflection point. Earnings are solid, which is good. But the details matter — credit quality, forward guidance, inflation data, and geopolitical developments can all shift sentiment quickly.

The lesson this week: don't get too comfortable near all-time highs, but don't panic at every headline either. Stay diversified, stay disciplined, and focus on what you can control.

Next week brings the Fed's October decision and the delayed inflation report. Both will move markets. But remember — investing isn't about predicting the next data point. It's about building a portfolio resilient enough to weather whatever comes next. Markets reward patience and punish panic. Keep that in mind as we head into the final stretch of 2025.

Until next week!

The Surmount Team

The information contained in this newsletter is for informational purposes only and should not be construed as investment advice. All investments carry risk, including the potential loss of principal. Past performance does not guarantee future results. Before making any investment decisions, consult with a qualified financial advisor to ensure any strategy aligns with your individual financial situation, goals, and risk tolerance.