- Surmount Markets

- Posts

- Market Rotation Accelerates as Fed Signals Patience, Small Caps Rally

Market Rotation Accelerates as Fed Signals Patience, Small Caps Rally

The Fed's divided December decision, jobs data revealing labor market cracks, and an unexpected market rotation away from mega-cap tech dominated this week's trading.

The final full trading week of 2025 delivered a master class in market regime change. While headlines focused on the Federal Reserve's third consecutive rate cut, the real story unfolded beneath the surface: a historic rotation from mega-cap technology into small-cap value stocks, combined with labor market data that confirmed the economy is cooling faster than many anticipated.

For high-earning investors planning 2026 allocations, this week's developments mark a potential inflection point worth understanding in detail.

Investors see ANOTHER return on Masterworks (!!!)

That’s 3 sales this quarter. 26 sales total.

And the performance?

14.6%, 17.6%, and 17.8% → The three most representative annualized net returns.

(See all 26 at Masterworks.com)

Masterworks is the biggest platform for investing in an asset class that hasn’t moved in lockstep with the S&P 500 since ‘95.

In fact, the market segment they target outpaced the S&P overall in that time frame.*

Not private equity or real estate… It’s contemporary and post war art. Crazy, right?

Masterworks investors are typically high net worth, but the point is that you don’t need to be a capital-B BILLIONAIRE to invest in high-caliber art anymore.

Banksy. Basquiat. Picasso and more.

80+ of the world’s most attractive artists have been featured.

511+ artworks offered

$67.5mm paid out as of December 2025

$2.3mm+ average offering size

Looking to update your investment portfolio before 2026?

*Masterworks data. Investing involves risk. Past performance not indicative of future returns. Reg A disclosures at masterworks.com/cd

Fed Delivers Divided Rate Cut, Signals 2026 Pause

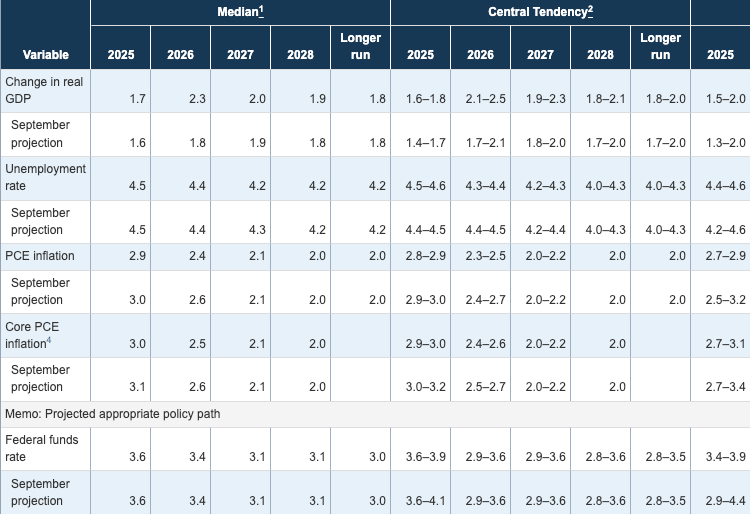

The Federal Reserve cut rates by 25 basis points Wednesday, bringing the benchmark rate to 3.5%-3.75%, but the decision revealed deep internal fractures.

Key Takeaways:

Historic division: 9-3 vote split—most divided FOMC decision since 2019

Three dissents: Two members (Goolsbee, Schmid) favored no cut; one (Miran) wanted 50 basis points

2026 outlook: Dot plot shows just one cut projected for next year, down from market expectations of 2-3 cuts

Seven members penciled in zero cuts for 2026, signaling growing hawkish sentiment

Chair Jerome Powell's press conference emphasized the Fed is "well positioned to wait and see," effectively closing the door on January action. Swaps markets now price only 20% odds of a January cut, with full rate certainty not expected until mid-2026.

The division reflects competing concerns: some members prioritize weakening labor markets, while others remain focused on inflation above the 2% target.

Labor Market Shows Deepening Cracks

Tuesday's delayed employment report—pushed back by the record 43-day government shutdown—revealed more significant weakness than economists anticipated.

November Jobs Data:

Payrolls: +64,000 jobs added (vs. expectations of ~100,000)

October revision: -105,000 jobs, primarily due to federal layoffs

Unemployment rate: 4.6%—highest since September 2021

Year-over-year: 700,000 more Americans unemployed than December 2024

Concerning Details:

Black unemployment surged to 8.3% from 7.5% in two months

Short-term jobless jumped by 316,000

Teenage unemployment: 16.3%

Prior months revised down by additional 33,000 jobs

The Bureau of Labor Statistics acknowledged the shutdown severely disrupted data collection, with October household survey data not collected at all. November figures required "additional collection time," raising questions about accuracy that will only be resolved with December's report in January.

Despite the weak print, markets showed limited reaction—the S&P 500 declined just 0.24% Tuesday—suggesting investors remain focused on Fed easing rather than growth concerns.

Historic Market Rotation: Small Caps Outperform

The most significant development this week wasn't the Fed or jobs data—it was the accelerating rotation from mega-cap technology into previously lagging sectors.

Performance Divergence:

Russell 2000 (small caps): +1.21% Thursday alone

S&P 400 (mid caps): +0.98%

Dow Jones Industrial Average: +1.34% Thursday, new all-time high Monday

Nasdaq Composite: -0.25% Thursday, down 1.6% for the week

What's Driving Rotation:

Multiple factors converged to accelerate capital flows away from concentrated mega-cap positions:

Valuation Gap: S&P 500 trades at 36% premium to 25-year average, while small caps sit just 2% above historical norms

Earnings Growth Reversion: Small-cap earnings projected to grow 22% next year vs. 15% for large caps, according to FactSet

Rate Sensitivity: Lower rates disproportionately benefit small caps, which carry higher debt loads

Policy Tailwinds: Anticipated corporate tax cuts and deregulation favor domestically focused smaller companies

Sector Leadership:

Financials: KBW Bank Index +1.16% Thursday; regional banks rallying on lower rate expectations

Materials: Leading S&P sectors

Industrials: Infrastructure spending and reshoring themes

Energy: Modestly positive despite oil weakness

AI Trade Faces Reality Check

The week's tech selloff crystallized around Broadcom's Thursday earnings, which beat estimates but revealed margin compression ahead.

Broadcom's Warning:

Q4 results: Beat revenue and earnings expectations; AI revenue up 74%

The problem: Q1 gross margin guidance of 76.9% vs. 79% last year

Market reaction: Stock plunged 11% Friday, erasing $200 billion in market capitalization

Cascade effect: Oracle -2.3%, semiconductor index broadly lower

As AI infrastructure moves from pure-play chips to integrated systems, margins are compressing toward commodity levels. Broadcom's $73 billion backlog is impressive in scale but less profitable per dollar than traditional high-margin software businesses.

The selloff suggests investors are beginning to question whether trillion-dollar valuations for AI companies can sustain when economics trend toward traditional semiconductor margins.

Global Central Banks: Divergence Continues

Thursday brought a flurry of central bank decisions, highlighting the growing policy divergence between major economies.

European Central Bank:

Held rates at 2.0% deposit rate for fourth consecutive meeting

Upgraded growth outlook: 1.4% for 2025 (from 0.9% in June)

President Lagarde suggested next move could be rate hike, not cut

Markets now price 30% odds of ECB rate hike by end of 2026

Bank of England:

Narrow 5-4 vote split signals internal disagreement

Inflation fell to 3.2% in November but remains above 2% target

Weak GDP growth (-0.1% in October) supported dovish case

Implications for USD:

The dollar's retreat to 98.4 on the DXY index—near two-month lows—despite divergent global policy reflects growing concern about U.S. fiscal trajectory and political uncertainty around Fed independence.

Strategy Spotlight: Recession Resistant

With unemployment at 4.6%—the highest since September 2021—and the most divided Fed vote since 2019, defensive positioning warrants consideration.

Surmount's Recession Resistant strategy focuses on companies that historically demonstrate resilience during economic downturns, targeting sectors like consumer staples, healthcare, utilities, and essential retail. These businesses provide products and services consumers need regardless of economic conditions.

Why It Fits Now: Labor market deterioration, Fed policy uncertainty, and late-cycle economic signals suggest increased recession risk. Defensive stocks typically underperform during strong growth but provide capital preservation when conditions deteriorate.

Portfolio Application: For investors concerned about economic weakening, tactical allocation to recession-resistant names can provide downside protection while maintaining equity exposure. The strategy prioritizes stability over maximum returns—appropriate when risk/reward skews defensively.

The Week Ahead: Watching for Confirmation

As we head into the holiday-shortened final week of 2025, several catalysts could either confirm or reverse this week's rotation:

Key Events:

Friday, December 20: PCE inflation data (Fed's preferred measure)

Monday, December 23: Durable goods orders

Holiday week: Thin liquidity could exaggerate moves in either direction

What to Watch:

Follow-through: Does small-cap outperformance continue, or was this week a head fake?

Tech stabilization: Can semiconductors and AI names find support?

Credit markets: Are spreads widening on growth concerns?

Dollar direction: Further weakness could boost international equities

Bottom Line: Prepare for Regime Change

This week's developments—a deeply divided Fed, weakening labor data, and accelerating market rotation—suggest 2026 may look very different from 2024's mega-cap dominance.

For Investors Planning 2026:

Rebalance mega-cap exposure: Years of outperformance have likely left portfolios overweight expensive growth

Consider value and small caps: Relative valuations favor diversification into previously lagging areas

Monitor labor markets: Rising unemployment is the key variable that could force Fed action

Stay diversified: No one knows if rotation continues, so balanced exposure across market caps and styles provides optionality

The market is sending clear signals that concentration risk is being repriced. Whether you respond by rebalancing, hedging, or staying the course depends on your time horizon and risk tolerance.

But ignoring the signal isn't a strategy—it's a gamble.

Have a restful weekend,

The Surmount Markets Team