- Surmount Markets

- Posts

- Holiday Spending Hits $1 Trillion—And Retail Investors Are Cashing In Big

Holiday Spending Hits $1 Trillion—And Retail Investors Are Cashing In Big

Consumers splurged this season while savvy investors scored triple-digit gains. Here's the good news you might've missed while unwrapping presents.

Happy holidays! While most of America was wrapping gifts and baking cookies this week, Wall Street was quietly wrapping up one of its best years in recent memory. The S&P 500 hit its 39th record close of 2025 on Christmas Eve at 6,932, and the Dow crossed 48,731 for the first time ever. Markets took Thursday off for Christmas (even traders deserve eggnog), and Friday's session is shaping up to be equally sleepy as everyone eases into the final stretch of the year.

But here's the thing: beneath all the festive cheer and light holiday volumes, 2025 has been an absolute gift for retail investors who stayed disciplined. Holiday retail sales just crossed $1 trillion for the first time ever. Memory chip stocks like SanDisk posted 570% gains. Alphabet surged 60%. And consumers, despite all the economic anxiety, spent like there's no tomorrow. As we head into 2026, let's unwrap what actually happened this week—and this year—and what it means for the road ahead.

Trusted by millions. Actually enjoyed by them too.

Morning Brew makes business news something you’ll actually look forward to — which is why over 4 million people read it every day.

Sure, the Brew’s take on the news is witty and sharp. But the games? Addictive. You might come for the crosswords and quizzes, but you’ll leave knowing the stories shaping your career and life.

Try Morning Brew’s newsletter for free — and join millions who keep up with the news because they want to, not because they have to.

Consumers Opened Their Wallets (Big Time)

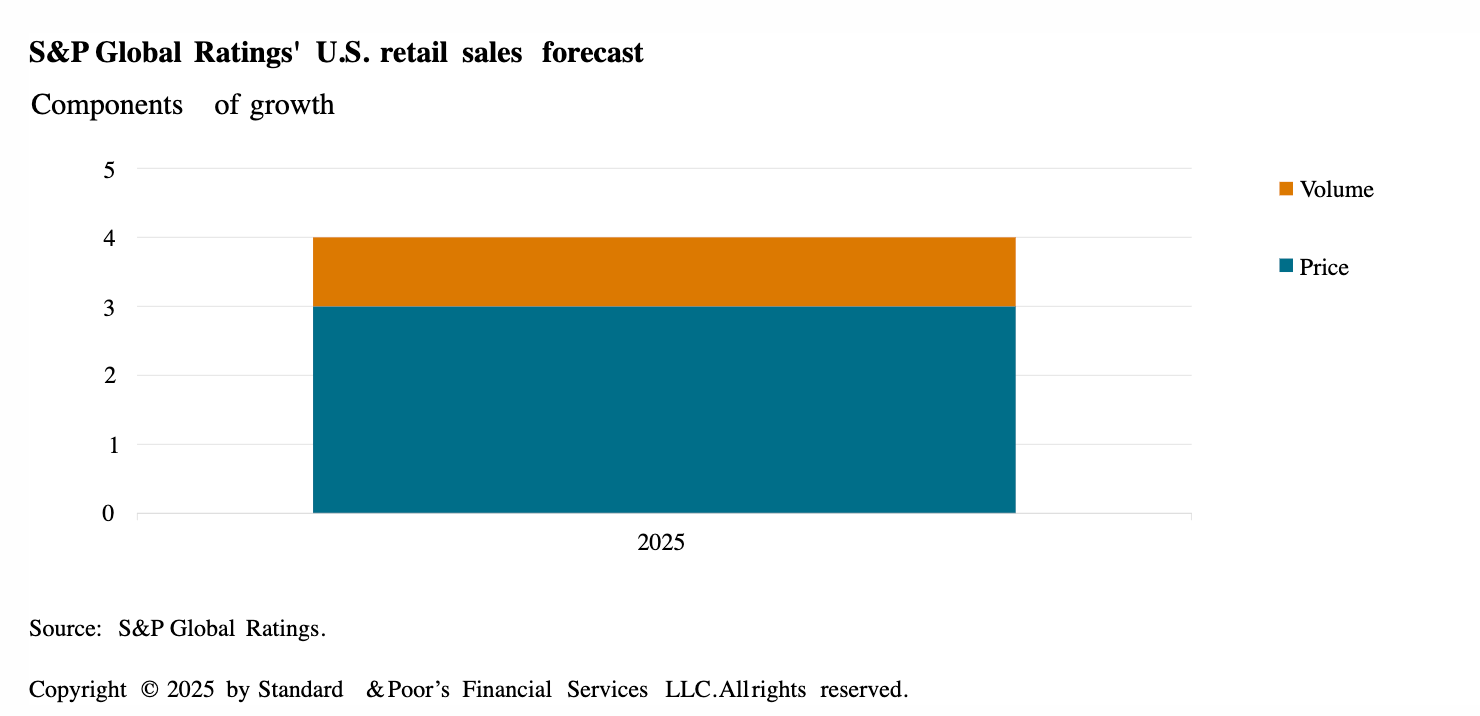

Let's start with the most cheerful news of the week: American consumers just delivered the biggest holiday shopping season on record. Retail sales from November through December are projected to hit between $1.01 trillion and $1.02 trillion, up 3.7% to 4.2% from last year, according to the National Retail Federation. That's the first time holiday spending has ever crossed the trillion-dollar mark.

Here's what made this season special:

Electronics led the way: Sales jumped 5.8% as consumers upgraded to AI-powered devices

Online dominated: E-commerce sales rose 7.8% while mobile accounted for 56% of online spending

Buy now, pay later surged: Consumers spent $20.2 billion through BNPL, up 11% from 2024

AI changed how we shop: Traffic from AI sources like ChatGPT to retail sites jumped 515% year-over-year

Holiday retail sales crossed $1 trillion for the first time in history Source: National Retail Federation, 2025

The disconnect between consumer sentiment and actual spending was one of the year's biggest surprises. Sure, 84% of consumers said they expected to cut back, and 77% worried about higher prices. But when it came time to buy gifts? Americans found a way. As one Visa economist put it: "The consumer is uncertain, they're cautious, but they're also smart about how they're spending their money."

The Year's Biggest Winners (Hint: Not Just Tech)

If you think 2025 was all about Nvidia and the Magnificent Seven, you missed some of the year's wildest stories. Sure, the big tech names did great—Alphabet posted 60% gains, and the Nasdaq is up over 22% for the year. But the real jaw-droppers came from corners of the market most investors weren't even watching.

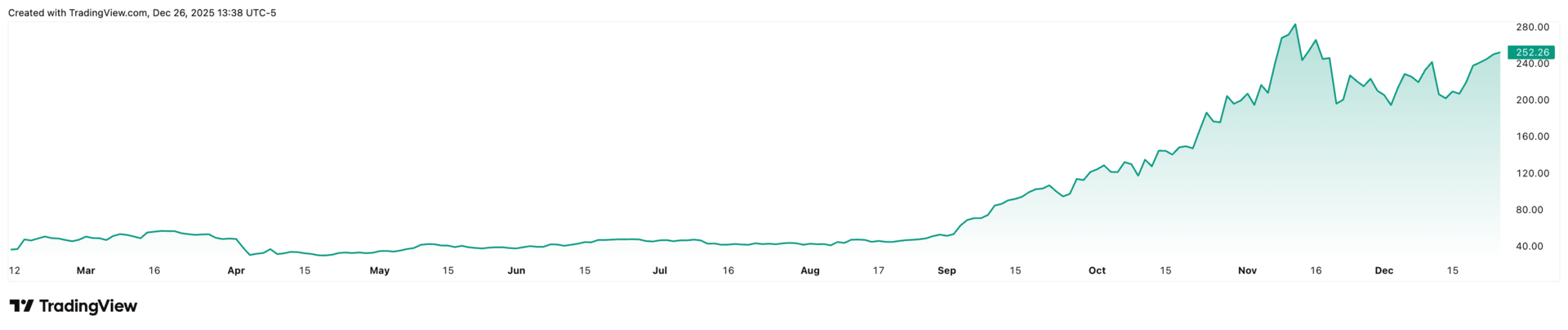

Data storage absolutely exploded:

Why the storage boom? Simple: AI models require massive amounts of data storage, and there's only so much manufacturing capacity in the world. NAND flash prices doubled since mid-2025 and are sold out through next year. When demand massively outstrips supply, margins go parabolic.

But tech wasn't the only winner:

Palantir: Up 157% on AI software contracts

Robinhood: Up 209% as retail trading boomed

Newmont (gold miner): Surged as gold hit record highs, up 70% for the year

The Fed's Mixed Message: One Cut and Done?

Now for the less cheerful part of the week. The Federal Reserve delivered its third rate cut of 2025 earlier this month, bringing rates to 3.50%–3.75%. But the forward guidance was decidedly grinchy: the updated dot plot now shows just one additional cut in 2026 and one in 2027—far fewer than the three cuts markets were expecting.

Fed Chair Jerome Powell made it clear the central bank is in no rush: "We are well positioned to wait and see." The problem? Inflation is still stuck at 2.8%—well above the 2% target—while GDP came in at a scorching 4.3% for Q3. When the economy is running this hot, why would the Fed keep cutting?

Markets got the message fast. Odds of a January rate cut dropped to just 13.3%, down from 24% a week earlier. For investors hoping mortgage rates or borrowing costs would come down quickly in 2026, Santa left coal in that stocking.

Tariffs: The Gift That Keeps On Taking

While we're on less cheerful topics, let's talk tariffs. The effective U.S. tariff rate hit nearly 17% in November—the highest since 1935. The tariffs have raised $236 billion in revenue but cost American households an average of $1,200 this year.

The impact on trade has been dramatic:

Chinese imports down 25% year-to-date

Mexico, Vietnam, and Taiwan imports surged as companies rerouted production

Manufacturing jobs haven't materialized despite promises

Supply chains remain disrupted

For 2026, expect tariffs to remain a permanent feature of the economic landscape. The good news? Consumers have proven remarkably resilient at finding ways to spend anyway.

Santa Claus Rally: History Says Pay Attention

Markets are in the middle of what's historically called a Santa Claus rally—the tendency for stocks to rise during the last five trading days of December and the first two of January. Since 1950, this seven-day window has delivered positive returns about 80% of the time, averaging gains of 1.3% for the S&P 500.

Here's why it matters: historically, successful Santa rallies have preceded three months of strong market performance, while failed rallies tend to signal three months of weakness. This year's setup looks promising—markets already notched five straight days of gains heading into Christmas, and sentiment is buoyant despite economic uncertainty.

Strategy in Focus: Next-Gen Data Infrastructure

With data storage stocks posting triple-digit returns and AI infrastructure spending projected to hit $3 trillion to $4 trillion annually by decade's end, the Next-Gen Data Infrastructure strategy has never been more relevant.

This thematic approach invests in companies building the backbone of the AI economy—cloud computing, data storage, data center operations, and networking. The portfolio includes about 20 companies with proven track records in next-generation infrastructure, rebalancing monthly to capture shifts in the landscape.

Why it fits the current environment: AI models don't run on hope—they run on massive data infrastructure. Every ChatGPT query, every AI-generated image, every autonomous vehicle decision requires storing, processing, and moving enormous amounts of data. The companies building that infrastructure are seeing unprecedented demand, and NAND flash shortages suggest the buildout is just getting started.

The strategy offers diversified exposure without the concentration risk of betting on a single chip maker or cloud provider. As AI continues transforming industries in 2026, the infrastructure layer represents a systematic way to capture that growth while spreading risk across the entire ecosystem.

Closing Thoughts: Cheers to an Unexpectedly Great Year

As we wrap up 2025 (literally—hope you saved some wrapping paper), it's worth stepping back to appreciate what actually happened. Despite widespread anxiety about inflation, tariffs, and Fed policy, consumers spent over $1 trillion during the holidays. Despite warnings of an AI bubble, infrastructure stocks posted some of the best returns in market history. And despite predictions of recession, GDP came in at 4.3%.

The disconnect between sentiment and reality was one of 2025's defining features. People felt nervous but spent anyway. Investors worried about valuations but stocks kept climbing. The Fed talked tough but markets shrugged it off.

For systematic investors heading into 2026, the lesson is clear: discipline beats emotion, diversification beats concentration, and staying invested beats trying to time every turn. The rally has been real, the gains have been substantial, and the opportunities ahead remain compelling—even if they look different than the ones we just experienced.

Here's to a prosperous 2026. May your portfolios be merry and your returns be bright. 🎄

— Surmount Markets Team