- Surmount Markets

- Posts

- Fed Hits Pause, Markets Hit Records — What January's Mixed Signals Mean for 2026

Fed Hits Pause, Markets Hit Records — What January's Mixed Signals Mean for 2026

The Fed's hawkish pivot collides with geopolitical surprises and labor market uncertainty as investors navigate the year's opening act.

The new year opened with markets posting fresh all-time highs while seismic shifts rippled through major sectors. The S&P 500 touched record territory above 6,900 this week, but beneath the headline gains, three major stories emerged that will shape investment narratives for months ahead: China's BYD officially dethroned Tesla as the world's EV king, semiconductor stocks surged on supply shortage optimism, and the Federal Reserve signaled a hawkish pause that caught many off guard.

This isn't about predicting crashes or calling tops. Rather, it's about recognizing inflection points where dominant narratives shift, where yesterday's assumptions need updating, and where disciplined investors separate signal from noise.

3 Tricks Billionaires Use to Help Protect Wealth Through Shaky Markets

“If I hear bad news about the stock market one more time, I’m gonna be sick.”

We get it. Investors are rattled, costs keep rising, and the world keeps getting weirder.

So, who’s better at handling their money than the uber-rich?

Have 3 long-term investing tips UBS (Swiss bank) shared for shaky times:

Hold extra cash for expenses and buying cheap if markets fall.

Diversify outside stocks (Gold, real estate, etc.).

Hold a slice of wealth in alternatives that tend not to move with equities.

The catch? Most alternatives aren’t open to everyday investors

That’s why Masterworks exists: 70,000+ members invest in shares of something that’s appreciated more overall than the S&P 500 over 30 years without moving in lockstep with it.*

Contemporary and post war art by legends like Banksy, Basquiat, and more.

Sounds crazy, but it’s real. One way to help reclaim control this week:

*Past performance is not indicative of future returns. Investing involves risk. Reg A disclosures: masterworks.com/cd

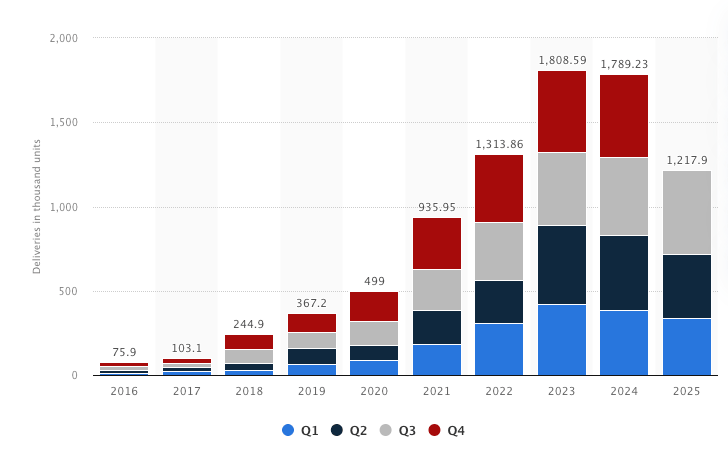

The EV Crown Changes Hands

In what marks perhaps the most significant power shift in automotive history, China's BYD sold 2.26 million electric vehicles in 2025, a stunning 28% year-over-year increase. Meanwhile, Tesla reported 1.64 million deliveries — down 9% annually and marking the company's second consecutive year of declining sales.

The Numbers Tell the Story:

BYD outsold Tesla by over 600,000 vehicles in 2025

Tesla's Q4 deliveries fell 16% from the prior year

BYD's overseas sales topped 1 million units, up 150% year-over-year

In May 2025, BYD registered more EVs in Europe than Tesla for the first time

Number of Tesla vehicles delivered worldwide from 1st quarter 2016 to 3rd quarter 2025

What Drove the Divergence:

Tesla's headwinds: Loss of $7,500 federal EV tax credit in September, stale product lineup relying on Model 3 and Y for 95% of volume, and CEO Elon Musk's polarizing political activities

BYD's momentum: Diverse lineup from compact city cars to luxury sedans, aggressive international expansion, competitive pricing even with EU tariffs

Market Implications:

The transition matters beyond Tesla's stock price, which fell 2.6% on the delivery news. It signals the automotive industry's center of gravity shifting eastward, with Chinese manufacturers leveraging scale, supply chain integration, and government support to dominate the fastest-growing segment of the car market.

For investors, this underscores the importance of looking beyond brand narratives to operational fundamentals. Tesla's energy storage business deployed record volumes and may offset some automotive weakness, but the core EV story now requires a more nuanced thesis around autonomy and AI rather than simple delivery growth.

The Semiconductor Supercycle Accelerates

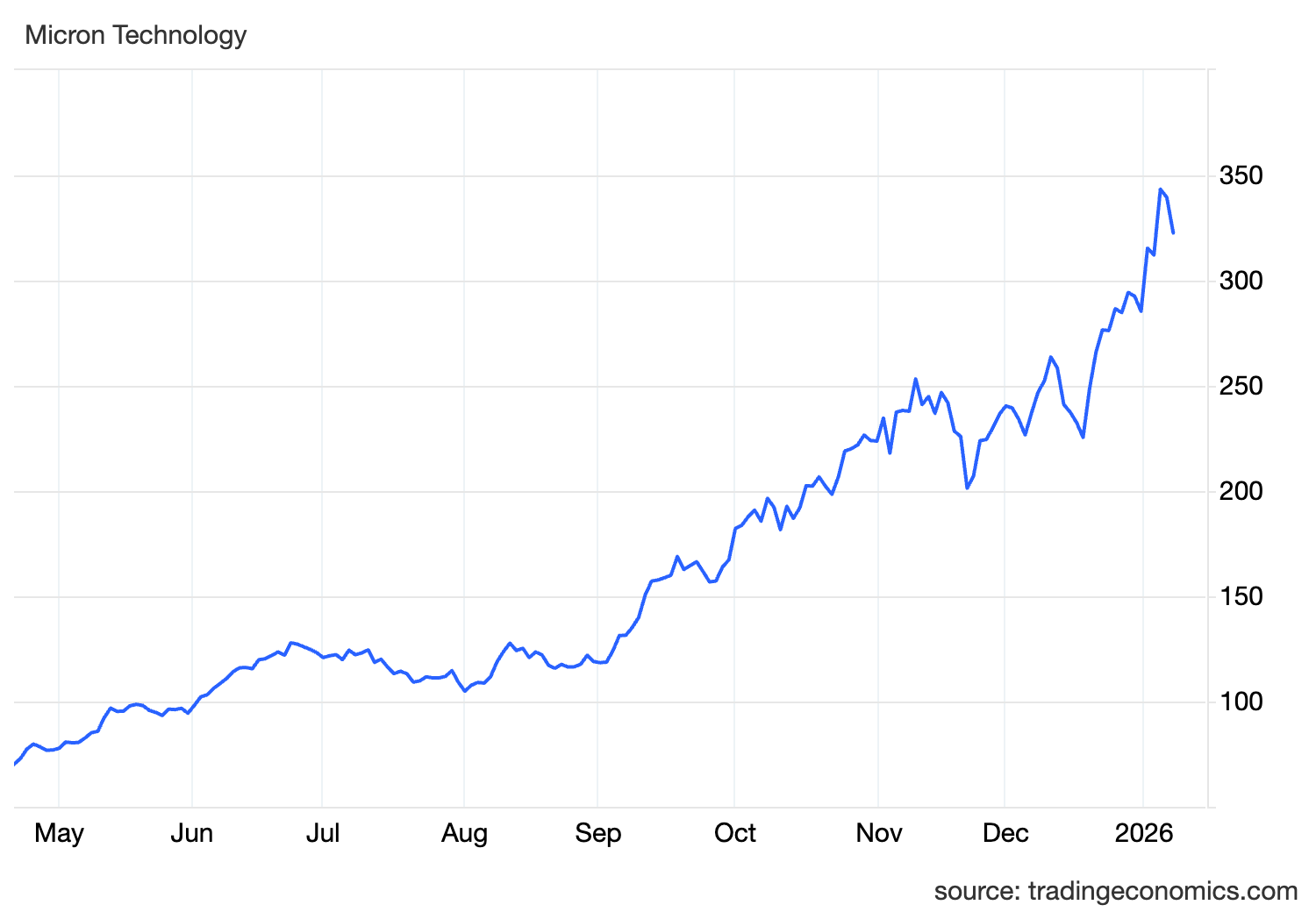

While Tesla stumbled, semiconductor stocks roared into 2026 with memory chip giants leading a global rally. The sector's momentum stems from a fundamental shift: AI moving from experimental chatbots to physical infrastructure requiring massive silicon investments.

The Rally in Numbers:

Why Memory Matters Now:

The rally centers on memory chips — specifically DRAM and high-bandwidth memory (HBM) essential for AI data centers. Counterpoint Research projects memory prices rising another 40% through Q2 2026 as supply constraints meet insatiable AI demand.

Bank of America analyst Vivek Arya anticipates semiconductor industry revenue hitting $1 trillion in 2026 — a 30% jump and a milestone previously not expected until 2030.

What's Driving Demand:

AI infrastructure buildout: Hyperscalers spending billions on data centers

"Physical AI" emergence: Autonomous vehicles, robotics, edge computing requiring local processing power

Supply constraints: High-bandwidth memory production bottlenecks creating pricing power

Advanced node migration: TSMC's 2nm capacity already sold out

Investment Considerations:

DA Davidson analyst Gil Luria noted, "We are very early in the memory cycle... memory is the next frontier." Yet he cautioned that memory remains a commodity — pricing power could erode once supply bottlenecks ease.

The sector's valuation presents a puzzle: Micron trades at just 9.9x forward earnings, a steep discount to the S&P 500's 22x and Nvidia's 25x. Either these multiples expand as the supercycle validates, or earnings growth significantly exceeds current forecasts.

The Fed's Hawkish Pivot

December's FOMC meeting revealed fractures at the Fed not seen in years. The central bank delivered its third consecutive quarter-point cut to 3.5%-3.75%, but the decision exposed deep divisions over competing mandates.

The Split:

Three voting members dissented — most since 2019

Four non-voting participants registered "soft dissents"

Seven officials indicated they want no cuts in 2026

Fed's dot plot projects just one cut for all of 2026

The Competing Data:

Unemployment: Rose from 4.0% to 4.6% through November — highest since October 2021

Inflation: Stuck at 2.7%, well above Fed's 2% target

Layoffs: Up 54% year-over-year through November

Job growth concentration: Healthcare adding 2.9% annually, other sectors stagnant or contracting

Market Pricing:

Futures markets assign just 17% probability to a January rate cut, with expectations for only one reduction across all of 2026. Chair Jerome Powell acknowledged the bind: "We're in the high end of the range of neutral... we think we're well positioned to wait and see."

The Leadership Transition:

Adding complexity, Powell's tenure expires in May. President Trump is expected to nominate a more dovish replacement, creating uncertainty about policy continuity as the economy navigates conflicting signals from labor markets and inflation data.

Asset Class Divergences Deepen

Beneath headline indices, major asset class movements tell a story of investor repositioning:

Gold's Historic Run:

Trading near $4,470 per ounce

China added 42 tons in final months of 2025

Bitcoin's Consolidation:

Range-bound between $84,000-$94,000

28% below October peak near $126,000

Spot ETF inflows hit $1.2 billion in first two days of 2026

Struggles as capital rotates to AI stocks and commodities

Treasury Yields:

10-year near 4.14% — not signaling recession fears

Creates puzzle: unemployment rising 60 basis points yet yields stable

Either yields decline as labor weakens, or equities reprice if economy proves resilient

The Geopolitical Wild Card:

The U.S. seizure of Venezuelan President Maduro barely moved markets. Oil prices wobbled — WTI near $57/barrel — but failed to surge despite geopolitical drama. BlackRock noted: "We see limited global market impact for now," given Venezuela produces less than 1% of global oil.

Energy stocks rallied on potential access to Venezuelan reserves, but historical analysis from UBS shows the S&P 500 averages just 0.3% declines one week after major geopolitical events, then rallies 7.7% over subsequent 12 months.

Strategy in Focus: Recession Resistant

Given the labor market's inflection point and the Fed's reluctance to provide accommodation, Surmount's Recession Resistant strategy merits attention for investors concerned about downside risk.

This systematic approach focuses on companies with historical resilience during economic downturns — specifically defensive sectors like consumer staples, healthcare, utilities, and essential retail. The premise is straightforward: during uncertainty, consumer spending shifts toward necessities. Demand for food, medicine, electricity, and basic goods proves less economically sensitive than discretionary purchases.

Why It Fits the Current Moment:

Unemployment rising 60 basis points in a year with job losses concentrated outside healthcare

Fed signaling fewer cuts than previously expected, removing accommodation cushion

Corporate earnings still strong but labor market showing cracks

Defensive characteristics — pricing power, consistent demand, strong balance sheets — matter more in deceleration environments

The Systematic Approach:

Rather than trying to time economic cycles, the strategy maintains rules-based allocation to recession-resistant businesses. This provides systematic downside management without abandoning equity exposure entirely. Companies selected typically have:

Strong cash flows and balance sheets

Products/services with inelastic demand

Pricing power to maintain margins in downturns

Histories of resilience through prior recessions

Important Trade-Offs:

If labor markets stabilize and the Fed eventually cuts more aggressively than currently priced, cyclical sectors and growth stocks could outperform. The strategy doesn't bet on recession — it positions for an environment where economic growth decelerates and defensive qualities provide relative stability.

This approach suits investors who want to maintain equity exposure while managing downside risk systematically rather than reactively selling into volatility.

Closing Thoughts

Markets enter 2026 with momentum but without the clarity that defined much of 2025's rally. Three major stories — BYD's EV ascendance, the semiconductor supercycle, and the Fed's divided stance — signal a year that will demand more active navigation than the past three years of near-continuous gains.

This doesn't mean abandoning equities. Corporate earnings remain strong, technology innovation continues, and long-term trends in AI, automation, and energy transformation persist. But it does mean:

Questioning dominant narratives: Tesla's delivery decline shows even market darlings aren't immune to competitive disruption

Following capital flows: The semiconductor rally reveals where smart money sees the AI infrastructure buildout heading

Respecting macro constraints: The Fed's hawkish pivot removes a tailwind many investors took for granted

Friday's jobs report will provide the next major data point in this unfolding narrative. Whatever the number, the broader story remains: 2026 opened with mixed signals, and successful investors will be those who balance opportunity with appropriate risk management — not those chasing yesterday's winners or reacting to each headline.

The best approach, as always, is systematic, diversified, and focused on long-term objectives rather than short-term noise. Markets reward patience and discipline, especially when conditions grow uncertain and narratives shift beneath our feet.