- Surmount Markets

- Posts

- CPI Crossroads, Tariff Shocks & What’s Next—With a Smart Mega-Cap Option

CPI Crossroads, Tariff Shocks & What’s Next—With a Smart Mega-Cap Option

This week’s CPI surprise, rising core inflation, trade turbulence—and how SP10 offers clarity when uncertainty reigns.

Learn from this investor’s $100m mistake

In 2010, a Grammy-winning artist passed on investing $200K in an emerging real estate disruptor. That stake could be worth $100+ million today.

One year later, another real estate disruptor, Zillow, went public. This time, everyday investors had regrets, missing pre-IPO gains.

Now, a new real estate innovator, Pacaso – founded by a former Zillow exec – is disrupting a $1.3T market. And unlike the others, you can invest in Pacaso as a private company.

Pacaso’s co-ownership model has generated $1B+ in luxury home sales and service fees, earned $110M+ in gross profits to date, and received backing from the same VCs behind Uber, Venmo, and eBay. They even reserved the Nasdaq ticker PCSO.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

This week was a masterclass in mixed signals. On the surface, inflation looks steady. Underneath, core prices are heating up, tariffs are tugging at supply chains, and traders are torn between betting on a September rate cut or bracing for a pause. It’s the kind of week where every headline seems to point in a different direction—so we’ve distilled it down to what actually matters, and how you can position without chasing noise.

1. Headlines at a Glance

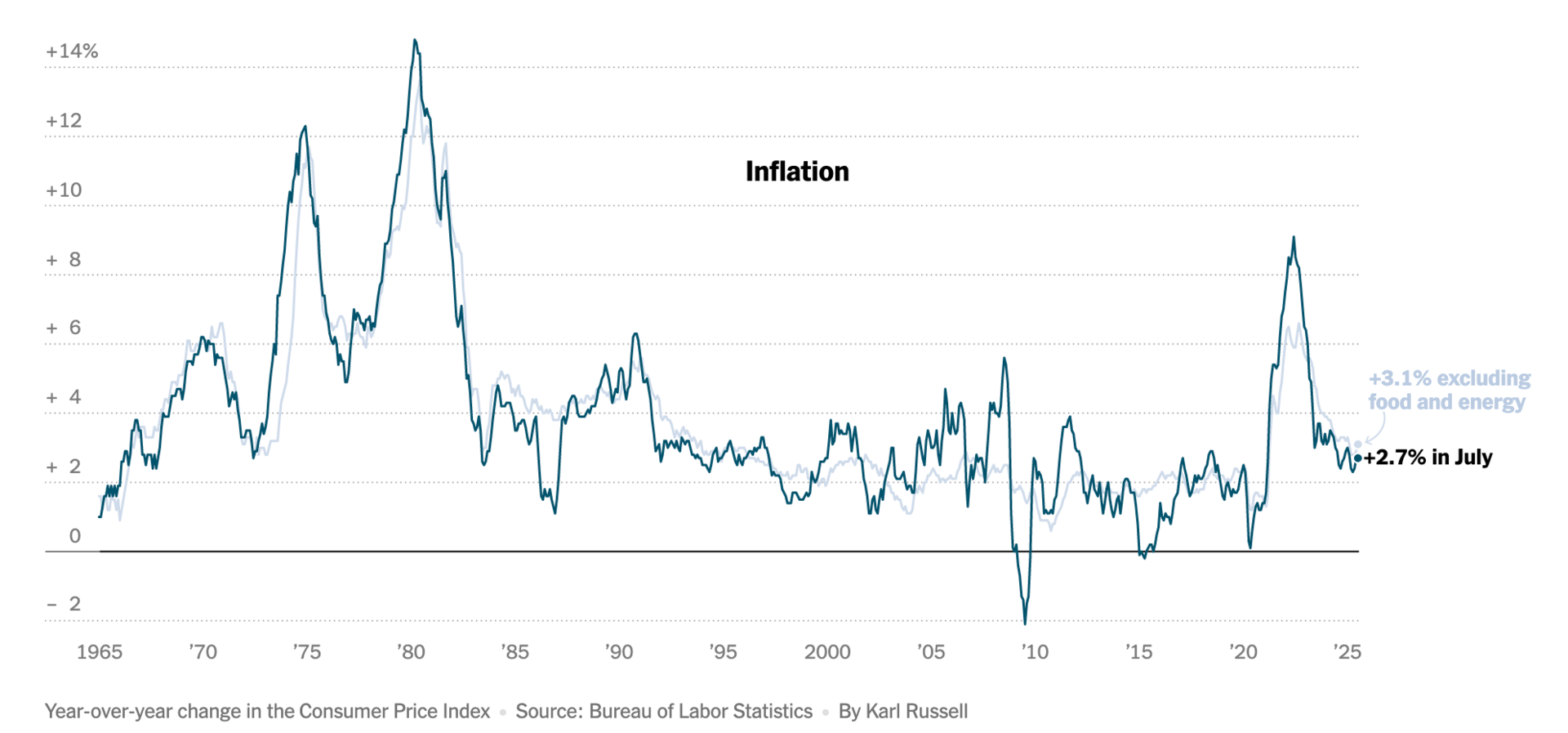

This week, markets pivoted as fresh data landed: headline U.S. CPI held steady at 2.7% YoY in July, just shy of forecasts, while core CPI—excluding food and energy—rose to 3.1%, its highest since February, showing persistent price pressures in services such as airfares, healthcare, and dental care. Tariff-driven cost pressures are emerging—but selectively. The market responded by enhancing expectations for a September rate cut. Meanwhile, U.S.–China trade tensions eased slightly with a 90-day tariff truce, yet sweeping tariffs from earlier this summer are still pressuring supply chains. As Fed watchers parse the next move, volatility remains a defining theme.

2. Deep Dive: CPI’s Crossroads—Inflation or Recession Ahead?

At first glance, flat headline inflation seems reassuring, but the details tell another story. A 3.1% rise in core CPI reflects rising prices in key services and goods like furniture, auto parts, and dental services—areas likely exposed to tariff effects.

What this means for markets:

If core pressures persist, the Fed may pause its rate-cut plans in September

If these pressures fade, lingering slack in labor data may nudge the Fed into easing sooner than markets expect

The increased intensity of services inflation—and its stickiness—makes this one of the most consequential CPI prints of the year

Stay nimble. Watch labor reports, PPI data, and upcoming Fed commentary for confirmation or contradiction of easing bets.

3. Stagflation Watch: Is the U.S. Back in the 1970s?

It’s too early for headlines invoking the 1970s—but some warning signs are starting to align. Slowing growth metrics, stubborn core inflation, and tariff-driven cost pressures are a classic recipe for stagflation. Services inflation is rattling the disinflation narrative, while core CPI’s rebound underscores the risk.

What to watch:

Do wage and job data continue to weaken? A persistent labor slowdown paired with inflation would heighten stagflation fears

Are corporate margins under pressure? Companies may be forced to pass costs to consumers or trim staffing

That said, energy and food prices remain subdued—cushioning headline inflation and providing the Fed some breathing room.

4. Tariff Tales and Market Ripples

The 90-day tariff truce with China gave markets a reprieve—but broader tariff policies are still biting. New reciprocal tariffs took effect August 7—including hefty duties on Brazilian goods and escalating duties on India tied to its Russian oil purchases.

Price reports underscore these effects in goods such as household furnishings, tires, and apparel—but macro pass-through is still limited.

That tariff truce might temper short-term disruption, but any re-escalation or new tariff mandates could reignite volatility—especially in consumer staples and industrials.

5. What to Watch Next: PPI, Labor & Jackson Hole

The rest of August brings critical reads:

Producer Price Index (PPI): Will wholesale inflation signal pass-through ahead?

Labor Market Data: A key Fed focus—any further slowing may reinforce easing expectations

Jackson Hole Symposium: Fed Chair commentaries here will be parsed for policy direction

How to stay ahead? Build scenario playbooks—chart paths if inflation persists or the labor market continues to soften.

6. Investor Playbook: Navigating the Crosswinds

Portfolio moves to consider:

Hedges: Add exposure to inflation-sensitive sectors—like consumer staples and healthcare—that offer potential buffers

Volatility plays: Consider short-term hedges or options strategies for conditional scenarios—like CPI surprises or Fed messaging shifts

Stable mega-caps: In uncertain times, large, liquid leaders can offer ballast

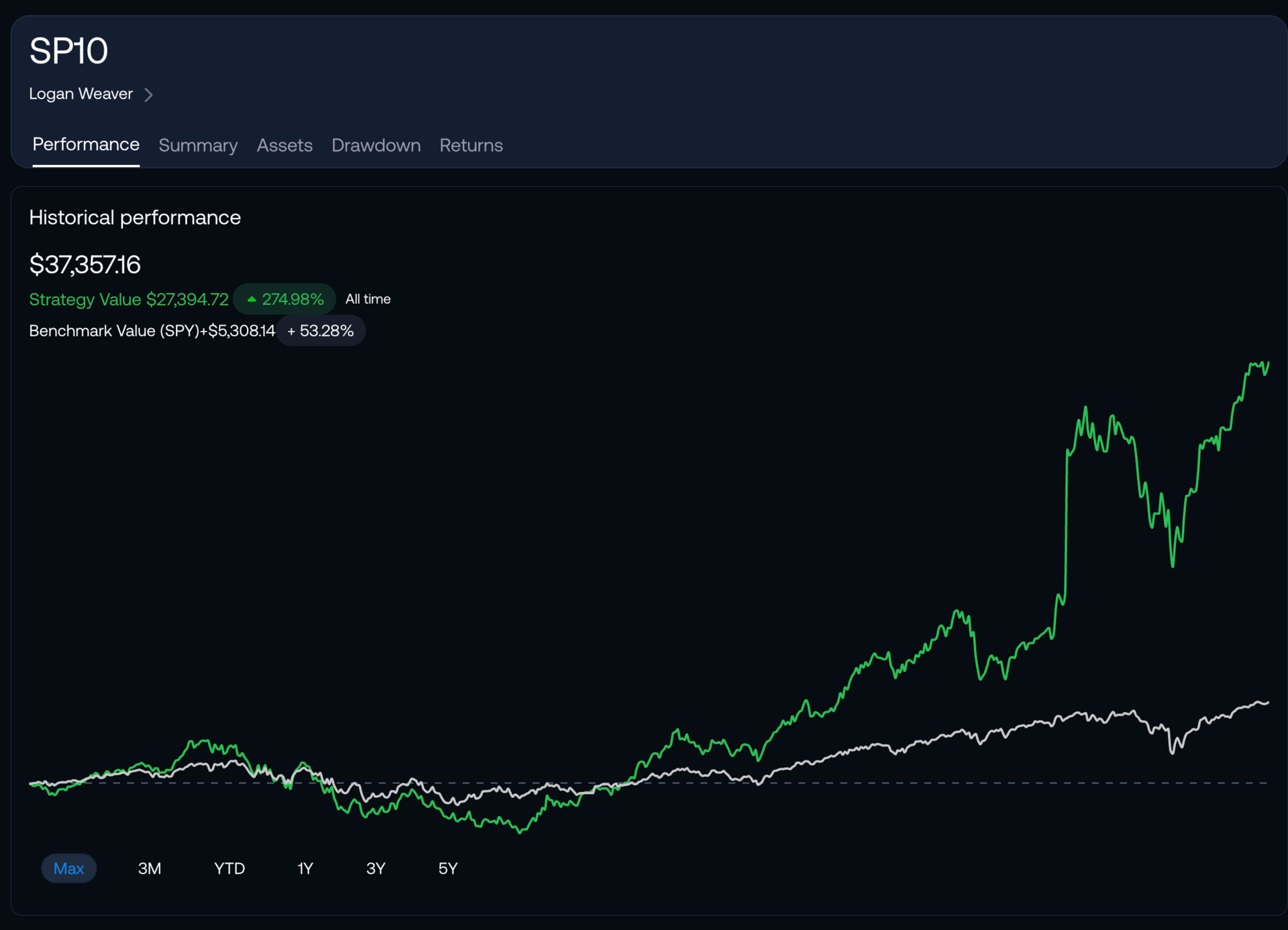

Introducing SP10: For readers seeking resilient exposure, Surmount’s newest SP10 strategy may be a smart fit. It invests in the ten largest S&P 500 companies, balancing industry leadership, financial strength, and liquidity. With quarterly rebalancing, SP10 offers a focused yet diversified way to lean into dominant market players—perfect for weathering short-term turbulence with a stable foundation.

7. Sector Spotlights & Trend Watchers

Here’s where energy, consumption, and activism intersect with market dynamics:

Energy & Commodities: Oil markets gained steadier footing as trade tensions eased and OPEC raised demand forecasts for 2026

Consumer Behavior: With grocery and energy prices slightly easing, discretionary spending may hold up—but continued core inflation threatens margins

Geopolitics: No major meetings before Friday, but attention is rising—particularly on trade and policy shifts

8. Final Thought: Grounded Confidence in Uncertain Times

Markets this week reminded us that the headlines often mask deeper currents. Inflation seems contained—but only at the surface. Underneath, rising services costs, looming trade shocks, and policy uncertainty demand vigilance.

That’s where Surmount shines—our Friday playbook gives readers clarity amid complexity. Whether it’s spotting CPI inflection points, mapping stagflation risks, or positioning with durable mega-caps like SP10, we help you navigate confidently—without the hype. Let’s end the week informed, empowered, and ready.

Disclaimer: The information presented is for educational purposes only and not an offer or solicitation for any specific investments. Investments involve risk and are not guaranteed. Consult with a financial adviser before making any investment decisions. Past performance does not guarantee future results.