- Surmount Markets

- Posts

- Small Caps Surge Historic Streak, Silver Breaks $90, TSMC Bets $56B on AI

Small Caps Surge Historic Streak, Silver Breaks $90, TSMC Bets $56B on AI

Russell 2000's longest win streak since the '80s, China's silver squeeze triggers supply crisis, chipmakers double down

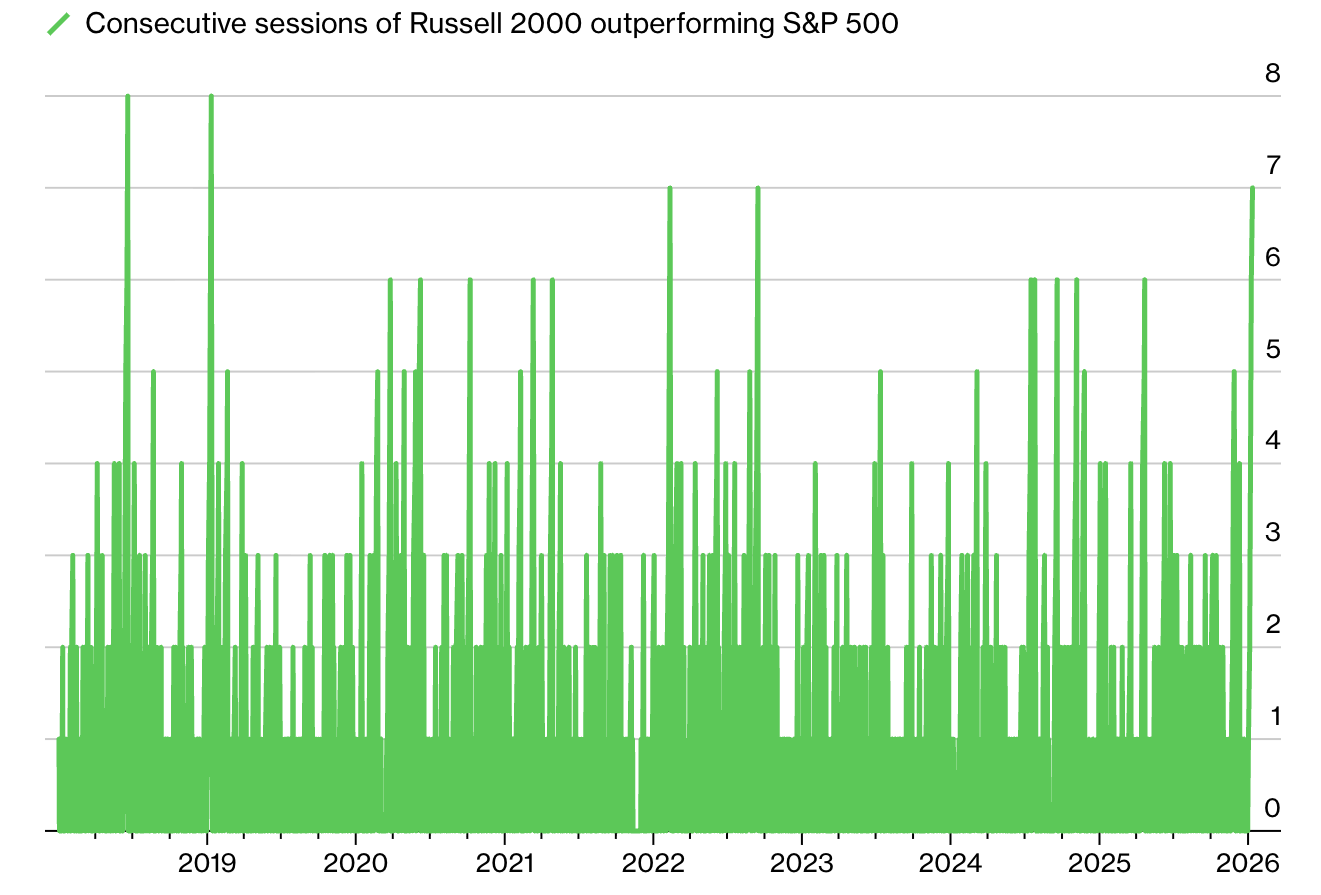

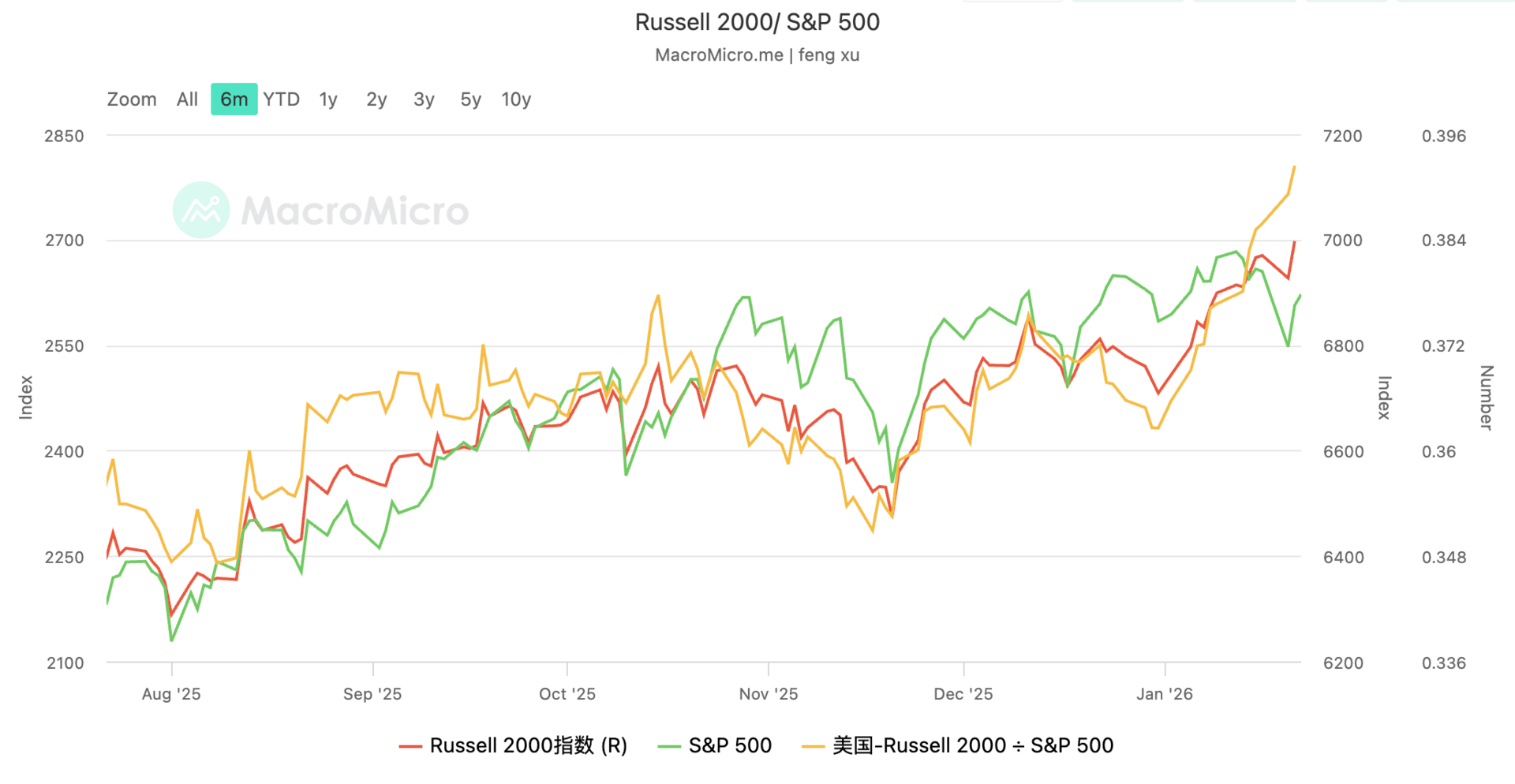

Markets delivered a historic rotation this week as the Russell 2000 outperformed large caps for seven straight sessions — the longest such stretch since 2019. The small-cap index surged 5.6% year-to-date versus the S&P 500's 1.2% gain, signaling what analysts call the "Great Rotation of 2026."

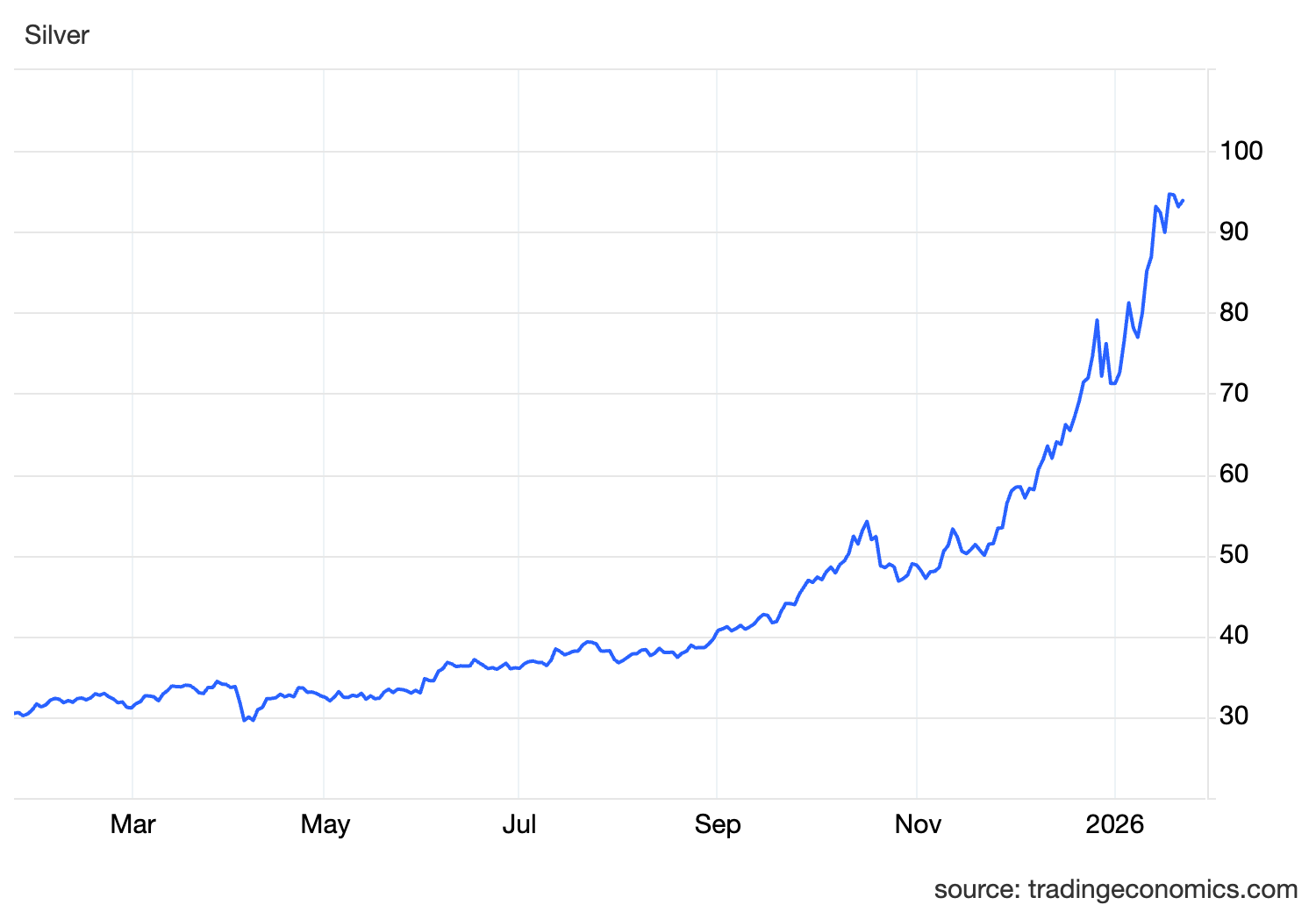

Meanwhile, TSMC reported record Q4 earnings with net income up 35% and announced $52-56 billion in 2026 capex — up at least 25% from 2025. And in commodities, silver broke above $90/oz following China's January 1st export restrictions, creating the most severe supply crisis the metal has seen in modern history.

The Great Rotation: Small Caps Stage Historic Comeback

After 15 years of underperformance, small-cap stocks are finally having their moment.

Here’s what’s driving the rotation:

Valuation gap: At 18x forward earnings, small caps trade at roughly a 31% discount to the S&P 500's 22x multiple

Rate sensitivity: Small-cap companies carry more floating-rate debt and benefit when the Fed holds rates at 3.50%-3.75% after three 2025 cuts

Domestic focus: Russell 2000 companies derive 70-80% of revenue domestically, positioning them to capture policy tailwinds without currency headwinds

Earnings inflection: Small-cap earnings projected to grow 15.4% in 2026, slightly exceeding the S&P 500's 14.8% forecast

Potential risks to watch: Sustainability hinges on whether earnings growth materializes. If inflation rebounds or the Fed reverses course, debt-sensitive small caps could face renewed pressure.

See every move your competitors make.

Get unlimited access to the world’s top-performing Facebook ads — and the data behind them. Gethookd gives you a library of 38+ million winning ads so you can reverse-engineer what’s working right now. Instantly see your competitors’ best creatives, hooks, and offers in one place.

Spend less time guessing and more time scaling.

Start your 14-day free trial and start creating ads that actually convert.

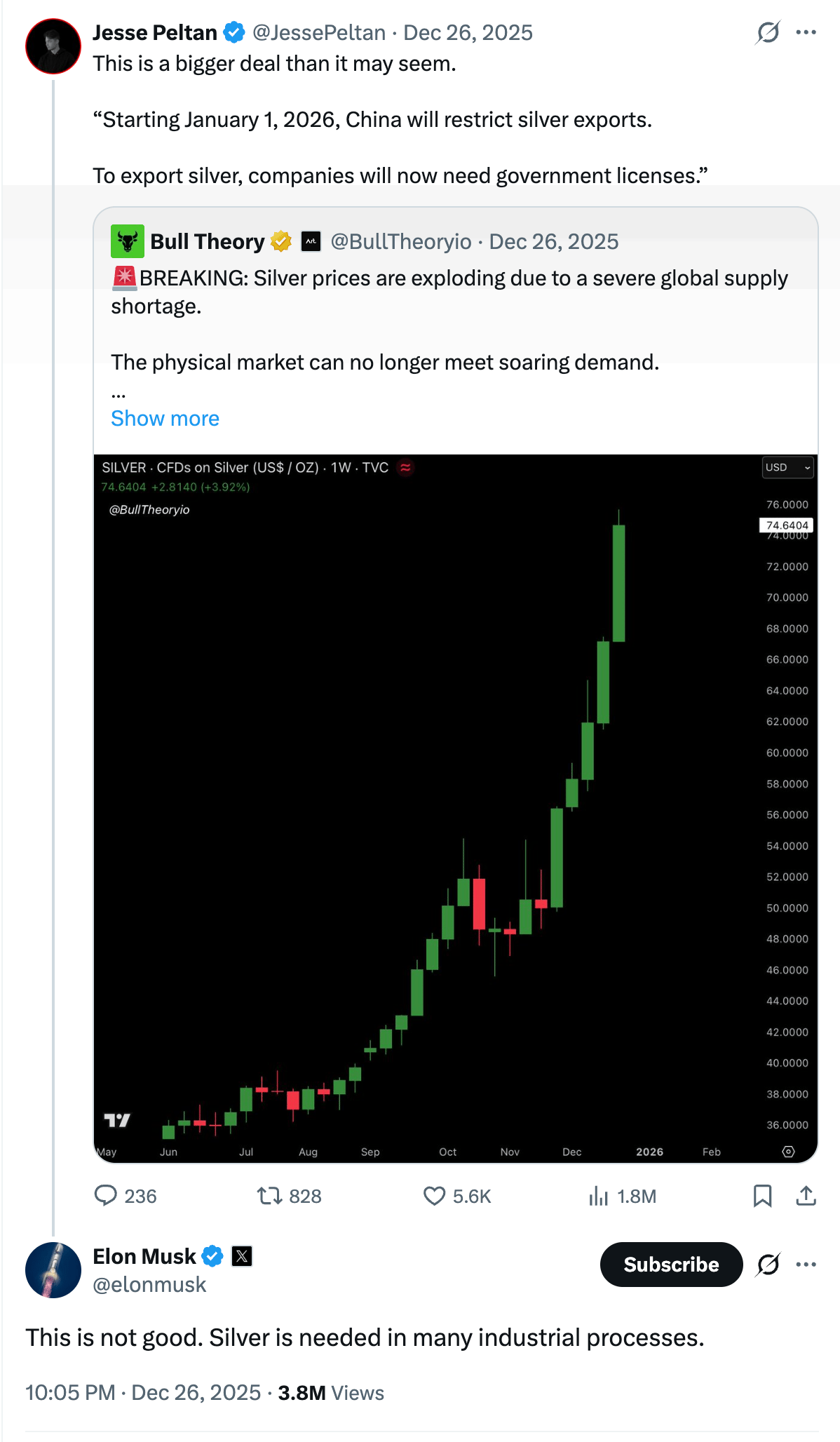

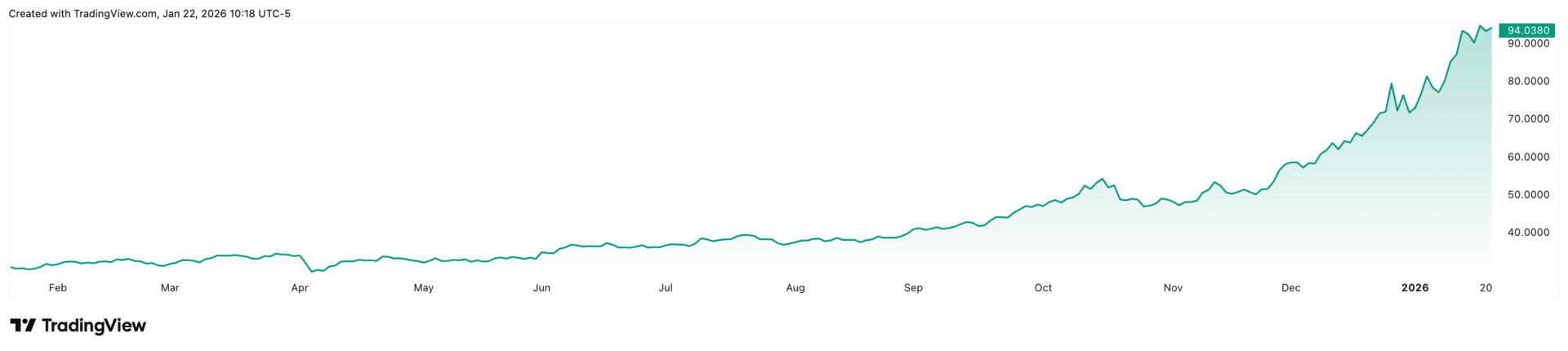

Silver's Supply Shock: China Export Controls Trigger Historic Squeeze

Silver surged past $90/oz in mid-January as China's January 1st export restrictions began reshaping global supply chains.

The supply crisis breakdown:

China controls 60-70% of global supply and now requires government licenses for all exports, with only 44 companies qualifying

Structural deficits persist: For five consecutive years, global demand exceeded supply — 2025 demand hit 1.24 billion ounces against supply of 1.01 billion

Industrial demand is inelastic: 20% goes to solar manufacturing, EVs require ~100 grams per battery — demand doesn't decline when prices surge

Paper market stress: The ratio of paper contracts to physical ounces stands at 356:1, creating severe delivery pressure

What this means: Silver's transformation from industrial commodity to strategic asset is accelerating. The bifurcation between paper prices and physical premiums is widening — in early January, COMEX contracts traded at $72.26 while physical coins in Dubai hit $99.93, a 38% premium.

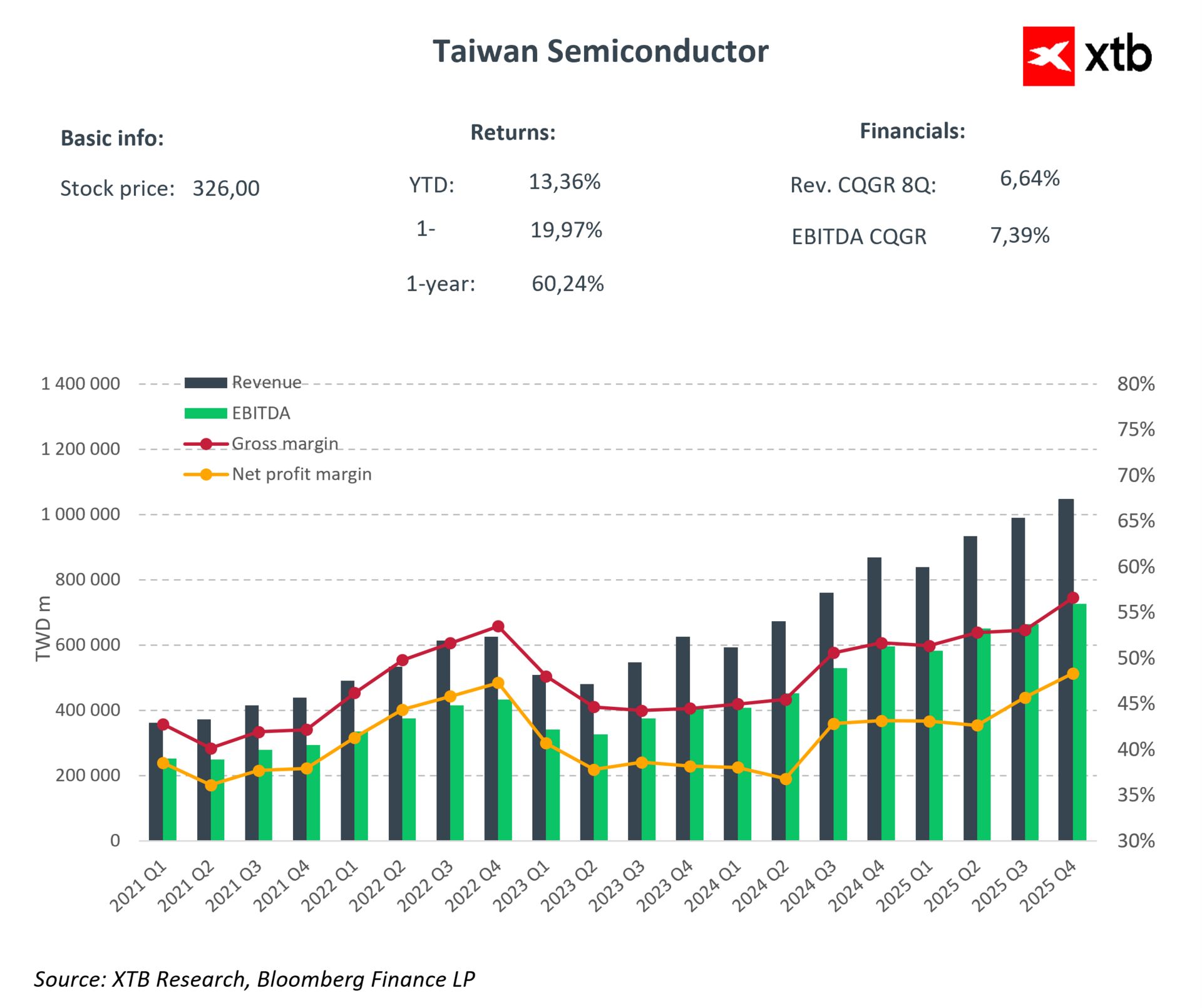

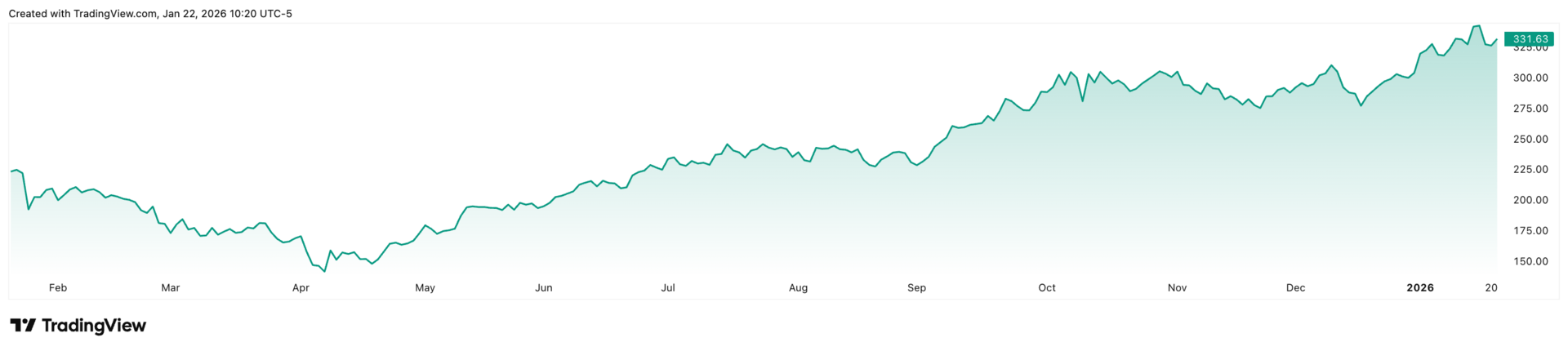

AI Infrastructure Intensifies: TSMC's $56B Bet

Taiwan Semiconductor delivered Q4 net income of $16.01 billion, up 35% year-over-year, and guided 2026 revenue growth near 30%.

Key takeaways:

Capex explosion: TSMC plans to spend $52-56 billion in 2026, up at least 25% from 2025, supporting 2nm production ramp

Arizona expansion: TSMC is purchasing additional land to create a "gigafab cluster" with high-volume manufacturing expected H2 2026

Demand visibility: CEO acknowledged nervousness but noted strong validation from customers' customers across search and social media applications

Supply chain impact: The guidance immediately lifted ASML shares 8% to a record, pushing the equipment supplier above $500 billion market value.

Banking Earnings: Split Verdict on Wall Street

Fourth-quarter bank earnings revealed stark bifurcation between investment banking strength and retail banking pressure.

Winners and losers:

Investment banks shine: Goldman Sachs reported fees up 25% while Morgan Stanley saw 47% surge

Retail banks pressured: Trump's proposed 10% credit card rate cap — down from 19.65% national average — sent Capital One down 6% and Synchrony down 8%

Bank executives pushed back hard, warning the cap would cause widespread credit access loss. Despite policy uncertainty, banks remain optimistic about M&A and IPO pipelines.

Strategy in Focus: SP 10

Given this week's rotation, we're highlighting SP 10 — a concentrated strategy investing exclusively in the ten largest S&P 500 companies.

This strategy targets industry leaders with dominant market share, strong balance sheets, and high liquidity, rebalancing quarterly to maintain exposure to the top 10 by market capitalization.

While small caps enjoy their rotation, mega-cap tech companies still generate the most reliable cash flows. With TSMC committing $56 billion to meet demand from its largest customers (many in the top 10), betting on AI infrastructure end-customers makes strategic sense. These companies have pricing power, fortress balance sheets, and secular growth tailwinds.

Higher concentration risk in exchange for exposure to the market's most influential drivers. A systematic, rules-based approach that removes emotional decision-making while maintaining quality exposure — though investors should weigh volatility carefully. (Past performance does not guarantee future results.)

What's Next

Three narratives will define February: whether small-cap earnings justify valuations, how AI infrastructure spending holds across Microsoft, Amazon, and Google earnings, and whether silver's supply crisis escalates or stabilizes.

The breadth expansion is healthy — it suggests value discovery beyond the Magnificent Seven. But sustainability depends on fundamentals delivering, not just sentiment shifting. Markets don't move in straight lines, and smart investors position for both scenarios rather than betting everything on one narrative.

— Surmount Markets Team