- Surmount Markets

- Posts

- Bank Earnings Beat Despite Credit Card Chaos, Chips Rally on TSMC Strength, Energy Soars on Venezuela

Bank Earnings Beat Despite Credit Card Chaos, Chips Rally on TSMC Strength, Energy Soars on Venezuela

Major banks reported solid Q4 results this week, but Trump's surprise credit card rate cap proposal sent financial stocks tumbling. Meanwhile, semiconductor demand shows no signs of slowing.

The first full trading week of 2026 delivered conflicting signals that perfectly capture today's market schizophrenia. Banks kicked off earnings season with solid fundamentals — strong trading revenues, improving capital markets activity, and robust guidance. Yet by midweek, the same stocks that beat earnings estimates were down 4-5%. The culprit? A Friday evening social media post from President Trump proposing a 10% cap on credit card interest rates that sent shockwaves through the financial sector. Meanwhile, semiconductors extended their AI-fueled rally, energy stocks jumped on Venezuela developments, and the S&P 500 notched fresh all-time highs. Welcome to 2026, where policy trumps earnings — literally.

Bank Earnings Season: Strong Results, Weak Stock Performance

Major banks delivered surprisingly solid fourth-quarter results this week, demonstrating resilience in both consumer banking and capital markets.

JPMorgan Chase reported Tuesday with adjusted EPS of $5.23 (vs. $5.00 expected) on revenue of $46.77 billion (vs. $46.2 billion expected). The beat came despite a $2.2 billion reserve for the Apple Card portfolio acquisition. Citigroup followed Wednesday with adjusted EPS of $1.81 (vs. $1.67 expected) on $21 billion in revenue, beating on both metrics.

JPMorgan Chase Stock Price — Past 6M

What drove the strength:

Trading revenue exceeded expectations as volatility returned to markets

Investment banking rebounded with M&A activity improving throughout 2025

Net interest income held steady despite Fed rate cuts

Credit quality remained solid with manageable loan loss provisions

But then Trump dropped a bombshell. Late Friday January 10, the President called for a one-year 10% cap on credit card interest rates, declaring Americans are being "ripped off" by rates as high as 30%. Current average rates stand around 23%, meaning this would represent a massive revenue hit.

Market reaction was swift and brutal:

Bank stocks tumbled Wednesday despite strong earnings

Bank of America and Wells Fargo both dropped roughly 5%

Citigroup fell more than 4%

Credit card issuers like Capital One, Visa, and Mastercard also declined

BAC Stock Price - Past Week

Credit cards are highly profitable. Banks generate over $150 billion annually in swipe fees before even counting interest income. JPMorgan CFO Jeremy Barnum warned that a 10% cap would cause consumers to "lose access to credit, like on a very, very extensive and broad basis, especially the people who need it the most."

The legislative reality: Trump cannot implement this via executive order — Congress would need to pass legislation. While bipartisan bills exist (Sanders-Hawley proposed similar caps in 2025), banking industry groups mobilized immediately, calling the plan "devastating for millions of American families" who would lose credit access.

Treat this as political posturing for now, but monitor Congressional action closely. The disconnect between solid earnings and weak stock performance shows how policy risk can overwhelm fundamentals in today's market.

Fast, accurate financial writeups

When accuracy matters, typing can introduce errors and slow you down. Wispr Flow captures your spoken thinking and turns it into formatted, number-ready text for reports, investor notes, and executive briefings. It cleans filler words, enforces clear lists, and keeps your voice professional. Use voice snippets for standard financial lines, recurring commentary, or compliance-ready summaries. Works on Mac, Windows, and iPhone. Try Wispr Flow for finance.

Semiconductors: TSMC Powers AI Infrastructure Narrative

While banks dealt with policy uncertainty, semiconductor stocks extended their remarkable run. Taiwan Semiconductor Manufacturing (TSMC) reported Q4 revenue of NT$1.05 trillion ($33.1 billion), beating estimates and marking roughly 20% year-over-year growth driven by insatiable AI chip demand.

The pricing power story: TSMC isn't just meeting demand — it's raising prices. The company implemented 3-10% price hikes on advanced nodes (7nm, 5nm, 3nm) at the start of 2026. When you control 72% market share in contract manufacturing and supply chips to Nvidia, Apple, and AMD, you have pricing power.

Wall Street responded enthusiastically:

Goldman Sachs raised TSMC's price target 35% to NT$2,330

JP Morgan lifted forecasts 24%, citing "pricing power"

TSMC shares jumped 6.9% in a single session, touching record highs

The company projects $56 billion in 2026 capital spending

TSMC Stock Price - Past 1Y

he rally extended beyond TSMC. Chip stocks started 2026 strong, with Micron and ASML jumping 10% and 9% respectively in early January trading. Bank of America forecasts global semiconductor sales will surge 30% in 2026, finally pushing the sector past the historic $1 trillion annual milestone.

Despite concerns about an AI bubble, TSMC's ability to raise prices while maintaining customer demand suggests the infrastructure buildout has years to run. The VanEck Semiconductor ETF gained nearly 49% in 2025 and continues climbing in early 2026.

Energy Rallies on Venezuela, But Fundamentals Tell Different Story

Energy stocks surged early in the week following news that U.S. forces captured Venezuelan President Nicolás Maduro. Speculation centered on potential infrastructure rebuilding in a country with the world's largest proven oil reserves — over 300 billion barrels.

Monday's market action:

The reality check: Venezuela currently produces less than 1% of global oil output due to decades of mismanagement. J.P. Morgan estimates output could reach 1.3-1.4 million barrels/day within two years, but full recovery could take $100 billion and a decade.

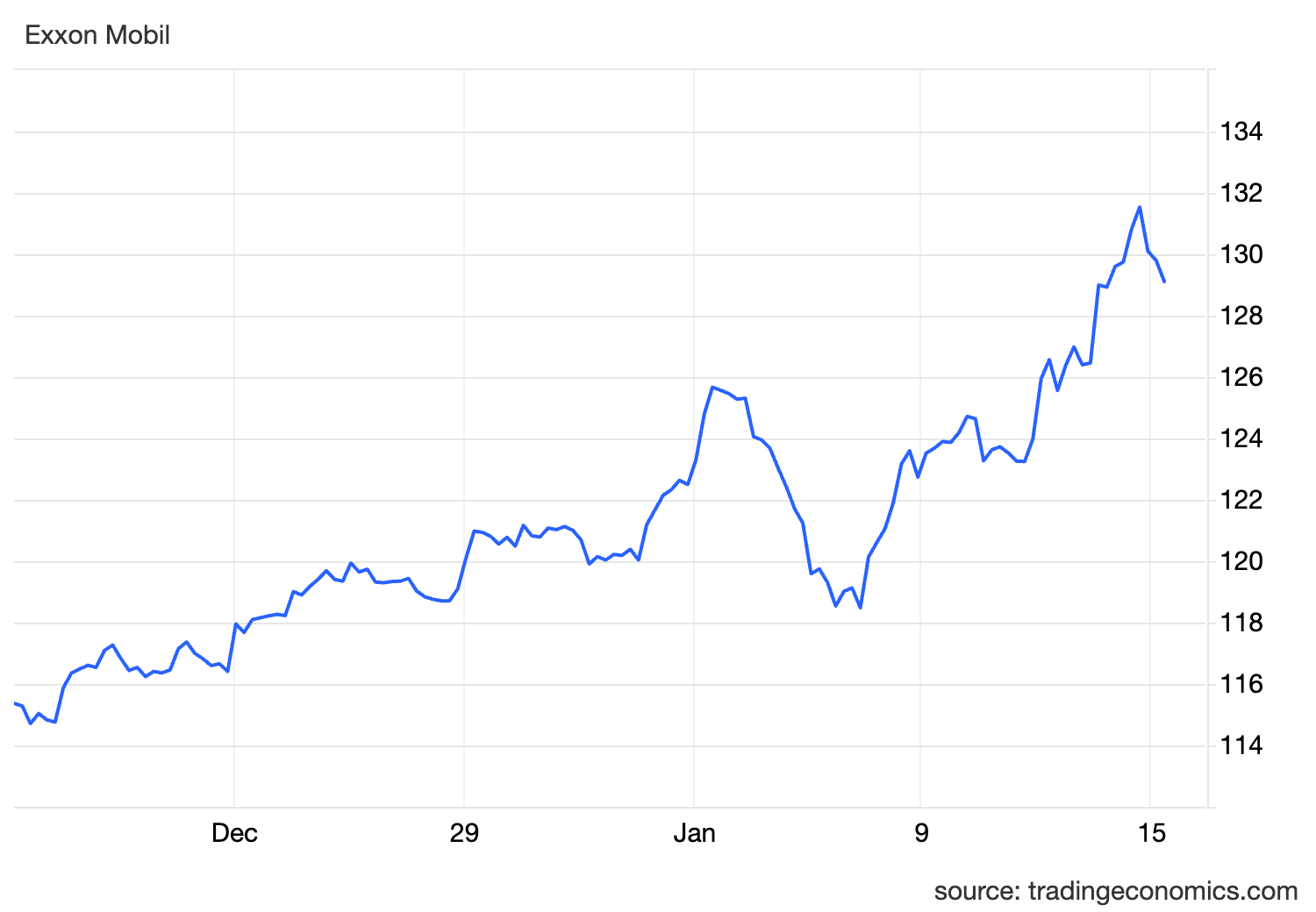

Exxon Mobil Stock Price - Past Month

Why this mattered anyway: It's not about immediate supply — it's about long-term strategic positioning. Meanwhile, oil prices remain subdued, with fundamentals pointing to potential supply gluts as OPEC increases output.

Natural gas may be 2026's real story. Demand is surging from LNG export terminals and AI data centers. Companies like

ExxonMobil are developing 1.2 gigawatt gas-fired power plants specifically to power data center customers.

Strategy in Focus: Deep Tech Innovators

This week's developments — particularly TSMC's pricing power and the relentless momentum in AI infrastructure spending — underscore why systematic exposure to deep technology makes sense for investors navigating 2026's volatility.

Surmount's Deep Tech Innovators strategy provides rules-based exposure to the entire AI infrastructure stack: semiconductors, cloud computing, cybersecurity, software, and IT services. Rather than betting on single names, the strategy captures the diverse ecosystem of companies powering the AI revolution — from chipmakers like those supplied by TSMC to the software and infrastructure firms building on top of that foundation.

Why it fits current conditions:

Captures the semiconductor momentum demonstrated by TSMC's ability to raise prices while maintaining demand

Provides exposure beyond just chips — cloud infrastructure, AI software, and cybersecurity all benefit from the same data center buildout driving TSMC's record results

Monthly rebalancing allows the strategy to adapt as leadership rotates within tech, particularly important given this week's reminder that policy headlines can shift sector dynamics overnight

Diversifies single-name risk across 30 established companies rather than concentrating in a handful of names vulnerable to unexpected regulatory or political developments

The risks: Deep tech valuations remain elevated across the board — not just semiconductors. If AI spending disappoints, Fed policy tightens unexpectedly, or political interference extends beyond credit cards to tech regulation, high-growth names typically correct hardest. However, with Bank of America forecasting 30% semiconductor growth, TSMC implementing price increases, and hyperscalers committed to multi-trillion dollar data center spending through 2030, the fundamental backdrop supports continued technology leadership.

In a week where bank stocks fell despite beating earnings, this strategy offers a disciplined way to maintain exposure to the market's most powerful structural trend while managing the single-stock risk that comes with concentrated technology bets.

Explore this and other systematic strategies at Surmount AI. Past performance does not guarantee future results.

Closing

This week proved that in 2026, policy announcements can overwhelm solid earnings faster than ever before. Banks reported strong results but got hammered on credit card uncertainty. Semiconductors extended their rally on fundamental strength. Energy jumped on geopolitical speculation.

The underlying fundamentals — AI infrastructure spending, bank profitability, energy sector positioning — remain constructive. But investors must now monitor Washington as closely as Wall Street. Diversification, systematic approaches, and disciplined risk management aren't optional extras — they're essential survival tools in markets where a single social media post can crater entire sectors.

Next week brings clarity on full-year bank guidance and continued semiconductor earnings. For now, the lesson is clear: stay diversified, stay systematic, and remember that the best investment strategy is one you can execute through both momentum surges and policy-driven selloffs.